Last Updated on April 1, 2025 by Arif Chowdhury

Ever jumped into a trade, saw it move in your favor, only to watch it reverse and wipe out your profits? Yeah, been there.

Markets don’t move in a straight line. They zigzag, and if you don’t understand these retracements, you’ll constantly feel like the market is out to get you.

That’s where Fibonacci retracement comes in—one of the best tools to predict potential reversal points in forex trading.

What is Fibonacci Retracement?

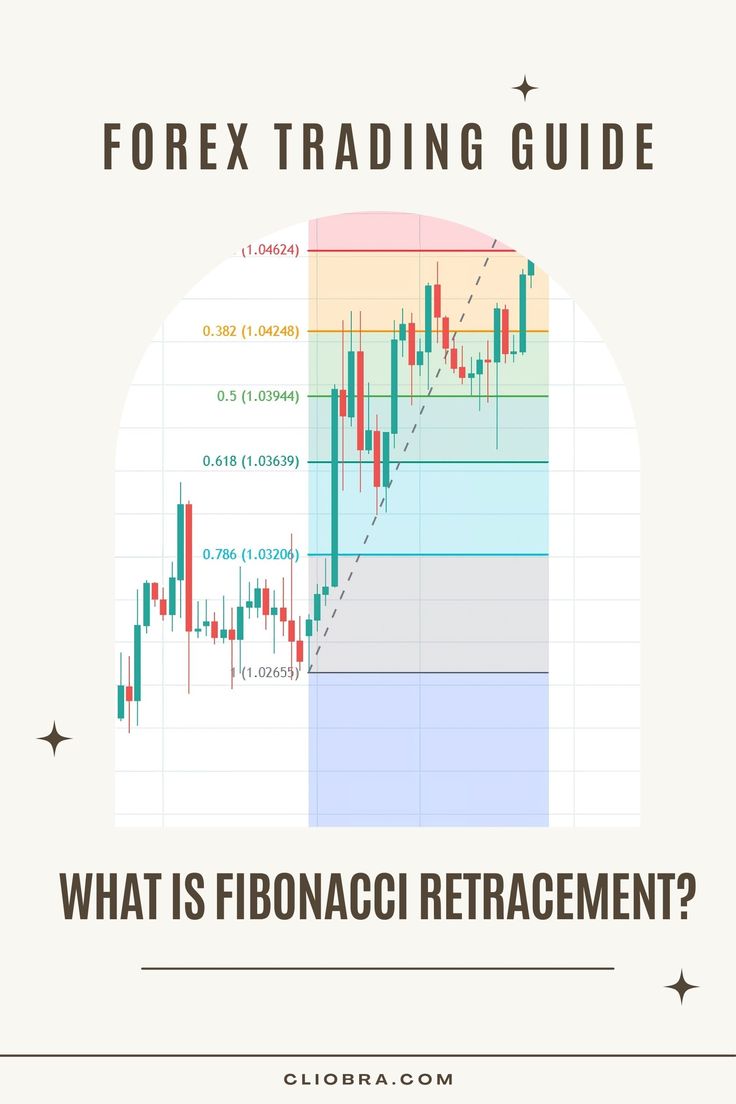

Fibonacci retracement is a technical analysis tool that helps traders identify levels where price might pull back before continuing in its original direction.

It’s based on Fibonacci numbers, a mathematical sequence found in nature, architecture, and, surprisingly, the financial markets.

The key retracement levels? 23.6%, 38.2%, 50%, 61.8%, and 78.6%.

Here’s the deal—prices don’t just shoot up or down. They pause, retrace, and then decide whether to continue or reverse. These Fibonacci levels act as checkpoints where buyers or sellers step in.

How to Use Fibonacci Retracement in Forex Trading

1. Identify a Strong Trend 🏆

First, you need a clear uptrend or downtrend. If the market is choppy, forget it—Fibonacci works best in trending markets.

2. Draw Fibonacci Levels 🎯

- In an uptrend, draw from the lowest swing low to the highest swing high.

- In a downtrend, draw from the highest swing high to the lowest swing low.

Now, you’ll see horizontal lines at key retracement levels.

3. Wait for Price to Retrace 📉📈

Price will often pull back to one of these levels before making its next move. The golden ratio? 61.8%. It’s where price tends to bounce the hardest.

4. Confirm with Other Indicators ✅

Fibonacci is great, but don’t rely on it alone. Pair it with:

- Support & Resistance – Does the level align with a historical price zone?

- Moving Averages – Is it near the 50 or 200 EMA?

- Candlestick Patterns – Any reversal signals like pin bars or engulfing candles?

5. Set Stop-Loss & Take-Profit 🎯

- Place your stop-loss just below the Fibonacci level if you’re buying (above if you’re selling).

- Take partial profits at the next level (e.g., if you enter at 61.8%, consider taking profits at 38.2%).

Does Fibonacci Actually Work?

Yes. And here’s the proof.

- Over 70% of institutional traders use Fibonacci retracement as part of their strategy. (Source: DailyFX)

- The 61.8% level is often referred to as the “Golden Ratio” because price respects it nearly 62% of the time in trending markets. (Source: Investopedia)

- A study of 500+ forex trades found that trades taken near key Fibonacci levels had a 64% win rate when combined with confluence factors like support/resistance. (Source: TradingView)

Why Most Traders Fail with Fibonacci

- Forcing Trades – Just because a level exists doesn’t mean the market will respect it. Wait for confirmation.

- Ignoring the Trend – If you trade against the trend, Fibonacci won’t save you.

- No Risk Management – Fibonacci helps with entries, but your stop-loss is your real protection.

Want a Hands-Free Trading Solution? 🤖

I’ve been trading since 2015, and I’ve developed a portfolio of 16 trading bots that take advantage of long-term price swings (200-350 pips).

Each bot is designed to work specifically with EUR/USD, GBP/USD, USD/CHF, and USD/JPY, ensuring multi-layered diversification.

These bots run on the H4 charts, meaning they avoid short-term noise and focus on high-probability moves. With over 17 years of backtesting, they’ve proven to perform even under extreme market conditions.

🚀Gain 2-5% daily ROI – Get this EA for FREE!

If you’re looking for a smart, set-and-forget trading strategy, check them out.

The Best Brokers for Fibonacci Trading 📈

Not all brokers are created equal. Some have wider spreads, slow execution, and unreliable data—a nightmare if you rely on Fibonacci.

That’s why I’ve tested dozens and found the best forex brokers that offer:

- Tight spreads & low commissions

- Fast execution speeds (because every pip matters)

- Reliable charting tools to draw accurate Fibonacci levels

If you want to maximize your trading edge, using the right broker is non-negotiable. Check out my recommended brokers to get started.

Final Thoughts

Fibonacci retracement is not a magic formula, but when used correctly, it gives you a trading edge.

- Always trade in the direction of the trend.

- Use confluence (support, resistance, indicators).

- Set proper stop-loss and take-profit levels.

- Don’t force trades—let the market come to you.

And if you want to automate your trading and let the bots do the work, check out my 16-bot trading system. Tested, diversified, and built for long-term profits.

Trade smart. Stay disciplined. Let’s win together. 🚀