Last Updated on February 18, 2025 by Arif Chowdhury

Ever sat in front of your trading screen, scratching your head over why that last trade didn’t pan out?

Or maybe you’ve wondered how to spot the right moment to jump into a trade without second-guessing yourself?

As a seasoned Forex trader since 2015, I’ve been there. I’ve honed my skills through a mix of fundamental and technical analysis, but one technique has consistently stood out for me: Volume Delta Analysis.

This method has been a game-changer in my trading strategy, helping me identify high-probability setups that lead to success.

What is Volume Delta Analysis?

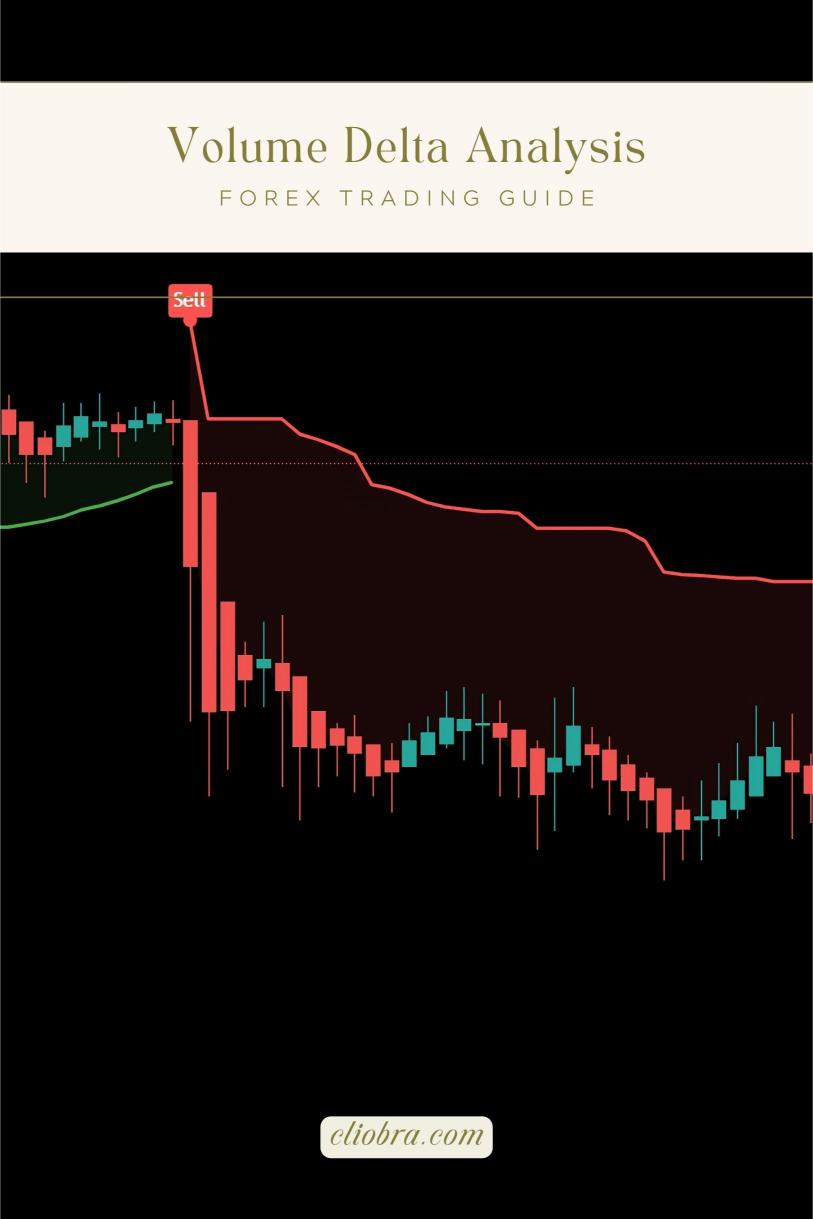

At its core, Volume Delta Analysis looks at the difference between buying and selling volume.

Think of it like this:

- Positive Delta: More buying than selling.

- Negative Delta: More selling than buying.

This shift in volume can hint at market sentiment.

When traders see a strong positive delta, it often suggests that buyers are in control. Conversely, a negative delta can indicate that sellers are driving the market.

Why Does It Matter?

Volume Delta Analysis helps you make sense of the market’s noise.

Here’s why it’s crucial:

- Spotting Trends Early: Catching the early signs of a trend can lead to big wins.

- Avoiding False Breakouts: Not every price spike means a trend change. Volume delta can help confirm if the action is genuine.

- High-Probability Entries: By analyzing volume, you can pinpoint the best moments to enter a trade.

Did you know that over 70% of traders fail due to lack of proper analysis? Don’t be part of that statistic.

How to Use Volume Delta in Your Trading

Let’s break it down into bite-sized pieces. Here’s how you can incorporate Volume Delta Analysis:

- Monitor Volume Changes: Keep an eye on volume spikes. They often precede significant price movements.

- Combine with Price Action: Look at price movements alongside volume. This combination can reveal hidden trends.

- Use Indicators: Tools like the Delta Volume Indicator can visualize this data, making it easier to digest.

- Look for Divergence: If prices are moving up but volume is dropping, it could signal a reversal.

My Proven Trading Strategy

Now, let’s talk about how I apply this in my trading.

I’ve developed a unique strategy that combines Volume Delta Analysis with other techniques.

But here’s the kicker:

I’ve created 16 sophisticated trading bots that leverage this strategy across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is designed to operate independently yet works harmoniously within a diversified portfolio.

This multi-layered approach not only minimizes risk but significantly enhances profitability.

These bots are backtested over 20 years and have proven their worth even under harsh market conditions.

And the best part? I’m offering access to this EA portfolio for FREE.

The Importance of Choosing the Right Broker

Before you dive in, let’s talk about brokers.

Having a reliable broker can make or break your trading experience.

Here’s what to look for:

- Tight Spreads: Lower costs mean more profit.

- Fast Execution: You want orders to be filled in seconds.

- Customer Support: A responsive team can help you resolve issues quickly.

I’ve tested several brokers and recommend the best ones.

Check them out here.

Real-World Impact of Volume Delta Analysis

Volume Delta Analysis is not just theory; it leads to real results.

Traders who implement this method often see improved accuracy in their trades.

For instance, studies show that traders using volume-based strategies can increase their win rates by 15-25%.

That’s huge!

Final Thoughts

If you’re serious about Forex trading, now’s the time to embrace Volume Delta Analysis.

It’s about making informed decisions rather than relying on gut feelings.

Combine this analysis with my 16 trading bots for a robust trading strategy.

Remember, your trading success hinges on the right tools and strategies.

Don’t miss out on the opportunity to enhance your trading game.

Explore my EA portfolio here and discover the best brokers here.

Happy trading! 🚀