Last Updated on February 15, 2025 by Arif Chowdhury

Ever find yourself staring at a chart, wondering why the market moved suddenly?

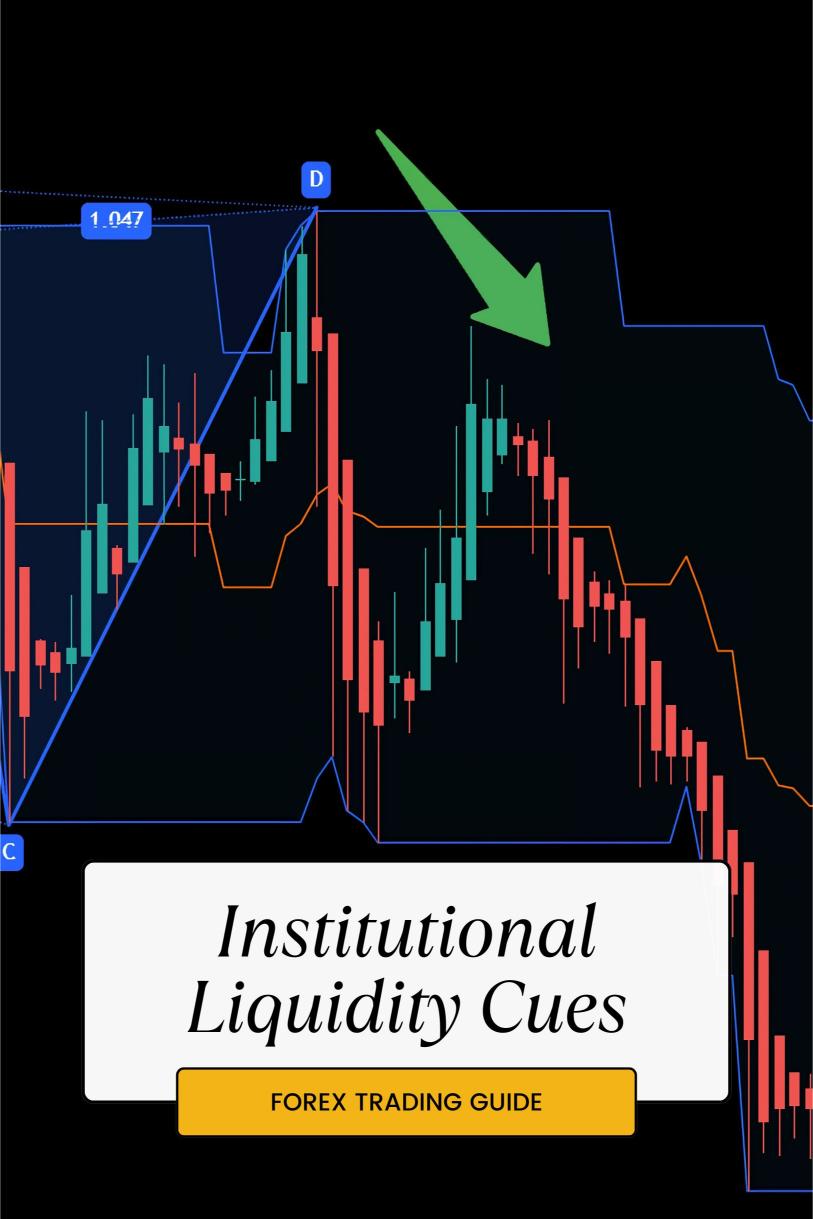

What if I told you that there are hidden signals, or “institutional liquidity cues,” that can unlock the mystery behind these movements?

As a seasoned Forex trader since 2015, I’ve spent countless hours diving into both fundamental and technical analysis. Today, I want to share what I’ve learned about these cues and how you can spot them.

Understanding Institutional Liquidity Cues

First off, let’s break it down.

Institutional liquidity cues are signals that indicate where large players in the market, like banks and hedge funds, are placing their orders.

These players have the power to move markets, and understanding their behavior can give you a competitive edge.

Why should you care?

Because about 80% of trading volume comes from these institutional players.

If you can spot their cues, you’re one step closer to making informed trading decisions.

How to Spot These Cues

- Look for Volume Spikes

When you see an unusual spike in volume, it’s a clue that institutions are entering or exiting positions. - Watch Key Support and Resistance Levels

Institutions often place large orders around these levels. If the price approaches a key level and volume spikes, pay attention. - Analyze Price Action

Look for abrupt price movements followed by consolidation. This can signal that institutions are accumulating or distributing positions. - Use Order Flow Analysis

Tools that show real-time order flow can help you see where big orders are being placed. This gives you insight into institutional activity. - Pay Attention to News Events

Major economic releases can trigger institutional activity. Monitor these events closely and watch how the market reacts.

My Journey with Liquidity Cues

I remember when I first started trading, I was clueless about these cues.

I relied purely on technical indicators and missed out on some big moves.

Once I began to understand institutional behavior, everything changed.

I developed a unique trading strategy that integrates these cues.

This approach has not only increased my profitability but also inspired me to create a portfolio of 16 sophisticated trading bots.

Each bot is designed to trade the major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

They leverage the insights I’ve gained over the years, optimizing trades based on institutional liquidity cues.

🚀Get this Forex EA Portfolio for FREE from here.

Why My Trading Bots Stand Out

- Robust Diversification

Each currency pair has a unique set of 3-4 bots, minimizing correlated losses. - Long-Term Focus

Designed to capture 200-350 pips, they thrive in the long run. - Backtested Excellence

I’ve backtested my bots for the past 20 years. They perform well under various market conditions.

And here’s the kicker: I’m offering this EA portfolio for FREE!

If you’re serious about leveling up your trading game, check out my trading bots portfolio.

Best Practices for Trading

Let’s wrap it up with some best practices to keep in mind as you begin spotting these cues:

- Stay Informed

Follow market news and trends. Knowing what’s happening can help you anticipate moves. - Practice Patience

Wait for clear signals before entering trades. Rushing can lead to mistakes. - Keep a Trading Journal

Documenting your trades and the cues you noticed can help you refine your strategy over time.

Finding the Right Brokers

Finally, don’t underestimate the importance of a good broker.

Having a reliable broker can make a world of difference in your trading experience.

I’ve tested several brokers and narrowed down the best ones for you.

Check out my top forex brokers to ensure you’re trading with the best.

Conclusion

Understanding and spotting institutional liquidity cues can significantly enhance your trading strategy.

By leveraging these insights, you can make more informed decisions and increase your chances of success.

And remember, my 16 trading bots are here to help you navigate the complexities of the Forex market effortlessly.

Don’t miss out on the opportunity to elevate your trading game.

Get started today!