Last Updated on March 2, 2025 by Arif Chowdhury

Have you ever felt the sting of a losing trade?

Or the rush of a profitable one, only to watch it slip away?

These emotions are part of the Forex game.

But what if I told you there’s a way to turn the odds in your favor?

Let’s dive into why the risk-reward ratio is crucial for your success.

Understanding Risk-Reward Ratio

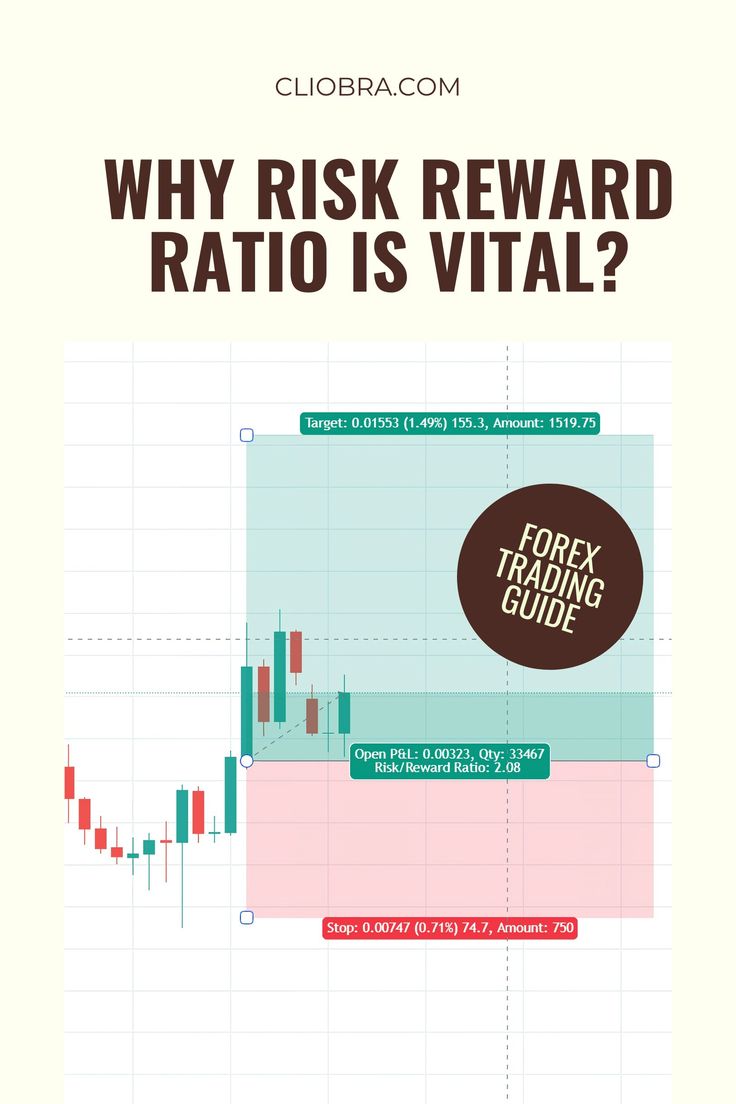

The risk-reward ratio compares the potential profit of a trade to its potential loss.

It’s simple yet powerful.

- Risk: What you stand to lose.

- Reward: What you stand to gain.

For example, if you risk $100 to potentially gain $300, your risk-reward ratio is 1:3.

This means for every dollar you risk, you’re aiming to gain three.

Why is this important?

Studies show that traders with a favorable risk-reward ratio are more likely to be successful over time.

In fact, having a ratio of 1:3 or better can lead to a profitability rate of 50% or more.

That’s a game changer!

The Power of a Positive Mindset

I remember when I first started trading in 2015.

I was eager, but I didn’t fully grasp the importance of the risk-reward ratio.

I’d enter trades based on gut feelings rather than calculated strategies.

This often ended in disappointment.

But as I honed my skills, I realized that maintaining a positive risk-reward ratio was essential.

It shifted my mindset from short-term wins to long-term success.

This is crucial in a volatile market like Forex.

Setting Up Your Trades

Here’s how to effectively set up your trades with risk-reward ratios in mind:

- Define Your Risk: Know how much you’re willing to lose before entering a trade.

- Set Your Target: Decide where you want to take profits.

- Calculate the Ratio: Use these figures to find your risk-reward ratio.

For instance, if you set a stop loss at 50 pips and a take profit at 150 pips, you have a 1:3 ratio.

Diversification is Key

When I developed my portfolio of 16 trading bots, I focused on diversification.

Each bot targets a unique currency pair: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s why this matters:

- Minimized Risk: By diversifying, you reduce the impact of a single loss.

- Consistent Performance: Each bot trades based on long-term strategies, aiming for 200-350 pips.

🚀Get this Forex EA Portfolio for FREE from here.

This multi-layered approach means that even if one bot underperforms, others can still generate profit.

Real-World Example

Let’s look at a scenario:

Imagine you’re trading the GBP/USD pair.

You identify a potential trade with a 1:4 risk-reward ratio.

You risk $100 for a chance to gain $400.

If you execute 10 trades like this and win 4, you’d still come out ahead.

This is the beauty of a solid risk-reward strategy.

The Role of Emotional Control

Handling emotions is a huge part of trading.

When you have a clear risk-reward mindset, it helps you stick to your plan—even when trades go against you.

Instead of panicking, you can stay focused.

This is where my YouTube channel comes in handy.

I share insights and strategies to help you manage your emotions and improve your trading discipline.

Key Takeaways

Remember these points:

- A favorable risk-reward ratio can lead to long-term success.

- Diversification across multiple trading bots can stabilize your portfolio.

- Emotional control is crucial for sticking to your strategy.

By focusing on these aspects, you’ll be well on your way to Forex success.

Conclusion

As a seasoned trader, I can’t stress enough how vital the risk-reward ratio is.

It’s not just about making money; it’s about managing risk effectively.

I’ve tested various Forex brokers and can recommend the best ones to maximize your trading experience.

And if you’re interested in automating your trading, check out my portfolio of 16 trading bots.

These bots are designed to work for you, using proven strategies to help you achieve consistent profits.

Embrace the risk-reward ratio, and watch your Forex journey transform!