Last Updated on March 28, 2025 by Arif Chowdhury

Ever felt like the market was playing tricks on you?

You see a price breakout, and your heart races.

But then, just as quickly, it reverses.

Frustrating, right?

As a seasoned Forex trader since 2015, I’ve been there.

I know the pain of watching what looks like a winning trade turn into a loss.

That’s why I developed The Market Trap Strategy.

Let’s break it down.

Understanding False Breakouts

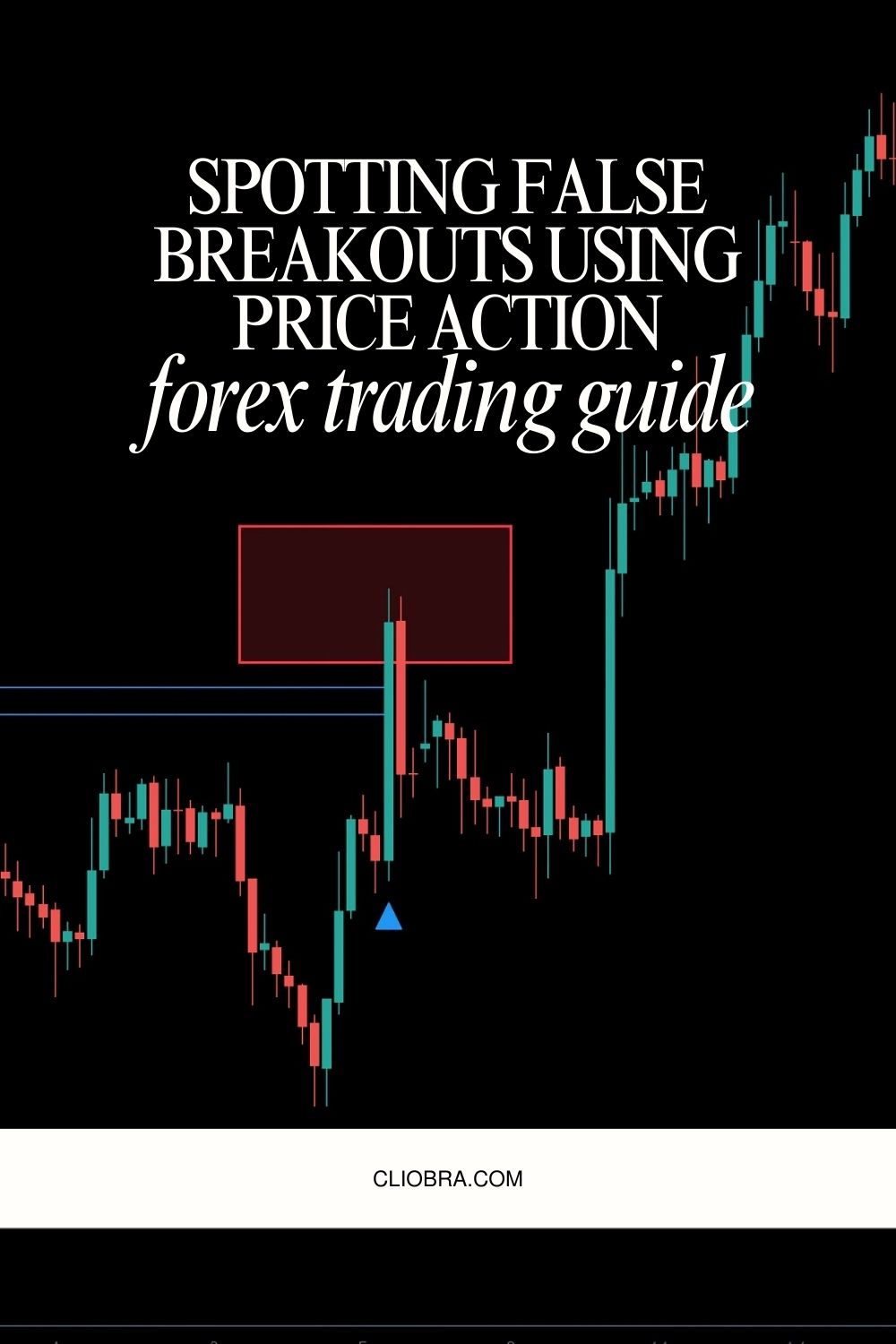

False breakouts happen when the price moves beyond a support or resistance level but quickly reverses.

Why does this happen?

Market psychology plays a huge role.

Traders jump in, thinking they’re riding a big wave, only to find it’s a trap.

Statistics show that about 70% of breakouts fail.

That’s a lot of lost opportunities.

How to Spot a False Breakout

Here’s how you can spot these sneaky traps:

- Price Action Signals: Look for candlestick patterns. A pin bar or engulfing candle can signal a reversal.

- Volume Analysis: Check if the volume supports the breakout. A low volume means weak conviction.

- Key Levels: Identify strong support and resistance levels. If the price breaks but quickly pulls back, it’s likely a false breakout.

- Market Sentiment: Keep an eye on news and events. They can cause unexpected price swings.

The Market Trap Strategy Steps

- Identify Key Levels: Mark your support and resistance zones on the chart.

- Wait for a Break: Let the price break these levels.

- Look for Confirmation: This is where we differentiate ourselves. Don’t just jump in. Wait for confirmation signals.

- Set Your Stop Loss: Always protect yourself. Place your stop loss just outside the level where you expect price to hold.

- Take Profits Smartly: Aim for 200-350 pips. This is where my 16 trading bots excel, strategically designed for long-term gains.

The Power of Diversification

Speaking of my trading bots, they’re a game changer.

I have 16 diverse algorithms targeting four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each pair has 3-4 bots, internally diversified to minimize risk and maximize returns.

This multi-layered diversification helps avoid correlated losses.

Did you know that backtesting shows they perform excellently even under harsh market conditions?

That’s right.

I’ve tested them for the past 20 years, ensuring they withstand the ups and downs of the market.

Plus, I offer this EA portfolio completely FREE.

If you’re curious, check it out here.

The Importance of Timing

Timing is everything in Forex trading.

False breakouts can often coincide with high-impact news releases.

That’s when the market can move unpredictably.

Stay ahead by being aware of the economic calendar.

The Role of Trading Psychology

Trading isn’t just about numbers; it’s about mindset.

Fear and greed can push you into traps.

Stick to your strategy.

Trust the process.

Best Forex Brokers to Consider

Choosing a reliable broker is crucial in your trading journey.

I’ve tested many, and I recommend the ones that offer tight spreads, no commissions, and outstanding support.

Remember, your broker can affect your trading performance.

It’s worth investing time to find one that fits your needs.

Check out my recommended brokers here for a solid start.

Conclusion

The Market Trap Strategy helps you navigate the tricky waters of Forex trading.

By spotting false breakouts, you can increase your winning trades and minimize losses.

Remember to use solid risk management and always stay informed.

And if you want to boost your trading game, check out my 16 trading bots that are designed for long-term success.

They’re a powerful tool in your trading arsenal.

Your journey in Forex doesn’t have to be lonely.

Stay educated, stay disciplined, and let’s conquer the market together.