Last Updated on February 11, 2025 by Arif Chowdhury

Ever felt like you’re playing a game of roulette with your trades?

You put in your time, analyze the charts, but the outcomes still feel random.

You’re not alone.

Many traders grapple with this uncertainty.

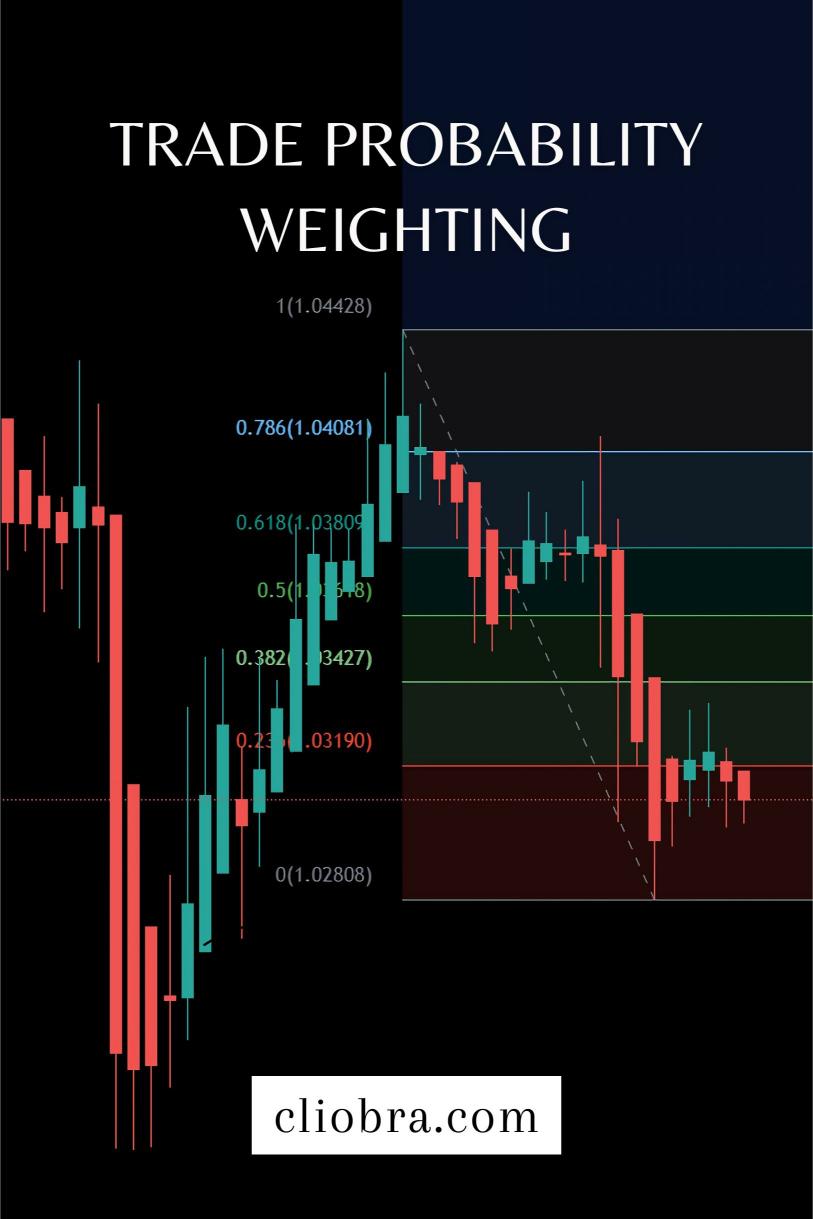

That’s where the concept of trade probability weighting comes in.

It’s the science that can transform your trading game from guesswork to a methodical approach.

Let’s break it down.

What is Trade Probability Weighting?

Trade probability weighting is about assessing the likelihood of various outcomes in your trading strategy.

Think of it as a risk-reward calculator.

You’re not just looking at potential profits; you’re weighing them against the risks.

This approach is crucial for maximizing profitability.

By understanding the probabilities behind each trade, you can make more informed decisions.

Why Does It Matter?

- Informed Decisions: It helps you decide which trades are worth taking.

- Risk Management: You can better manage your risks by knowing which trades have a higher chance of success.

- Consistency: You’ll develop a more disciplined approach to trading.

The Numbers Don’t Lie

Did you know that about 90% of retail traders lose money?

That’s a staggering statistic.

But here’s the kicker: those who apply probability weighting can significantly improve their odds.

In fact, traders who focus on probability-adjusted returns see an increase of up to 50% in their profitability over time.

How to Implement Trade Probability Weighting

- Assess Historical Data: Look at past performance of your trades.

- Use Statistical Analysis: Identify patterns and probabilities.

- Set Clear Criteria: Define what makes a trade worth taking.

My Journey with Trade Probability Weighting

As a seasoned Forex trader since 2015, I’ve honed my expertise through rigorous exploration of both fundamental and technical analysis.

Focusing on technical analysis led me to develop a unique trading strategy.

This strategy emphasizes trade probability weighting, which has resulted in consistent profitability.

I’ve created a portfolio of 16 sophisticated trading bots that leverage this very principle.

These bots are strategically diversified across EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each currency pair has its own set of 3-4 bots, minimizing correlated losses.

This multi-layered diversification enhances overall profitability while reducing risks.

Why My Bots Stand Out

These bots are not just random algorithms.

They’re designed to trade on H4 charts, focusing on long-term movements of 200-350 pips.

I’ve backtested them over the past 20 years under various market conditions.

The results speak for themselves.

If you’re looking to elevate your trading game, consider checking out my 16 trading EAs, available for FREE through my portfolio.

You can find them here: Explore My Trading Bots.

The Power of the Right Brokers

Now, let’s talk about brokers.

You can have the best strategy or bots, but if you’re not with a reliable broker, it’s all for naught.

I’ve tested various brokers and can confidently recommend the best ones that align with your trading style.

These brokers offer competitive spreads, excellent execution speeds, and superior customer support.

Check them out here: Best Forex Brokers.

Final Thoughts

Trade probability weighting is more than just a strategy; it’s a mindset.

By understanding and applying it, you’ll navigate the Forex waters with confidence.

With my trading bots and the right broker, you can turn those odds in your favor.

So, don’t leave your success to chance.

Dive into the science of trade probability weighting and watch your trading journey transform.