Last Updated on March 17, 2025 by Arif Chowdhury

Ever find yourself staring at the charts, wondering which way the market will swing next?

You’re not alone.

Many traders grapple with uncertainty and mixed signals.

That’s why I want to share a strategy that has helped me navigate the Forex landscape since 2015.

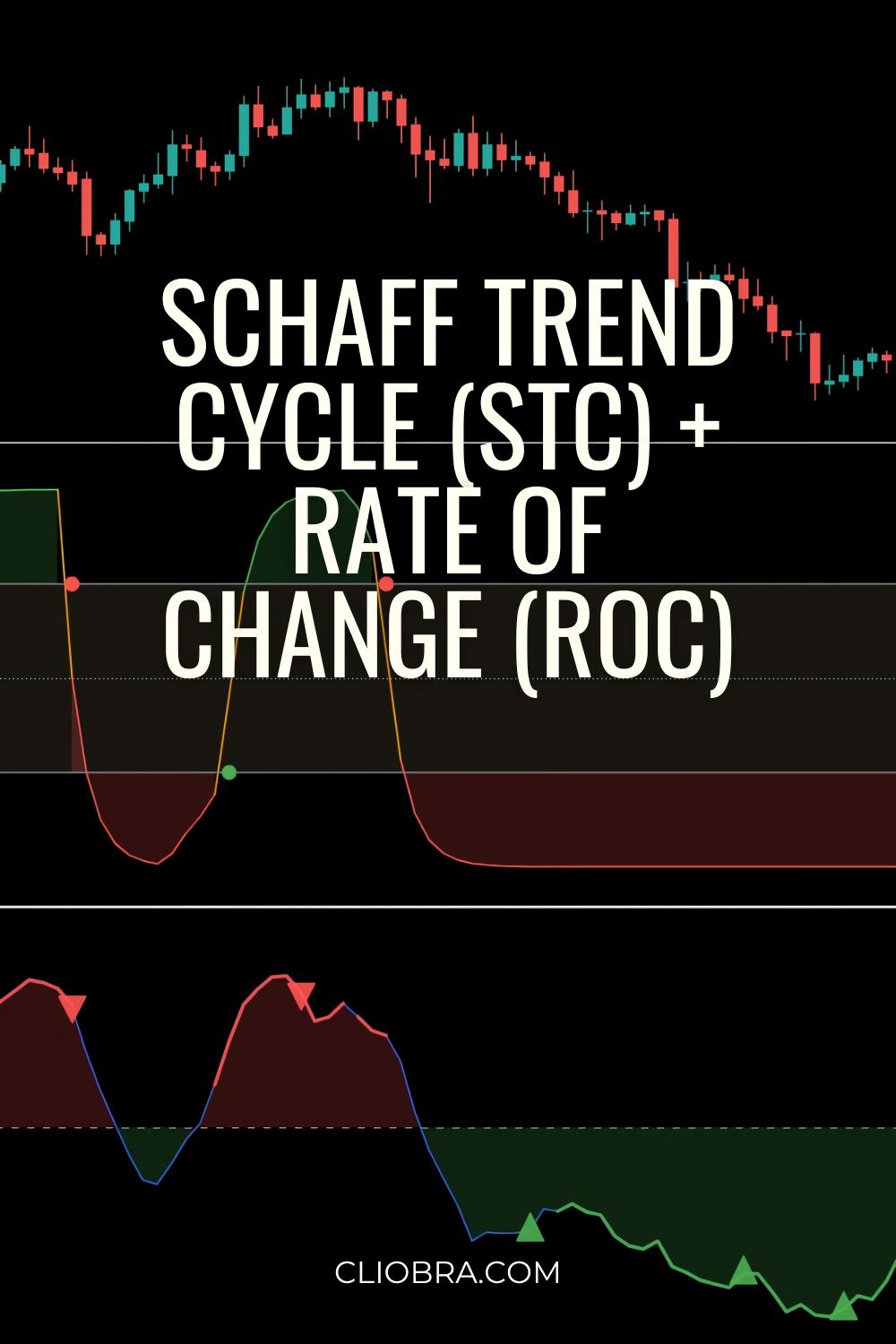

Let’s dive into the Schaff Trend Cycle (STC) and Rate of Change (ROC) strategy for swing trading.

Why STC + ROC?

Both indicators are powerful.

When combined, they create a robust approach for catching trends while avoiding false signals.

- Schaff Trend Cycle (STC): A refined version of the traditional cycle indicators, STC helps identify the trend direction and potential reversals.

- Rate of Change (ROC): This measures the speed at which price changes, helping you spot momentum shifts.

How It Works

- Identifying the Trend:

Use the STC to determine if the market is bullish or bearish.- When STC is above 25, consider it bullish.

- Below 25, think bearish.

- Confirming Momentum with ROC:

Look for ROC to cross zero.- ROC turning positive? It’s a buy signal.

- ROC turning negative? Time to sell.

- Entry and Exit Points:

Combine these signals for entry points.- Enter when STC confirms a trend and ROC supports it.

- Exit when the STC shows divergence from price action.

Statistical Insights

Did you know that around 70% of traders lose money in Forex due to emotional trading and poor strategy?

By using the STC and ROC strategy, you can join the minority of successful traders.

Also, studies show that traders who employ a systematic approach improve their chances of long-term profitability by 30%.

Building a Solid Portfolio

Now, let’s talk about my 16 trading bots.

These bots utilize the STC + ROC strategy alongside other techniques to diversify risk and maximize profit.

- Diverse Algorithms: Each currency pair has 3-4 bots tailored for optimal performance.

- Robust System: The internal diversification minimizes correlated losses, enhancing your portfolio’s stability.

- Long-Term Focus: Designed to trade on H4 charts, my bots aim for consistent gains of 200-350 pips.

After backtesting for 20 years, their performance remains stellar—even under tough market conditions.

And guess what? You can access this entire EA portfolio for FREE.

Check out my trading bots portfolio to see how you can elevate your trading game.

Tips for Success

- Choose the Right Broker: Your trading experience hinges on your broker. Look for those with tight spreads and excellent support.

- Stay Educated: Continuously learn about market dynamics and refine your strategies.

- Emotional Control: Stick to your plan. Don’t let fear or greed dictate your trades.

Final Thoughts

The STC + ROC strategy can be a game-changer in your trading journey.

By combining these indicators, you can identify trends and shifts in momentum with greater accuracy.

But remember, even the best strategies need a solid foundation.

So, make sure you’re trading with a trusted broker.

Check out my recommendations for the best Forex brokers that I’ve personally tested.

Your success is a journey, not a destination. Equip yourself with the right tools and knowledge.

Happy trading! 🚀