Last Updated on February 18, 2025 by Arif Chowdhury

Ever felt like you’re just spinning your wheels in Forex trading?

You’re not alone.

Many traders wrestle with the unpredictability of the markets.

You might be asking:

How can I gain an edge?

What strategies actually work?

Let’s dive into something that’s been a game changer for me: Time-Series Momentum.

What is Time-Series Momentum?

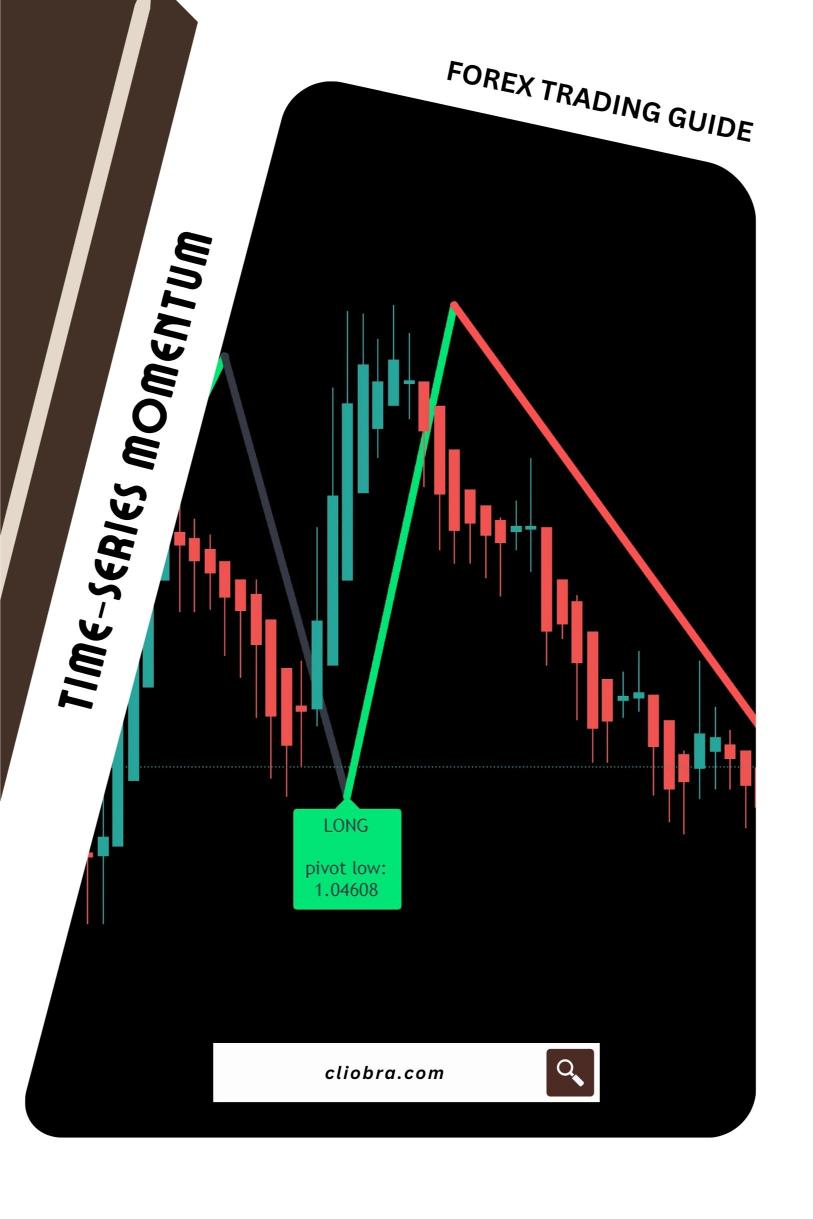

In simple terms, Time-Series Momentum is about following the trend.

When a currency pair is moving upwards, you ride that wave.

When it’s going down, you shift your focus.

This strategy captures the essence of price movements over time, enabling traders to make informed decisions based on historical data.

Here’s why it matters:

- Statistical Edge: Research shows that momentum strategies can yield returns of around 8-12% annually in Forex trading.

- Adaptability: It works across various time frames, making it perfect for both short-term and long-term traders.

Why It Works

Trends tend to persist.

When a currency pair shows strength, there’s a good chance it’ll keep moving in that direction.

The market psychology behind this is simple:

Traders often overreact to news, leading to extended trends.

This is where Time-Series Momentum shines.

By analyzing past price data, you can identify these trends early.

My Trading Journey with Time-Series Momentum

Since I started trading in 2015, I’ve explored countless strategies.

Time-Series Momentum stood out.

Why?

Because it aligns with my core philosophy:

Maximize profits while minimizing risks.

I’ve developed a unique trading strategy that incorporates this momentum principle.

This strategy has been the backbone of my exceptional trading portfolio, which includes 16 sophisticated trading bots.

These bots are strategically diversified across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot uses Time-Series Momentum among other strategies to navigate the market effectively.

🚀Get this Forex EA Portfolio for FREE from here.

Key Benefits of Using Time-Series Momentum

- Risk Management: By systematically entering and exiting trades, you limit potential losses.

- Diversification: My portfolio of bots includes 3-4 specialized bots for each currency pair. This internal diversification minimizes correlated losses, enhancing overall stability.

- Long-Term Focus: Operating on H4 charts, my bots aim for substantial gains, typically between 200-350 pips. This long-term approach leads to better performance over time.

Statistical Insights

Did you know that:

- Approximately 70% of traders fail because they don’t stick to a strategy?

- Utilizing a momentum-based approach can improve your success rate significantly?

These stats are a wake-up call.

The Forex market doesn’t favor the faint-hearted.

You need a solid strategy—like Time-Series Momentum—to thrive.

My Trading Bots: A Perfect Match

Curious about how to implement this strategy without spending hours on analysis?

Check out my 16 trading bots portfolio.

They’re designed to optimize the Time-Series Momentum strategy, providing you with an edge in the market.

And the best part?

I’m offering this EA portfolio for completely FREE.

These bots have been backtested for the past 20 years, proving their resilience in various market conditions.

Choosing the Right Forex Broker

Now, let’s talk about the foundation of successful trading: choosing the right broker.

A top-notch broker can make or break your trading experience.

Here’s what to look for:

- Tight Spreads: Lower costs mean better profits.

- Fast Execution: Every second counts in trading.

- Customer Support: You want help when you need it.

I’ve tested and curated a list of the best Forex brokers out there.

If you’re serious about your trading journey, check out my recommendations here: Most Trusted Forex Brokers.

Final Thoughts

Time-Series Momentum is a powerful tool in advanced algorithmic Forex trading.

It can give you the edge you need to navigate the complexities of the market.

Combine this strategy with my 16 trading bots to make the most of your trading experience.

Don’t forget to choose the right broker for your trades.

With a solid strategy and the right tools, you’re well on your way to becoming a successful Forex trader.

Ready to take the plunge?

Let’s make those pips count!