Last Updated on February 7, 2025 by Arif Chowdhury

Ever found yourself staring at a chart, wondering why the price just won’t budge?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve seen the market dance around certain levels, and trust me, it’s usually because of stop loss clusters.

So, what exactly are they?

Understanding Stop Loss Clusters

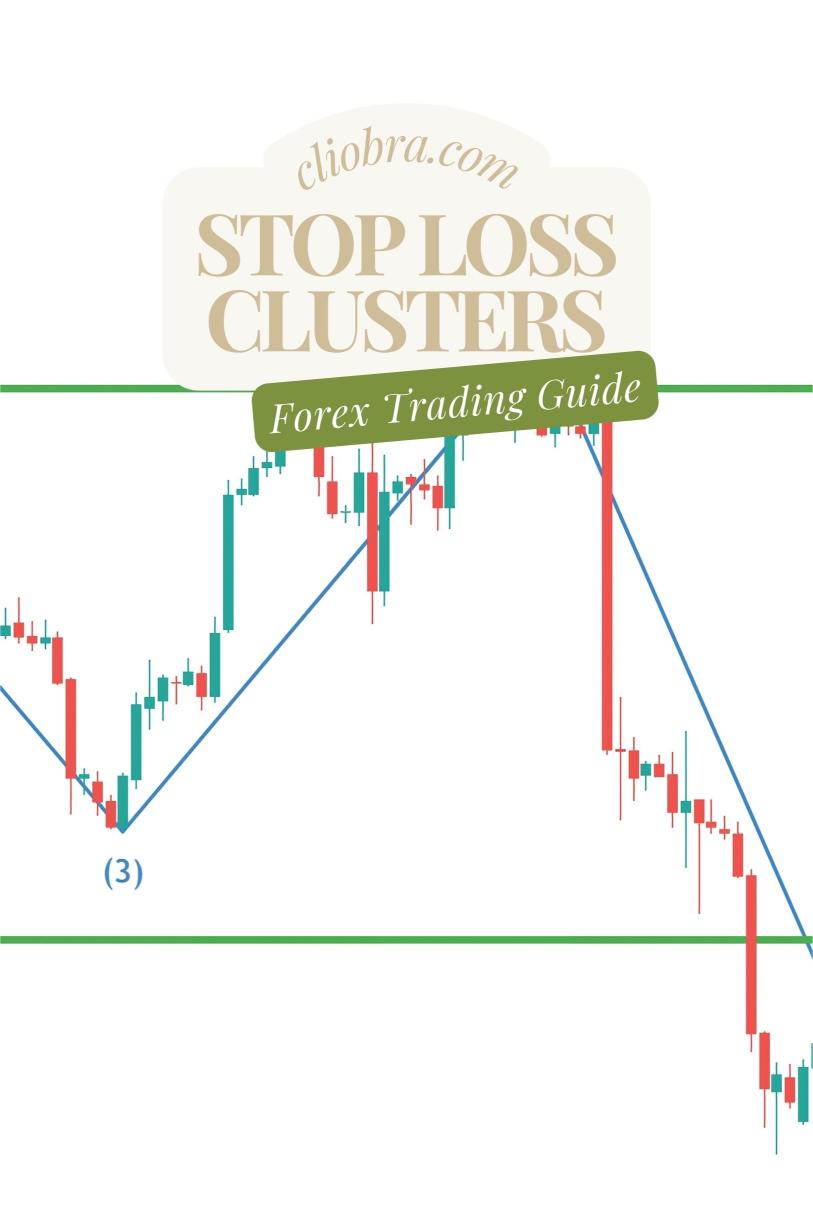

Stop loss clusters form when many traders place their stop loss orders at similar price levels.

Think of it like a mass of traders holding hands at a cliff, ready to jump if the market takes a dive.

When the price approaches these levels, it can create a domino effect.

Here’s how it works:

- Price Approaches the Cluster: As the price nears these stop loss levels, it triggers selling pressure.

- Market Manipulation: Big players (like institutions) often push the price just enough to trigger these stops, causing a rapid price movement.

- Volatility Spike: This can lead to significant volatility in the market, as a cascade of stop losses gets hit.

The Impact on Price Movement

But why should you care?

Understanding how stop loss clusters work can give you an edge in your trading strategy.

Here are some key points to consider:

- Increased Volatility: When stop losses are triggered, the price can swing wildly, creating opportunities (or risks) for traders.

- Potential for Reversals: Often, when a cluster is hit, the price may reverse sharply. Institutions know this and use it to their advantage.

- Psychological Factors: Traders watching these levels can become emotional, leading to irrational decisions.

Statistical Insights

You might be wondering: how significant are these clusters?

Here are a couple of stats that will blow your mind:

- Market Behavior: Studies show that nearly 70% of price movements in Forex can be linked to stop loss triggers.

- Risk Management: Traders who effectively use stop loss placements can reduce their overall risk exposure by up to 30%.

Strategies for Navigating Stop Loss Clusters

So how can you navigate this tricky terrain?

Here are some strategies that have worked for me:

- Identify Key Levels: Look for areas where clusters are likely to form. Support and resistance levels are great starting points.

- Use a Buffer: Instead of placing your stop exactly at a cluster, consider adding a buffer. This can help you avoid getting stopped out prematurely.

- Monitor Volume: High volume near stop loss levels can indicate potential price movement. Use this as a signal to adjust your strategy.

Real-Life Example

I remember a trade on EUR/USD where a significant stop loss cluster formed around the 1.0800 level.

As the price approached, I noticed an uptick in volume.

I decided to hold my position instead of cutting my losses.

Sure enough, the price dipped, triggering a bunch of stop losses before reversing and shooting up.

That day, I walked away with a solid profit.

Conclusion

Stop loss clusters are a powerful phenomenon in Forex trading.

By understanding them, you can better anticipate price movements and make more informed trading decisions.

Want to capitalize on these insights?

Check out the best Forex brokers I’ve tested at this link.

And if you’re serious about trading, consider my exceptional trading bot portfolio at this link.

These bots are designed to thrive in volatile conditions, just like those created by stop loss clusters.