Last Updated on February 19, 2025 by Arif Chowdhury

Have you ever watched your trade get hit just before it bounces back in the direction you expected?

Frustrating, right?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve seen it all.

Stop hunting is a phenomenon where market makers push prices to trigger stop-loss orders, leaving traders scratching their heads.

Let’s get into why this happens and how you can dodge these traps.

What is Stop Hunting?

In simple terms, stop hunting is when large players or market makers deliberately drive prices to specific levels.

They’re looking to trigger stops set by retail traders.

Once those stops are hit, the market may reverse, allowing the big players to profit.

This isn’t just a conspiracy theory; it’s a real strategy used in the Forex market.

Why Does Stop Hunting Occur?

- Market Liquidity:

- Big players need liquidity to enter or exit positions.

- By pushing prices to hit stop-loss orders, they create the liquidity they need.

- Psychological Warfare:

- Traders panic when they see their stops hit.

- This emotional response can lead to more selling or buying, creating further price movement.

- Profit Taking:

- Once the stops are triggered, prices often reverse.

- This creates opportunities for large traders to enter at more favorable prices.

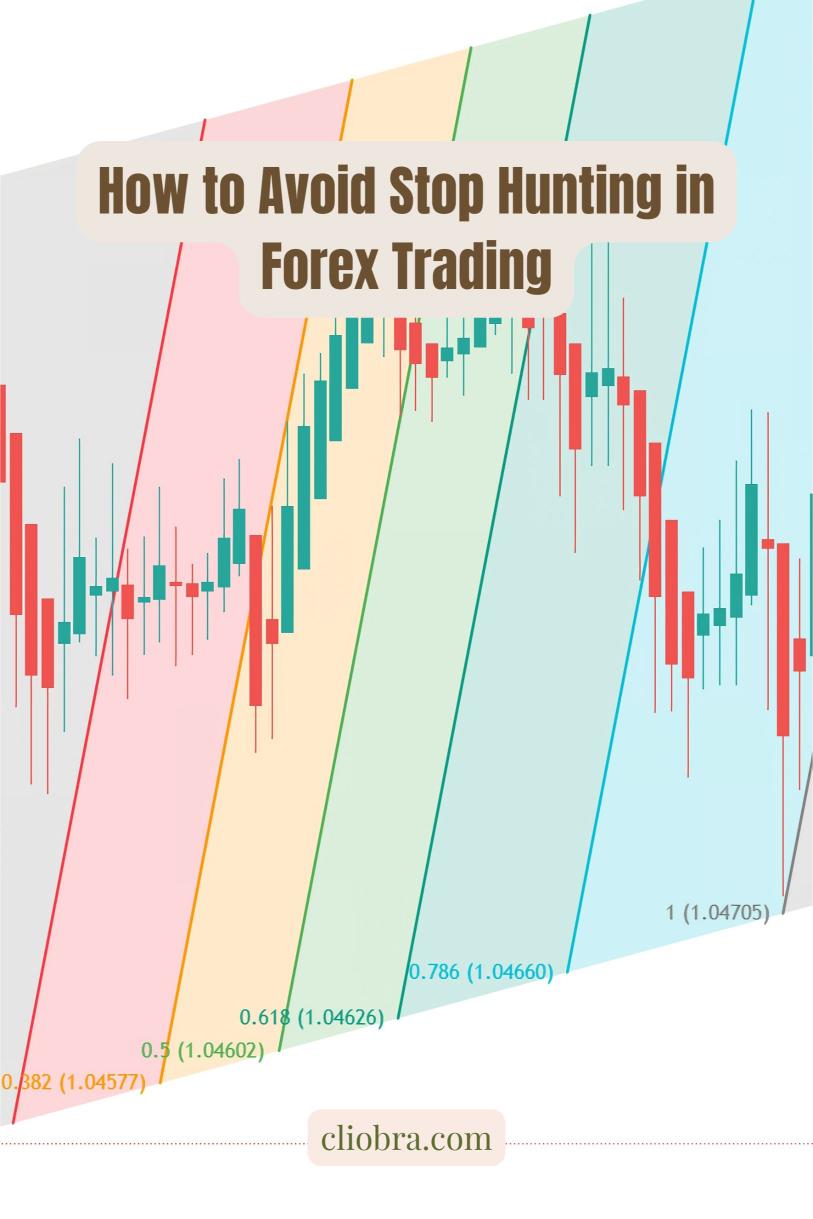

How to Spot Stop Hunting

Recognizing stop hunting can save you from unnecessary losses.

Here are some signs:

- Price Movement Before Major News:

- If you see prices move significantly before a news announcement, it may be a setup for stop hunting.

- Unusual Volume:

- An increase in trading volume without clear news can signal that big players are entering the market.

- Reversal Patterns:

- Look for sudden reversals right after price hits key support or resistance levels.

Strategies to Avoid Stop Hunting

- Set Wider Stops:

- Giving your trades some breathing room can help you avoid getting stopped out.

- Instead of placing your stop just below a support level, give it some extra space.

- Use Limit Orders:

- Instead of market orders, use limit orders to control your entry points better.

- This way, you can avoid being a victim of sudden price spikes.

- Diversify Your Trading:

- I’ve developed a portfolio of 16 sophisticated trading bots that help mitigate risk.

- Each bot is strategically diversified across major currency pairs like EUR/USD and GBP/USD.

- Trade with the Trend:

- When you align your trades with the prevailing market trend, you’re less likely to get caught in stop hunting.

- Analyze Market Sentiment:

- Keep an eye on trader sentiment.

- If everyone is bullish, be cautious; the opposite might happen.

The Role of Trading Bots in Mitigating Risk

Now, let me introduce you to my 16 trading EAs.

These bots are designed to minimize correlated losses and enhance overall profitability.

Here’s how they help:

- Diversification Across Pairs:

- Each currency pair has 3-4 unique bots, reducing risk.

- Long-Term Strategy:

- They focus on capturing 200-350 pips, making them resilient against short-term market fluctuations.

- Backtested Performance:

- I’ve backtested these bots for the past 20 years.

- They perform excellently under various market conditions.

What’s even better?

I’m currently offering this EA portfolio completely FREE.

You can grab it and start trading with a robust system that’s designed to work for you.

Check out my trading bots portfolio here.

Choosing the Right Broker

To effectively avoid stop hunting, you need to trade with a reliable broker.

Here are a few tips:

- Low Spread:

- Look for brokers that offer tight spreads to maximize your profits.

- Good Execution Speed:

- Fast execution is crucial, especially when the market is volatile.

- Transparent Practices:

- Choose brokers that are regulated and have a reputation for fair practices.

I’ve tested several brokers and can recommend some of the best.

For more information, check out my top picks at Most Trusted Forex Brokers.

Conclusion

Stop hunting is a real market phenomenon that can catch even seasoned traders off guard.

By understanding its mechanics and employing smart strategies, you can protect your trades.

Don’t forget to leverage technology.

My 16 trading bots can significantly enhance your trading experience while mitigating risk.

Grab your FREE EA portfolio today and start trading smarter!