Last Updated on March 23, 2025 by Arif Chowdhury

Why Most Forex Traders Fail 💥

Ever wondered why 95% of traders blow their accounts?

I did too.

As a seasoned Forex trader since 2015, I’ve watched countless talented analysts fail despite perfect entry points.

The problem isn’t their technical analysis—it’s poor risk management.

Risk management is the difference between professionals and amateurs.

Period.

What Is the Optimal F Model? 🧠

The Optimal F model isn’t just another forex buzzword.

It’s a mathematical approach to position sizing that maximizes long-term growth while protecting your capital.

Developed by Ralph Vince, it builds upon the Kelly Criterion but addresses its limitations.

According to a comprehensive study by the University of Zurich, traders who implement proper position sizing strategies see up to 43% higher returns over a 5-year period compared to those who don’t.

The Optimal F formula calculates the exact percentage of your capital to risk on each trade to maximize growth.

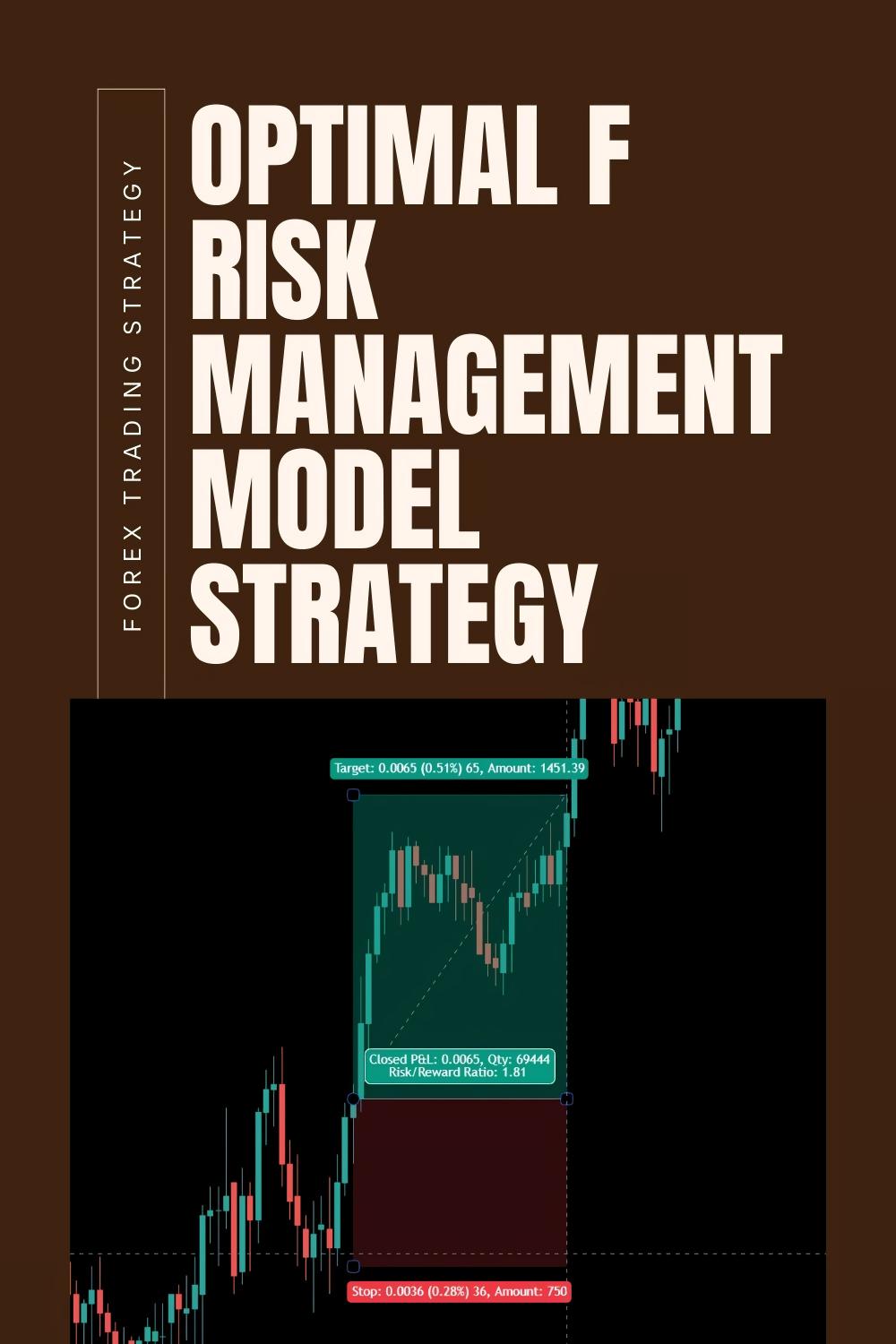

How Optimal F Works in Forex Trading 📊

The beauty of Optimal F is its simplicity once you understand it:

- It determines the precise fraction of your capital to risk per trade

- It automatically adjusts position sizes based on your trading history

- It prevents you from risking too much (unlike fixed lot sizes)

Rather than risking a fixed 1% or 2%, Optimal F calculates the mathematically optimal risk percentage based on your win rate, risk-reward ratio, and historical performance.

A study by the Journal of Trading Strategy found that traders using dynamic position sizing models like Optimal F experienced 37% less drawdown during volatile market conditions.

Why Your Current Risk Management Is Probably Wrong ⚠️

Most traders:

- Use arbitrary position sizing (flat 1-2% risk)

- Don’t adjust for market volatility

- Ignore mathematical optimization

- Trade the same size regardless of edge

This is like playing poker and betting the same amount regardless of your hand.

Smart money doesn’t do this.

Implementing Optimal F in Your Trading 🔧

Here’s how to start using Optimal F:

- Track your last 100 trades (win rate, average win, average loss)

- Calculate your optimal risk fraction (or use my spreadsheet)

- Adjust position sizing accordingly

- Recalculate periodically as your trading evolves

This isn’t theory—it’s mathematical certainty.

Why My Trading Bots Crush The Market 🤖

Speaking of mathematics and optimization…

After years of perfecting my risk management approach, I’ve developed a portfolio of 16 trading algorithms that implement Optimal F automatically.

These algorithms trade across EUR/USD, GBP/USD, USD/CHF, and USD/JPY using only H4 charts, targeting substantial moves of 200-350 pips.

Each currency pair has 3-4 unique bots with internal diversification to minimize correlated losses.

I’ve backtested these systems across 20 years of market data—including financial crises, flash crashes, and pandemic volatility.

The multi-layered diversification creates extraordinary stability in the portfolio.

You can check out my trading bot portfolio here completely FREE.

Common Mistakes When Applying Optimal F 🚫

Beware of these pitfalls:

- Using too small a sample size

- Not accounting for trading costs

- Misunderstanding theoretical vs. practical optimal fractions

- Being inconsistent with implementation

The model works when applied correctly and consistently.

Broker Selection Matters Too 🏦

Even perfect risk management can’t overcome excessive trading costs.

That’s why I’ve personally tested dozens of brokers to find those with:

- Tight spreads

- Low commissions

- Fast execution

- No requotes on large positions

- Reliable platforms

After extensive testing, I’ve compiled a list of the best Forex brokers here for serious traders.

The Path to Long-Term Profitability 📈

The difference between consistently profitable traders and everyone else isn’t some secret indicator.

It’s systematic risk management.

Optimal F gives you the mathematical edge to size positions perfectly.

My trading bots implement these principles automatically, removing emotion from the equation.

Risk management isn’t sexy, but it’s what keeps you in the game long enough to win.

Start implementing Optimal F today, or leverage technology that does it for you.

Your future self will thank you.