Last Updated on March 9, 2025 by Arif Chowdhury

Ever felt the sting of a stop loss hitting just before the market turns in your favor?

Or maybe you’ve watched your trades oscillate wildly, only to close them at a loss due to poor stop loss management.

These are common frustrations in trading.

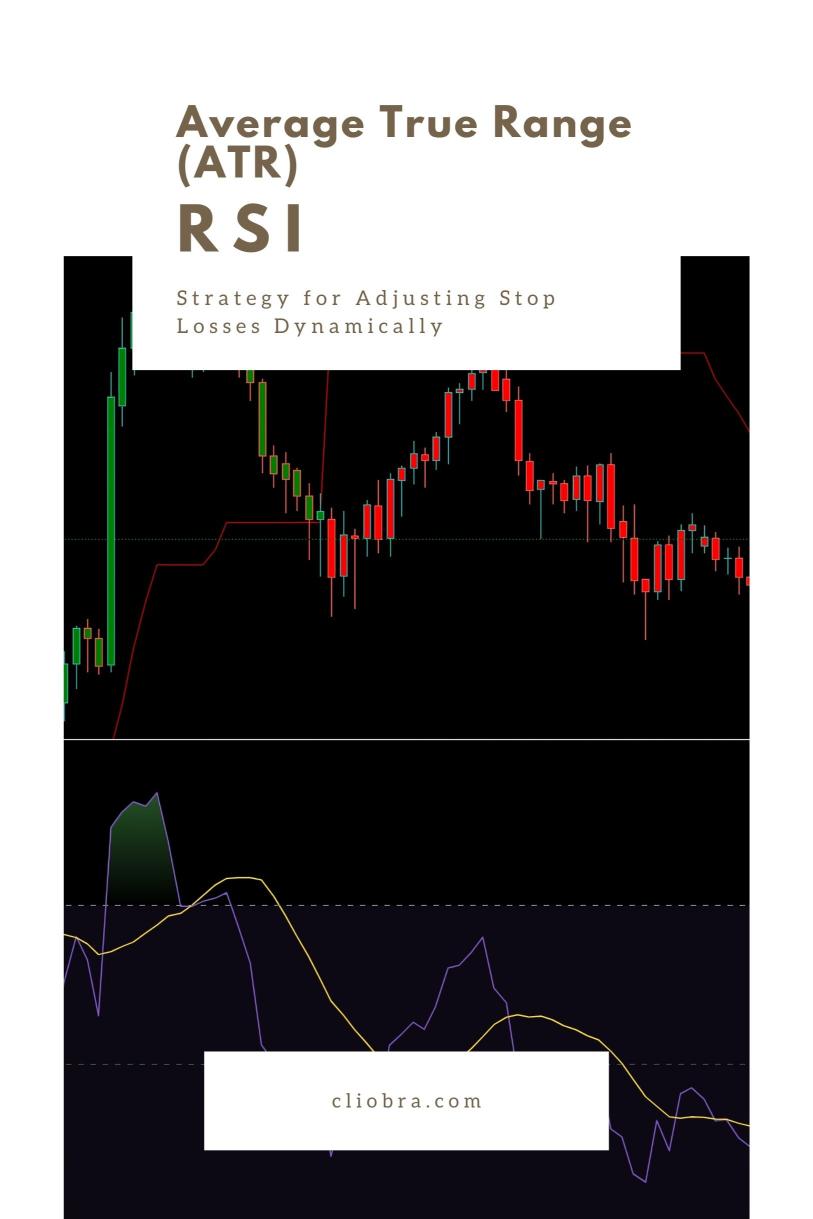

But what if I told you there’s a way to adjust your stop losses dynamically using the RSI and ATR?

Let’s dive in.

Understanding RSI and ATR

Relative Strength Index (RSI)

- Measures the speed and change of price movements.

- Ranges from 0 to 100.

- Typically, an RSI above 70 indicates overbought conditions, while below 30 indicates oversold.

Average True Range (ATR)

- Measures market volatility.

- A higher ATR means more volatility, which can be crucial for setting stop losses.

Both tools provide invaluable insights.

Using them together can help you adapt your stop loss based on market conditions.

Why Use the RSI + ATR Strategy?

- Dynamic Adjustments

This strategy allows your stop losses to adapt to changing market conditions, unlike static stop losses that can get hit during normal fluctuations. - Risk Mitigation

By adjusting your stop loss based on volatility, you can potentially avoid unnecessary losses. - Profit Optimization

This strategy can help lock in profits while allowing your trade some breathing room.

How to Implement the RSI + ATR Strategy

Here’s a simple way to use this strategy.

Step 1: Identify the Trend

- Check the RSI.

- Is it above 70 or below 30?

- This indicates whether the market is overbought or oversold.

Step 2: Calculate the ATR

- Look at the ATR value on your chart.

- This tells you how much the price has been moving.

Step 3: Set Your Initial Stop Loss

- For a buy trade, set your stop loss below the recent swing low minus a multiple of the ATR (e.g., 1.5x ATR).

- For a sell trade, set it above the recent swing high plus a multiple of the ATR.

Step 4: Adjust Dynamically

- As the trade moves in your favor, keep an eye on the RSI and ATR.

- If the RSI shows overbought conditions, consider tightening your stop loss to protect your gains.

- If the ATR increases, you may want to give your trade more room by adjusting the stop loss further away.

My Trading Bots and the RSI + ATR Strategy

As a seasoned Forex trader since 2015, I’ve tested dozens of strategies.

One standout is the RSI + ATR strategy, which my exceptional portfolio of 16 trading bots utilizes.

These bots work across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is designed to trade long-term, aiming for 200-350 pips.

What’s great is that they’re all based on the same principles of dynamic stop loss adjustments.

This multi-layered diversification reduces correlated losses, making my system robust and resilient.

And guess what? I’m offering this entire EA portfolio for FREE.

If you’re eager to elevate your trading game, check out my trading bots here.

Statistical Insights

- Did you know that using dynamic stop losses can decrease the likelihood of being stopped out by as much as 30%?

- Research shows that traders who adjust their stop losses based on market volatility tend to see 20% higher returns over time.

Final Thoughts

Implementing the RSI + ATR strategy can revolutionize your trading approach.

It’s all about adapting to the market’s pulse.

Don’t let static stop losses hold you back.

If you’re looking for reliable brokers to execute your trades, check out my top recommendations here.

By leveraging both the right tools and the right partners, you’ll be on your way to becoming a more profitable trader.