Last Updated on January 31, 2025 by Arif Chowdhury

Ever found yourself wondering why some trades seem to hit the jackpot while others flop?

Or maybe you’ve felt the sting of a loss and thought, “If only I had set my targets differently?”

As a seasoned Forex trader since 2015, I can tell you that understanding the risk-reward ratio is crucial for long-term profitability.

Let’s dive into why this ratio matters and how to use it effectively in your trading strategy.

What is Risk-Reward Ratio?

Simply put, the risk-reward ratio compares the potential profit of a trade to its potential loss.

For example, if you’re risking $100 to make $300, your risk-reward ratio is 1:3.

This means for every dollar you risk, you stand to gain three dollars.

Statistically, traders who use a solid risk-reward ratio are more likely to succeed.

In fact, studies show that maintaining a ratio of 1:2 or better can significantly enhance your chances of profitability over time.

Why is Risk-Reward Ratio Important?

Understanding the risk-reward ratio is essential for several reasons:

- Informed Decision-Making: It helps you make better decisions about which trades to take.

- Emotional Control: Knowing your potential profit versus loss can reduce anxiety during trades.

- Long-Term Success: A good ratio can keep you profitable even if you lose more trades than you win.

How to Calculate Your Risk-Reward Ratio

Calculating your risk-reward ratio is straightforward once you know the basics.

Here’s how to do it:

- Determine Your Entry Point: Know where you plan to enter the trade.

- Set Your Stop-Loss: Decide how much you’re willing to lose on the trade. This is your risk.

- Identify Your Take-Profit Target: Set a realistic profit target based on your analysis.

- Calculate the Ratio: Use this formula:

Example in Action

Let’s make this real with a quick story.

Last month, I entered a trade on GBP/USD.

- Entry Point: 1.3000

- Stop-Loss: 1.2950 (risking 50 pips)

- Take-Profit: 1.3100 (targeting 100 pips)

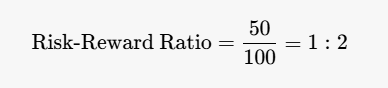

Now, let’s calculate the risk-reward ratio:

- Potential loss = 50 pips

- Potential profit = 100 pips

Using the formula:

This means for every dollar I risked, I stood to gain two dollars.

That’s a solid ratio and gives me confidence in the trade.

Tips for Implementing Risk-Reward Ratios

- Be Realistic: Set achievable targets based on market conditions. Don’t just aim for the moon.

- Adjust for Volatility: During volatile market conditions, consider adjusting your ratios to account for increased risk.

- Use a Trading Journal: Track your trades and their outcomes. This helps you refine your strategy over time.

- Backtest Your Strategy: Before going live, backtest your risk-reward strategies to see how they perform under different market conditions.

The Role of Automated Trading Bots

If you find calculating risk-reward ratios and managing trades overwhelming, consider using automated trading bots.

I’ve developed 15 sophisticated trading bots that manage risk-reward ratios for you, trading across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots are designed for long-term success, targeting 200-350 pips while minimizing correlated losses.

Having bots handle this aspect can take the pressure off you, allowing you to focus on what really matters: strategy and market analysis.

Finding the Right Broker

Choosing the right Forex broker is crucial for successful risk management.

- Look for Flexibility: Some brokers allow for adjustable take-profit and stop-loss settings, which can help you maintain your desired risk-reward ratio.

- Good Trading Platform: Ensure your broker offers a robust platform that allows you to track and manage your trades effectively.

I’ve tested several brokers and can recommend a few that align with disciplined trading practices.

Final Thoughts

The risk-reward ratio is more than just a number; it’s a cornerstone of successful Forex trading.

By understanding and applying this ratio, you can make informed decisions, control your emotions, and pave the way for long-term profitability.

If you’re serious about leveling up your trading game, consider checking out my 15 trading bots.

They’re designed to help you navigate the Forex market with precision and confidence.