Last Updated on March 2, 2025 by Arif Chowdhury

Are you tired of guessing where the market is heading next?

Do you often feel like you’re trading in the dark, unsure of when to enter or exit a position?

Trust me, I’ve been there.

As a seasoned Forex trader since 2015, I know the struggle.

But I’ve uncovered a gem of a strategy that can help you spot those crucial reversal zones: the RSI + Zig Zag Indicator Strategy.

Let’s dive into it.

What is the RSI + Zig Zag Indicator Strategy?

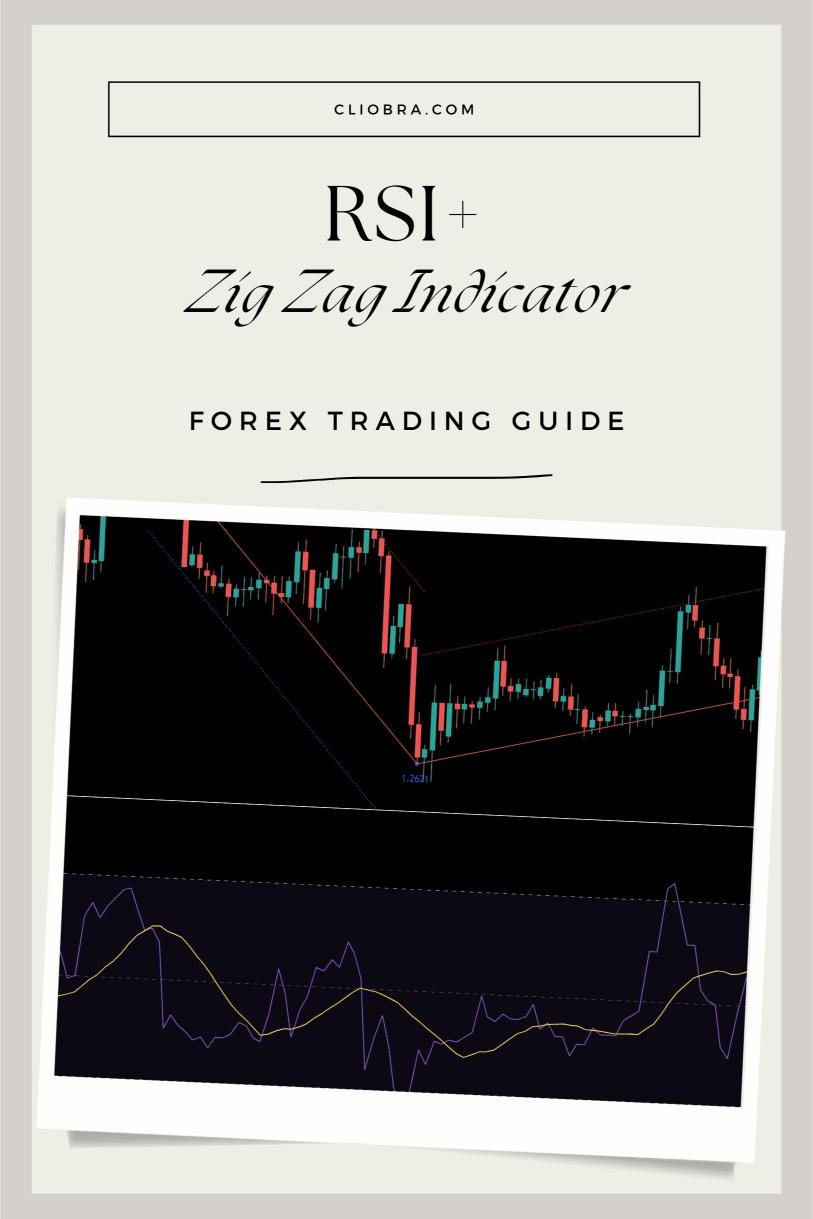

The Relative Strength Index (RSI) and Zig Zag Indicator are two powerful tools that, when combined, can enhance your trading decisions.

- RSI measures the speed and change of price movements.

- Zig Zag helps to filter out market noise by showing the most significant price changes.

When used together, they can help you identify potential reversal zones effectively.

Why Use This Strategy?

Here’s the deal:

- Many traders miss out on key market reversals simply because they don’t have the right tools.

- Studies show that traders who use multiple indicators tend to have better outcomes. In fact, a study found that using a combination of indicators can increase the accuracy of trading signals by up to 30%.

How to Implement the RSI + Zig Zag Strategy

- Set Up Your Indicators

- Add the RSI to your chart (set it to 14 periods).

- Add the Zig Zag indicator to filter price movements.

- Identify Overbought/Oversold Conditions

- Look for RSI levels above 70 (overbought) or below 30 (oversold).

- These levels suggest potential reversals.

- Watch for Zig Zag Changes

- When the RSI indicates overbought or oversold conditions, check the Zig Zag indicator.

- A change in direction on the Zig Zag can confirm a potential reversal.

- Entry and Exit Points

- Enter a trade when both indicators align (RSI signals reversal and Zig Zag confirms it).

- Set your stop-loss just outside the recent swing high/low for better risk management.

The Power of Diversification

While this strategy is solid, it’s important to diversify your approach.

That’s where my 16 sophisticated trading bots come into play.

Each bot utilizes strategies like the RSI + Zig Zag, among others, to minimize risk and maximize returns.

Imagine having a robust portfolio that not only trades across major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY but also spreads the risk across multiple algorithms.

- Each currency pair has 3-4 bots specifically designed to operate within their unique market dynamics.

- This multi-layered diversification significantly enhances overall profitability while reducing correlated losses.

You can check out my trading bots portfolio for free.

Real-World Application

In my trading journey, I’ve seen the effectiveness of combining these indicators.

For example, during a recent market downturn, the RSI + Zig Zag strategy allowed me to pinpoint reversal zones that many traders overlooked.

This led to timely entries and exits, proving the strategy’s worth in real-time scenarios.

Key Takeaways

- The RSI + Zig Zag Indicator Strategy is effective for spotting reversal zones.

- Use it to identify overbought and oversold conditions, then confirm with Zig Zag.

- Diversifying through trading bots can significantly enhance your trading game.

Choosing the Right Brokers

As you embark on your trading journey, don’t forget the importance of choosing a reliable broker.

The right broker can make a world of difference in your trading experience.

I’ve tested various options and recommend checking out the best forex brokers to ensure you’re set up for success.

Final Thoughts

Trading doesn’t have to be a guessing game.

With the RSI + Zig Zag strategy, you can gain clarity on potential reversals.

And remember, pairing this strategy with a diversified trading approach using my 16 EAs will enhance your chances of long-term success.

So, what are you waiting for?

Dive into the world of Forex trading with confidence.