Last Updated on November 1, 2025 by Arif Chowdhury

Ever felt overwhelmed by the noise in the Forex market?

You’re not alone. Many traders struggle with market volatility, false signals, and emotional decision-making.

So, how can you cut through the chaos?

Let’s dive into a strategy that has transformed my trading journey: the MACD + Heikin Ashi Candlestick strategy.

This approach helps filter out the noise and spot high-probability trades.

What is the MACD?

The Moving Average Convergence Divergence (MACD) is a popular momentum indicator.

It helps identify potential buy and sell signals by showing the relationship between two moving averages.

Here’s how it works:

- MACD Line: The difference between the 12-day and 26-day exponential moving averages (EMAs).

- Signal Line: A 9-day EMA of the MACD line.

- Histogram: Shows the difference between the MACD line and the signal line.

This nifty tool tells you when momentum is shifting.

When the MACD crosses above the signal line, it’s a potential buy signal.

When it crosses below, it’s a potential sell signal.

What are Heikin Ashi Candlesticks?

Heikin Ashi candlesticks provide a smoother visual representation of price action.

Unlike traditional candlesticks, they’re calculated differently, which helps filter out market noise.

Here’s the breakdown:

- Close: Average price of the current bar.

- Open: Average of the previous Heikin Ashi open and close.

- High: Maximum of the current high, open, or close.

- Low: Minimum of the current low, open, or close.

This method reduces market fluctuations, making it easier to spot trends and reversals.

Combining MACD and Heikin Ashi

Now, let’s see how to combine these two powerful tools.

- Identify the Trend: Use Heikin Ashi to determine the overall trend. If you see consecutive bullish candles, you’re likely in an uptrend.

- Confirm with MACD: Check the MACD. Look for bullish crossovers to enter long positions.

- Set Exit Points: If the Heikin Ashi candles start to change color or the MACD line crosses back, it’s time to consider exiting.

Why This Strategy Works

Statistically, traders using the MACD have a higher win rate.

In fact, studies show that combining momentum indicators with trend-following tools can yield up to 80% accuracy in identifying trade opportunities.

The Heikin Ashi method further enhances this by minimizing false signals, especially in choppy markets.

My Trading Bots and the MACD + Heikin Ashi Strategy

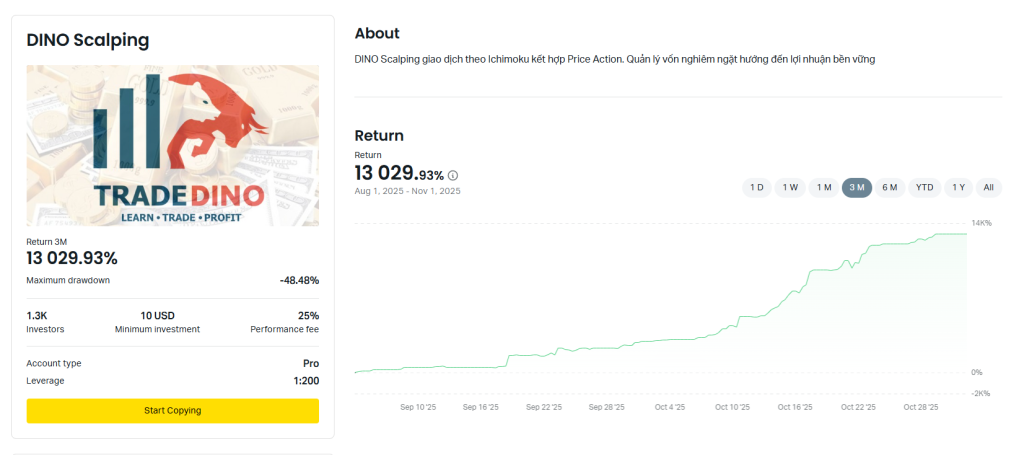

As a seasoned Forex trader since 2015, I’ve developed a portfolio of 16 sophisticated trading bots.

These bots strategically use the MACD + Heikin Ashi Candlestick strategy alongside various other techniques to maximize profit while minimizing risk.

- Each bot is tailored for major currency pairs like EUR/USD and GBP/USD.

- The algorithms are internally diversified to mitigate correlated losses.

This means you’re less likely to face simultaneous losses across all bots.

Plus, they’re designed for long-term trades, targeting 200-350 pips.

I’ve backtested these bots for 20 years, and they perform excellently, even in harsh market conditions.

And here’s the best part: I’m offering this EA portfolio for FREE!

If you’re ready to enhance your trading experience, check out my trading bots here.

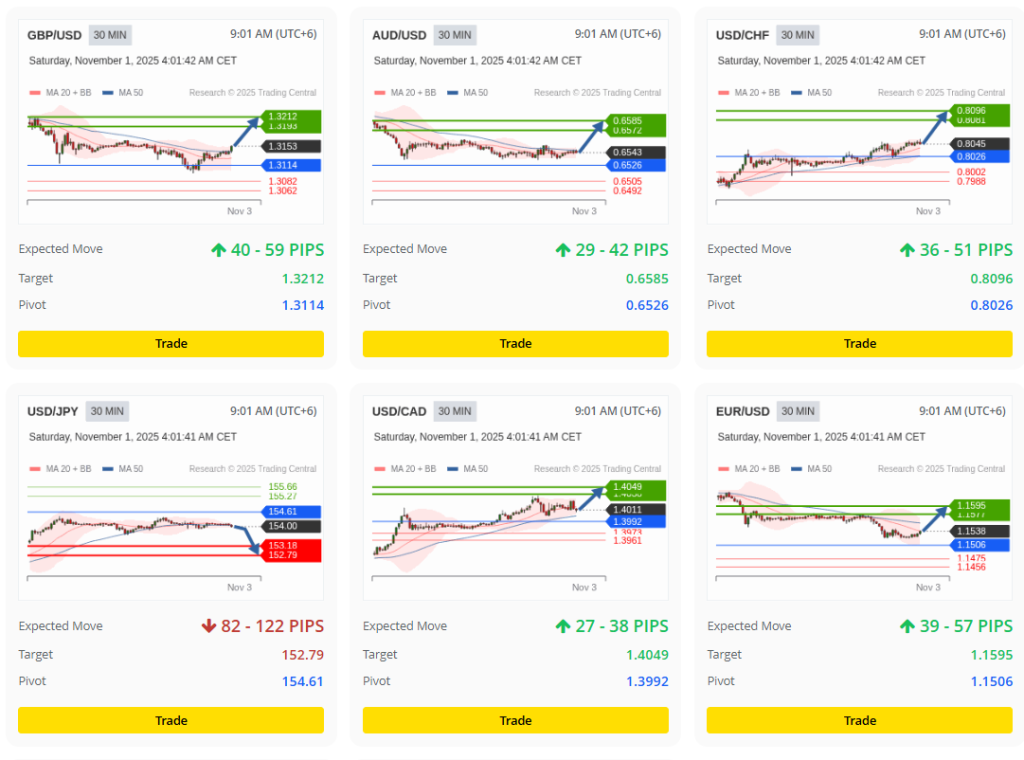

Choosing the Right Forex Broker

Now that you have a solid strategy and tools at your disposal, the next step is choosing a reliable Forex broker.

I’ve tested various brokers, and I recommend selecting one that provides tight spreads, good execution speed, and excellent customer support.

Remember, the right broker can significantly impact your trading success.

I’ve compiled a list of the best Forex brokers I trust. You can check them out here.

Conclusion

The MACD + Heikin Ashi Candlestick strategy is a powerful way to filter noise in the Forex market.

By combining these tools, you can make more informed trading decisions and enhance your profitability.

Don’t forget to explore my portfolio of 16 trading EAs that utilize this strategy and more.

Your trading journey doesn’t have to be a solo endeavor.

Leverage the tools and resources available to you, and watch your trading skills grow!