Last Updated on February 18, 2025 by Arif Chowdhury

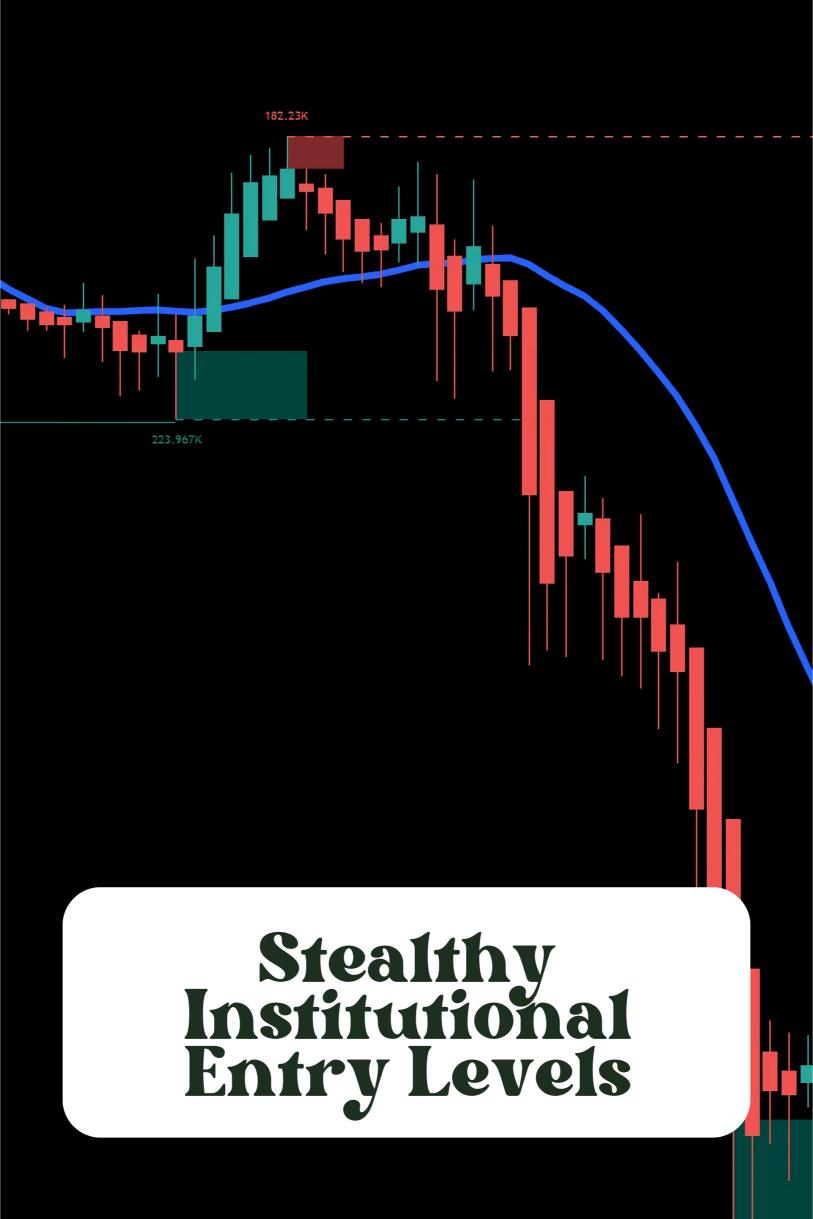

Ever wondered why your trades keep getting stopped out—just before the market suddenly moves in your direction? Feels like someone’s watching, right? That’s because they are.

Institutions don’t trade like us retail traders. They operate in the shadows, entering at levels you don’t see.

That’s why ‘Stealthy Institutional Entry Levels’ matter in Forex. Miss them, and you’re basically handing over your money.

What Are Stealthy Institutional Entry Levels?

Big banks and hedge funds don’t just throw in random buy/sell orders. They use liquidity pockets—areas where they can get massive orders filled without slippage.

Their game? Accumulation and manipulation. They lure retail traders in, shake them out, and then move the market in their favor.

You see a breakout? They see fresh liquidity.

You think a trend is forming? They’re just setting a trap.

This is why most traders fail. You’re trading against professionals who have billions at their disposal. But if you learn to spot their entry levels, you flip the game in your favor.

How Institutions Enter Without You Noticing

- Fake Breakouts: Market spikes past resistance, luring breakout traders, then slams back down.

- Stop Hunts: Price dips just enough to wipe out retail stop losses before reversing.

- Liquidity Pools: Areas where retail orders cluster—institutions use them to get better entries.

Stat Fact: Over 70% of Forex volume is controlled by banks and hedge funds. If you don’t know their tricks, you’re just free money for them.

How to Spot Institutional Entry Levels

- Look at the Wicks – Large wicks often signal institutional entries.

- Volume Spikes at Key Levels – Sudden volume shifts mean big players are in.

- Price Moving Without Retails – If a trend starts without any obvious news, institutions are likely behind it.

Why This Matters for You

If you’re always late to the move, it’s because you’re trading where institutions want you to trade—not where they are actually entering.

That’s where a strong automated system gives you an edge. Instead of reacting to retail traps, my 16 highly diversified trading bots are designed to identify and capitalize on these institutional entry levels automatically. They operate across EUR/USD, GBP/USD, USD/CHF, and USD/JPY, running on H4 charts, targeting 200-350 pip moves.

Unlike manual trading, where emotions mess up your strategy, my bots are built for the long-term game. Backtested for 20 years, they thrive in all market conditions.

You can check out my entire EA portfolio for free here.

How Retail Traders Get Crushed (And How to Avoid It)

- Retail Traders Chase: They enter breakouts after the move starts.

- Institutions Accumulate: They enter when retail traders are stopping out.

- Retail Traders Over-Leverage: One bad trade wipes them out.

- Institutions Use Risk Management: They play the long game.

If you don’t adjust your strategy, you’re handing your account over to institutions on a silver platter. Instead of trading blindly, use a system that tracks and leverages institutional behavior. That’s exactly what my trading bots are designed to do.

The Role of the Right Forex Broker

None of this matters if your broker is working against you. Slippage, spread manipulation, and poor execution will ruin even the best strategies.

I’ve tested multiple brokers, and these are the best Forex brokers that actually let you trade on a level playing field. Check them out here.

Bottom Line

- Institutions control the market. Learn their game, or get crushed.

- Stealthy institutional entry levels are the key to consistent profitability.

- Trading manually? You’re already at a disadvantage. Use automation to gain the edge.

- My 16 trading bots identify and execute on institutional entry points automatically—get them for free here.

- A bad broker will ruin everything. Choose a trusted Forex broker here.

You can trade against institutions or trade like them. Your choice.