Last Updated on March 2, 2025 by Arif Chowdhury

Have you ever placed a trade, only to watch the price shift away from you?

That frustrating moment is called slippage.

As a seasoned Forex trader since 2015, I’ve faced this challenge countless times. It’s a common concern for many traders, especially when the market gets volatile.

Let’s break down what slippage is, why it happens, and how to dodge it.

What is Slippage?

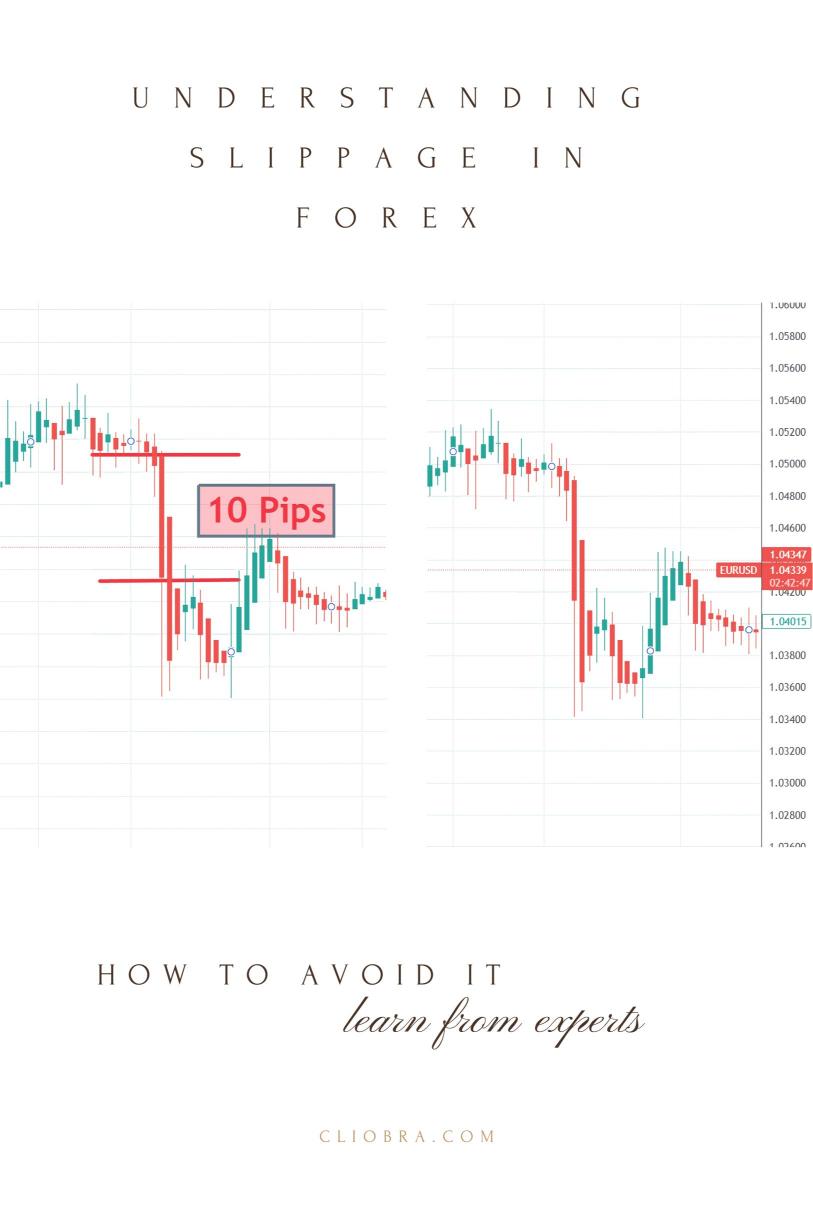

Slippage occurs when an order is executed at a different price than what you expected.

Imagine you want to buy EUR/USD at 1.1000.

You hit the button, but due to market movement, your order fills at 1.1005.

You just experienced slippage.

Why Does Slippage Happen?

Several factors contribute to slippage:

- Market Volatility: High volatility means prices can jump around quickly. For instance, during major news announcements, prices can change in seconds.

- Order Type: Market orders are more prone to slippage. If you use limit orders, you can set a specific price, reducing the risk of slippage.

- Liquidity: In thinly traded markets, there might not be enough buyers or sellers at your desired price.

Statistically, about 70% of traders experience slippage at some point. That’s a significant number!

Types of Slippage

- Positive Slippage: This is when your order fills at a better price than expected. Example: You wanted to buy at 1.1000, but it fills at 1.0995. Sweet deal!

- Negative Slippage: The more common type, where your order fills at a worse price. Example: You wanted to sell at 1.1000, but it fills at 1.1005. Not so sweet!

How Can You Avoid Slippage?

Here’s the good stuff—how to minimize slippage:

- Use Limit Orders: This gives you control over the price you pay or receive. You set your price, and the order only executes if the market reaches it.

- Trade During High Liquidity: Focus on trading during peak hours when the market has more participants. For major currency pairs like EUR/USD or GBP/USD, this usually means during the London and New York sessions.

- Avoid Major News Events: Check an economic calendar. If big news is coming out, consider waiting to trade until after it’s released.

- Choose a Reliable Broker: Not all brokers are created equal. Some have better execution speeds and lower slippage rates. I’ve tested several brokers, and some stand out for their execution quality.

- Stay Calm During Volatility: Panic can lead to hasty decisions. Stick to your strategy, and don’t let emotions dictate your trades.

Real-Life Example

Let me share a quick story.

One time, I placed a trade right before a major economic announcement.

I knew the risks, but I thought I could handle it.

Sure enough, the market spiked, and my order slipped significantly.

I learned my lesson. Now, I always check the economic calendar and adjust my trading times accordingly.

Why You Should Care About Slippage

Understanding slippage isn’t just about avoiding a bad trade.

It’s about protecting your capital and maximizing your profits.

If you’re losing just a few pips due to slippage on every trade, it adds up over time.

Imagine missing out on 2% of your profits in a month due to slippage.

That’s real money!

Utilize Trading Bots

Slippage can be a trader’s nightmare, but it doesn’t have to be.

By implementing the strategies mentioned, you can significantly reduce your risk of slippage.

And hey, if you’re serious about Forex trading, consider diversifying your approach.

My portfolio comprises 16 unique trading bots, each designed to tackle different market scenarios across major currency pairs.

🚀Get this Forex EA Portfolio for FREE from here.

These bots are backtested for 17 years, ensuring they perform even in tough conditions.

Check out the best Forex brokers I’ve tested, and see how my trading bots can enhance your trading journey.