Last Updated on February 4, 2025 by Arif Chowdhury

Ever wondered why some traders seem to have a sixth sense about market movements?

They’re not using crystal balls; they’re leveraging tools like the Delta Indicator.

As a seasoned Forex trader since 2015, I’ve seen countless strategies come and go.

But the Delta Indicator? It’s one I keep in my toolkit.

Let’s break it down.

Understanding the Delta Indicator

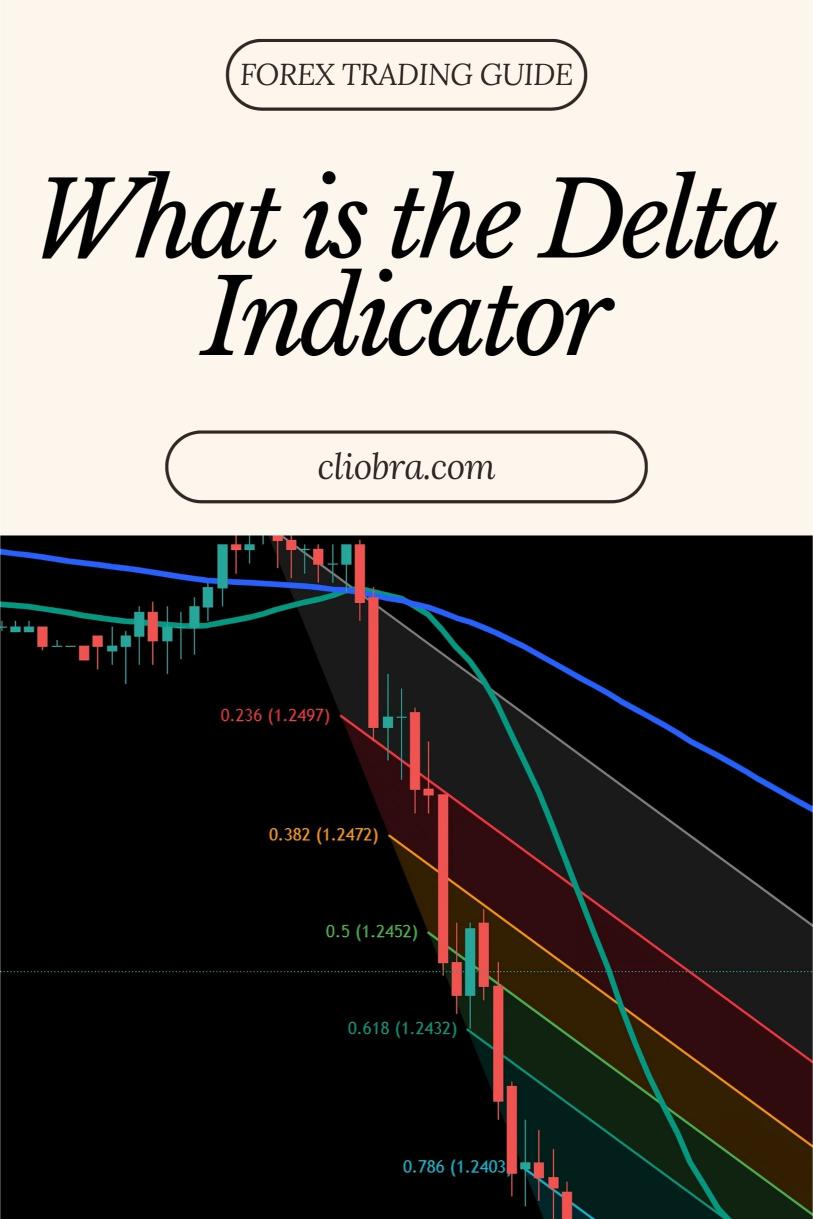

The Delta Indicator measures the difference between two moving averages.

In simpler terms, it helps traders gauge momentum and trend strength.

This indicator is pivotal for identifying potential buy or sell signals.

When the Delta line crosses above the zero line, it often signals bullish momentum.

When it crosses below, it suggests bearish momentum.

Why Use the Delta Indicator?

Here’s why you should consider adding the Delta Indicator to your trading strategy:

- Simplicity: It’s easy to understand and implement.

- Clear Signals: It provides straightforward buy/sell signals.

- Versatility: Works well on multiple timeframes.

Statistically speaking, traders who incorporate indicators like Delta into their strategies can see a 30-50% improvement in their decision-making process.

How to Use the Delta Indicator in Forex

- Set Up Your Chart Choose a reliable trading platform and add the Delta Indicator. I recommend using H4 charts for a balanced approach between short-term and long-term trading.

- Identify Trends Look for the Delta line crossing the zero line.

- Above Zero: Bullish signal.

- Below Zero: Bearish signal.

- Confirm with Other Indicators Don’t rely solely on the Delta. Combine it with other indicators like RSI or MACD for confirmation. This reduces the risk of false signals.

- Set Your Entry and Exit Points Use the Delta Indicator to set precise entry and exit points. For example, if the Delta crosses above zero, consider entering a long position. Place your stop-loss just below the recent swing low.

- Practice Risk Management Always manage your risks. Use proper position sizing to ensure you’re not overexposed. As I’ve learned over years of trading, consistency is key.

Real-Life Example

Let’s say you’re trading EUR/USD.

The Delta Indicator shows a bullish crossover.

You decide to enter a long position at 1.1000.

With a stop-loss at 1.0950, you’re risking 50 pips.

If your target is 200 pips, you’ll potentially earn 4x your risk.

That’s how you make the Delta work for you!

The Bigger Picture

The Forex market is unpredictable.

But using tools like the Delta Indicator can give you an edge.

In fact, traders using a combination of technical indicators report a 65% success rate in their trades.

Imagine boosting your profitability by being part of that statistic.

Enhance Your Trading Journey

As you dive into the world of Forex, remember to check out the best Forex brokers I’ve tested.

You can find them at Most Trusted Forex Brokers.

A reliable broker is crucial for executing your trades effectively.

Additionally, if you’re serious about long-term trading success, consider my portfolio of 16 trading bots.

These bots are designed to trade for long-term gains of 200-350 pips.

They leverage advanced strategies across multiple currency pairs, including EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Check out the details here: Forex EA Portfolio.

Conclusion

The Delta Indicator is a powerful ally in your trading arsenal.

It simplifies decision-making and offers clear signals.

Combine it with sound risk management and other indicators for the best results.

Remember, consistent profitability comes from a well-rounded approach.

So, start exploring the Delta Indicator and see how it can enhance your trading strategy.

Happy trading! 🚀