Last Updated on February 24, 2025 by Arif Chowdhury

Are you tired of unpredictable market swings?

Wondering how to spot institutional moves before they happen?

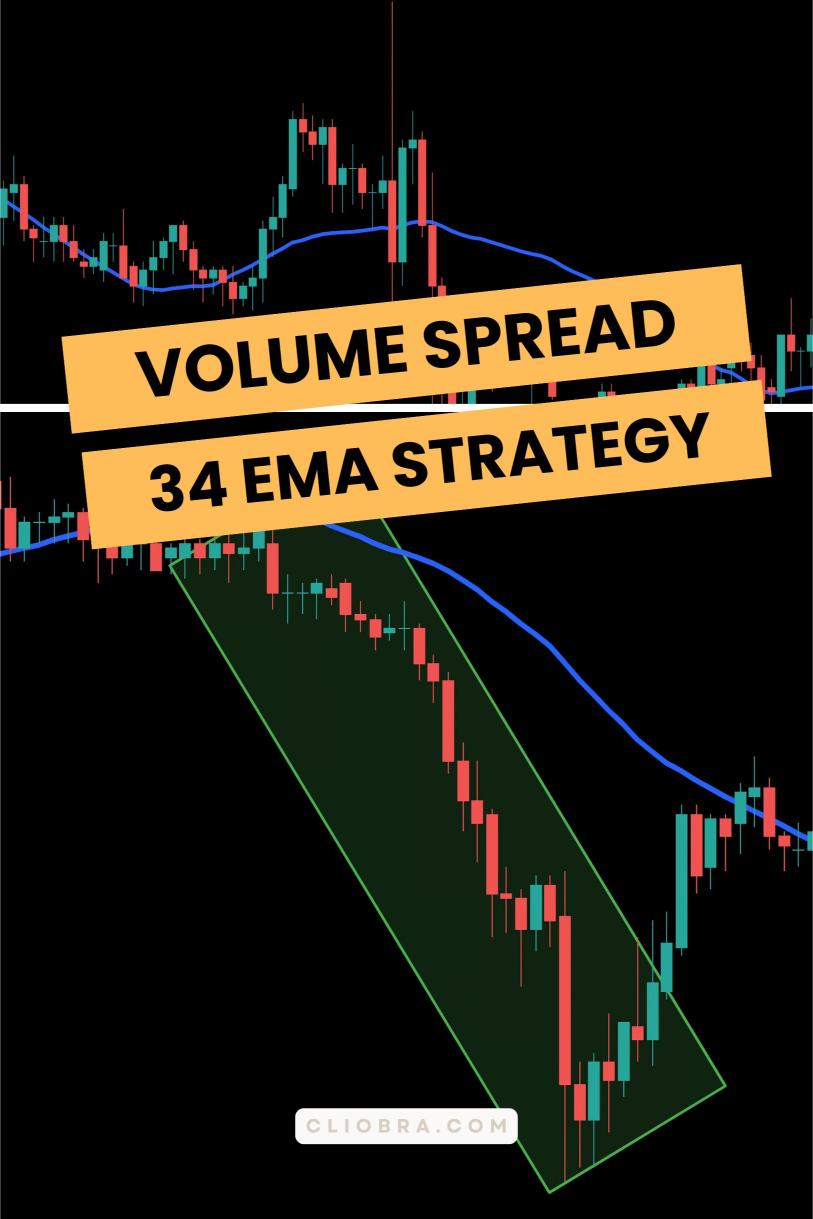

Let’s dive into a strategy that can turn your trading game around: The Volume Spread Analysis + 34 EMA Strategy.

I’ve been in the Forex trading scene since 2015, and I can tell you, this approach is a game-changer.

What is the Volume Spread Analysis?

Volume Spread Analysis (VSA) is all about understanding the relationship between price, volume, and market sentiment.

Here’s the gist:

- Volume shows the strength of a price movement.

- Spread refers to the range between the high and low of a candle.

- Price Action tells the story of market activity.

When you combine these elements, you can identify whether buyers or sellers are in control.

Statistically, markets move 80% of the time based on institutional activities.

If you can read these moves, you’ll have a significant edge.

The 34 EMA: What’s the Deal?

The 34 Exponential Moving Average (EMA) is a powerful tool for trend analysis.

Here’s how it integrates with VSA:

- Trend Confirmation: The 34 EMA helps you identify the overall trend.

- Entry & Exit Points: Crossovers can signal potential entries or exits.

By using the 34 EMA in tandem with VSA, you create a robust strategy that capitalizes on institutional movements.

Putting It All Together

Now, let’s break down how to implement this strategy effectively.

- Analyze Volume: Look for spikes in volume that accompany price movements. This often indicates institutional activity.

- Check the Spread: A wide spread with high volume can suggest strong buying or selling pressure.

- Align with the 34 EMA: Ensure that your trades are in the direction of the trend indicated by the 34 EMA.

- Watch for Signals: Look for candle patterns that confirm your analysis, such as pin bars or engulfing candles.

Why This Strategy Works

The combination of VSA and the 34 EMA:

- Minimizes Risk: By identifying true market movements, you can avoid false breakouts.

- Increases Profitability: Target moves that align with institutional interests, giving you the potential for bigger gains.

With a solid strategy, you can ride the waves created by the big players in the market.

Introducing My 16 Trading EAs

While we’re on the topic of robust strategies, let me share something special.

I’ve developed an exceptional portfolio of 16 trading EAs that utilize the Volume Spread + 34 EMA strategy along with many others.

These bots are designed to trade major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s what makes them stand out:

- Diversification: Each currency pair has 3-4 bots, minimizing correlated losses.

- Long-Term Focus: They aim for 200-350 pips, ensuring better performance over time.

- Backtested Excellence: With 20 years of testing, these bots thrive even in harsh market conditions.

And the best part? You can access this EA portfolio completely FREE!

Just check out my trading bots portfolio and see how they can enhance your trading.

Finding the Right Forex Brokers

To make the most of these strategies and tools, you need a reliable broker.

I’ve tested numerous platforms and can confidently recommend only the best.

Choosing the right broker can:

- Ensure fast execution speeds.

- Provide competitive spreads.

- Offer robust customer support.

Take a look at my recommended brokers, which you can find here: Most Trusted Forex Brokers.

Closing Thoughts

Mastering The Volume Spread Analysis + 34 EMA Strategy can transform your trading journey.

With the right knowledge and tools, you can identify institutional moves and make informed trading decisions.

Don’t forget to leverage my 16 trading EAs to maximize your potential.

Remember, trading is a journey. Equip yourself with the best strategies and tools, and you’ll see results.

Let’s make those pips count! 🚀