Last Updated on February 12, 2025 by Arif Chowdhury

Ever wonder why your trades sometimes feel like they’re bouncing off a wall?

Or why you see unexpected price spikes?

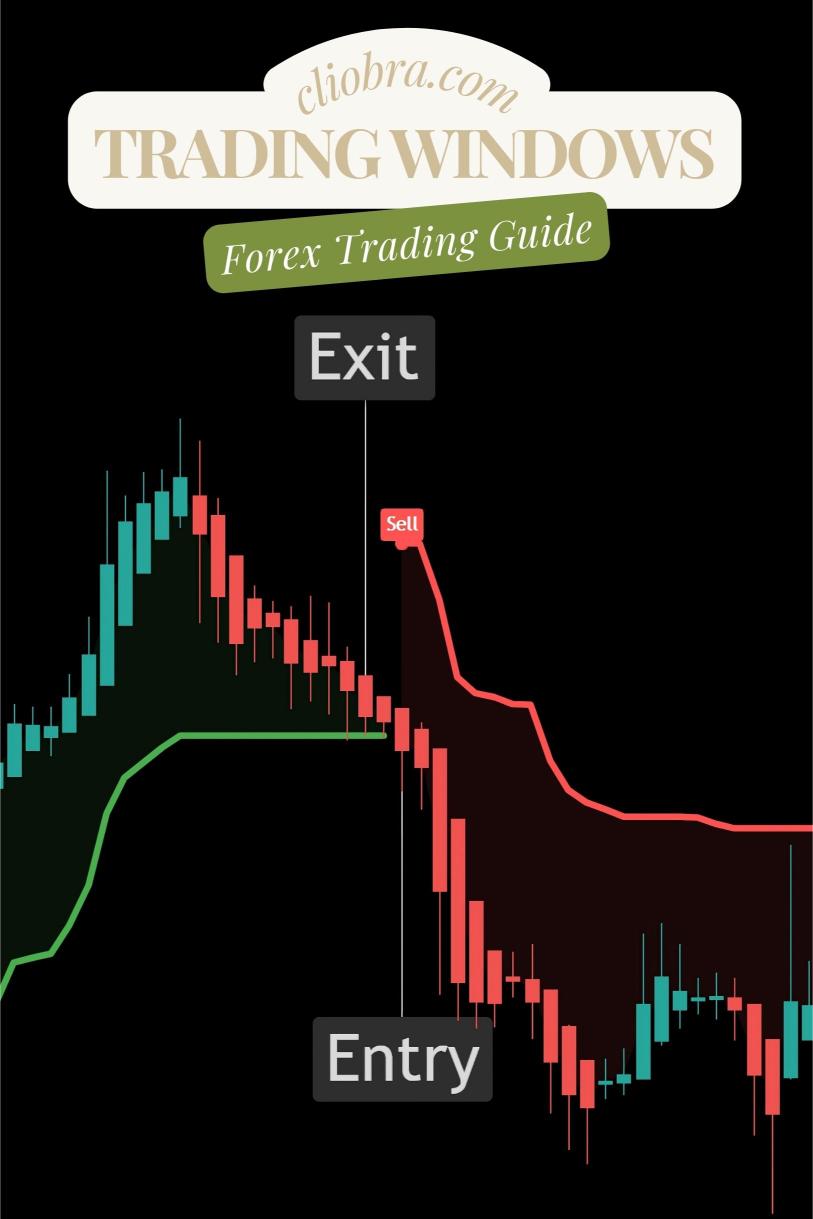

Let’s dive into the gritty details of institutional trading windows and how they shape the Forex landscape. 📈

What Are Institutional Trading Windows?

Institutional trading windows refer to specific times when large financial institutions execute their trades.

These windows can create significant market movements, impacting retail traders like us.

Here’s the kicker: these institutions often have access to better information and faster execution.

This can leave retail traders scrambling to keep up.

Why Should You Care?

- Market Volatility: Institutional windows can lead to sudden price swings, increasing volatility.

- Liquidity Changes: During these windows, liquidity can dry up, making it harder to execute trades at desired prices.

- Price Manipulation: Some traders argue that institutions can manipulate prices to their advantage.

The Realities of Trading Windows

Let’s break it down.

Institutions often trade during specific sessions when the market is most active—think London and New York overlaps.

This is when the big money flows in, and as a result, prices can shift dramatically.

For example, studies show that about 70% of Forex trading volume occurs during these peak hours.

How This Affects You

Understanding these trading windows can give you a leg up.

Here are a few insights:

- Timing Your Trades: Try to align your trades with these active sessions for optimal results.

- Watch the News: Major economic releases often coincide with these windows, leading to increased volatility.

- Be Prepared: Know that price can move quickly during these times. Use stop-loss orders to protect yourself.

My Take on Institutional Influence

As a seasoned Forex trader since 2015, I’ve seen firsthand how institutional trading impacts the market.

It’s like playing chess against a grandmaster while you’re still learning the rules.

They have resources, speed, and information we simply don’t.

But here’s the good news: you can level the playing field.

Introducing My Forex EA Portfolio

I’ve developed a robust portfolio of 16 sophisticated trading bots that focus on four major currency pairs:

EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is meticulously designed to minimize risk while maximizing returns.

Here’s why my bots stand out:

- Diverse Algorithms: Each currency pair has 3-4 unique bots, minimizing correlated losses.

- Long-Term Trading: They target 200-350 pips, ensuring consistent performance over time.

- Backtested Success: I’ve tested these bots over 20 years, and they thrive even in turbulent market conditions.

And the best part? I’m offering this EA portfolio for FREE!

You can start trading smarter today without any investment in the bots themselves.

Just check out my trading bots portfolio to get started!

What You Can Do

- Stay Informed: Keep an eye on market trends and institutional activity.

- Use Technology: Consider using trading bots to help you navigate these windows efficiently.

My bots are designed to trade long-term, allowing you to focus on strategy rather than constant monitoring. - Choose the Right Broker: A good broker can make all the difference.

Make sure to pick one that executes trades quickly and has minimal slippage.

I’ve tested several, and you can find the best Forex brokers through my recommendations here: Most Trusted Forex Brokers.

Final Thoughts

The Forex market is a complex beast, but understanding institutional trading windows can help you become a more effective trader.

Stay sharp, use the right tools, and don’t hesitate to leverage technology like my 16 trading bots to enhance your trading strategy.

Remember, it’s all about making informed decisions and adapting to the ever-changing market landscape.

With the right knowledge and tools, you can navigate this market with confidence.

Let’s make those trades work for you! 🚀