Last Updated on February 12, 2025 by Arif Chowdhury

Ever felt stuck watching the charts, wondering why your trades aren’t lining up?

You’re not alone.

Many traders grapple with the frustrations of market volatility and unexpected reversals.

So, what if I told you there’s a tool that could help you make sense of the chaos?

Enter the Dealer Box.

What’s a Dealer Box?

A Dealer Box is essentially a price range where market makers operate.

Think of it like a safety net.

It’s where they place their orders to manage liquidity and minimize risk.

Understanding this concept can give you a leg up in your trading game.

Why Should You Care?

- Market Insight: It helps you gauge where major players are likely to step in or out of positions.

- Trade Triggers: You can identify potential entry and exit points based on these price ranges.

- Risk Management: Knowing the Dealer Box can help you set better stop-loss levels.

Here’s a fun fact: Over 70% of Forex volume is driven by market makers.

That’s a huge chunk of the market!

How to Spot a Dealer Box

Identifying a Dealer Box isn’t rocket science.

Here’s a quick rundown:

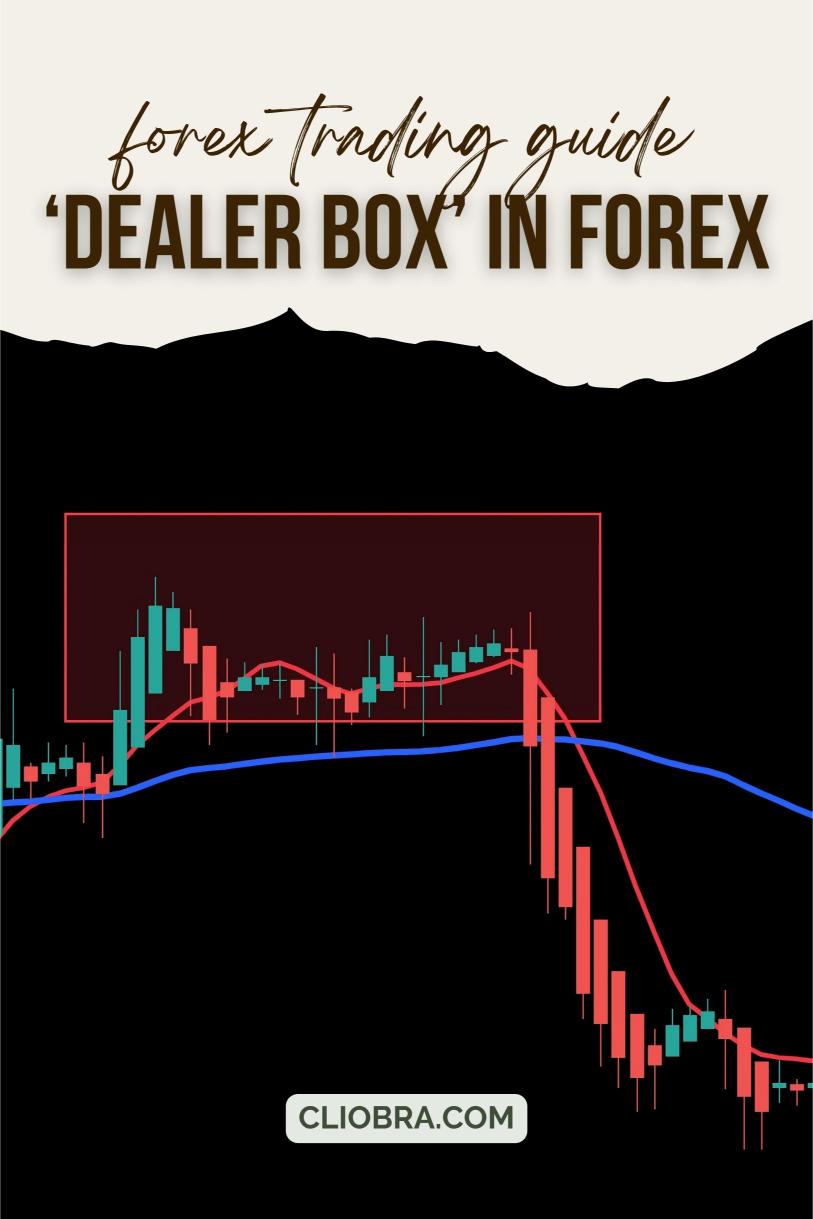

- Look for Consolidation: When prices move sideways for a while, it often indicates the presence of a Dealer Box.

- Volume Analysis: Increased volume during these periods suggests that big players are accumulating or distributing positions.

- Support and Resistance Levels: These boxes often align with key support and resistance levels.

Using the Dealer Box for Trading

So now that you know what it is, how do you use it?

Here’s a straightforward approach:

- Identify the Box: Use the steps above to find the Dealer Box on your chart.

- Set Your Entry Points: Plan your trades around the upper and lower bounds of the box.

- Place Stop Losses: Set your stop-loss orders just outside the box to minimize risk.

- Take Profit Levels: Look for potential exits at nearby support or resistance levels.

My Journey with Trading Bots

As a seasoned Forex trader since 2015, I’ve seen how the right tools can elevate your trading.

That’s why I developed a portfolio of 16 sophisticated trading bots.

They’re strategically diversified across major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is designed to minimize correlated losses and maximize profitability.

Here’s what’s cool:

- Multi-layered Diversification: This means your risk is spread out, reducing the chances of simultaneous losses.

- Long-Term Focus: My bots are optimized to trade for 200-350 pips, performing excellently over time.

- Free Access: You can grab this EA portfolio for FREE! Check it out here.

Enhancing Your Trading with the Right Broker

You can have the best strategies and tools, but a solid broker is crucial.

I’ve tested several, and here’s why you should consider working with one of the best:

- Tight Spreads: Look for brokers that offer competitive spreads to keep your costs low.

- Speedy Execution: Fast order execution can make or break your trading strategy.

- Customer Support: Having a broker who’s there when you need them is invaluable.

I recommend checking out the most trusted Forex brokers here.

Common Pitfalls to Avoid

Even with a Dealer Box strategy, there are mistakes to watch out for:

- Ignoring Market News: Events can cause volatility that breaks your box.

- Overtrading: Stick to your plan. Don’t chase trades outside the box.

- Neglecting Risk Management: Always use stop-loss orders to protect your capital.

Final Thoughts

Understanding the Dealer Box can transform your trading approach.

It gives you insight into market dynamics, helping you make informed decisions.

Combine that with my 16 trading bots, and you’re on your way to consistent profitability.

Don’t forget to choose a reliable broker to support your trading journey.

So, are you ready to tackle the Forex market with confidence?