Last Updated on March 8, 2025 by Arif Chowdhury

Are you tired of unpredictable market swings?

Do you want to catch those price reversals before they leave you in the dust?

I get it. As a seasoned Forex trader since 2015, I’ve been in your shoes.

The search for reliable strategies can feel endless.

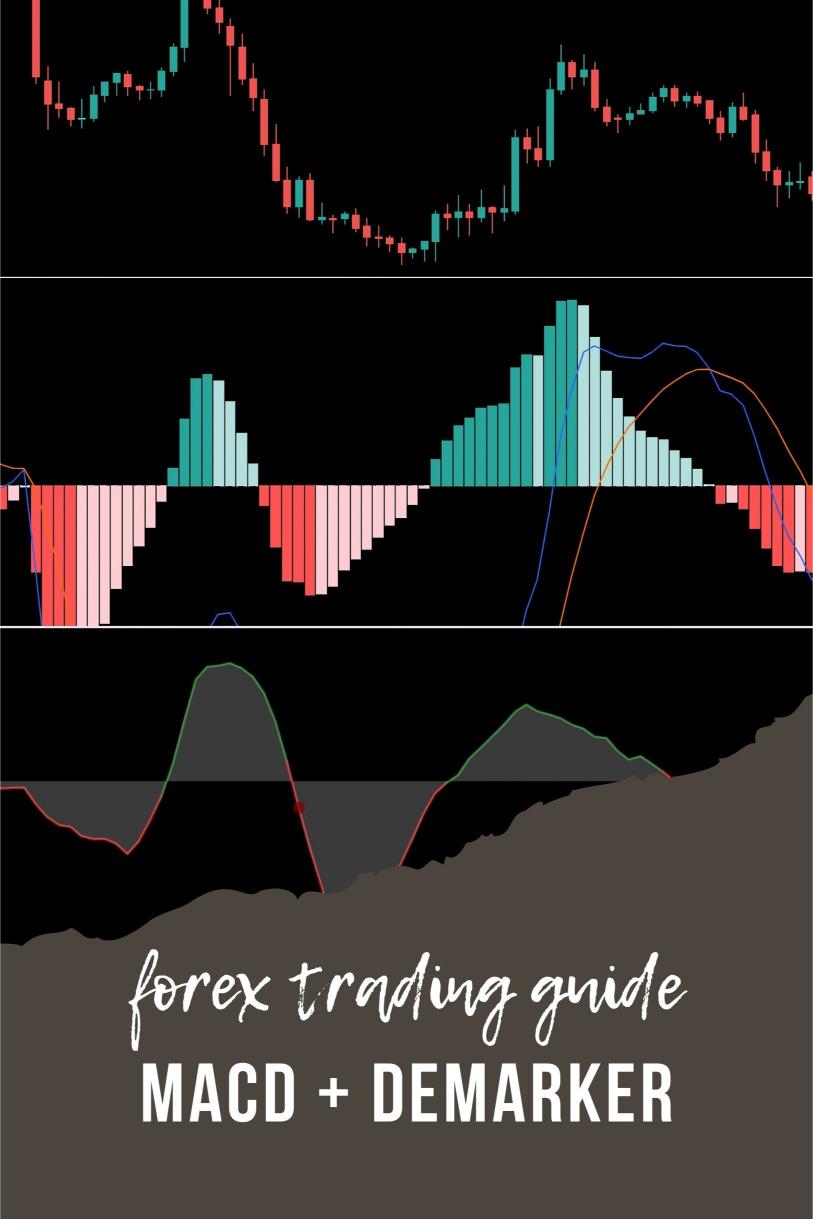

But let me share something powerful: the MACD + DeMarker Indicator Strategy.

This strategy has been a game changer for me.

Why Use the MACD + DeMarker Strategy?

First off, let’s break down why this combo works so well.

- MACD (Moving Average Convergence Divergence) is one of the most popular indicators for spotting trends.

- DeMarker Indicator helps identify price extremes.

When combined, these indicators can signal potential reversals effectively.

Here’s what you need to know:

- Trend Confirmation: The MACD helps confirm the direction of the trend.

- Extreme Conditions: The DeMarker Indicator indicates when the price is overbought or oversold.

Using both provides a solid foundation for your trading decisions.

How It Works

Let’s dive into how to implement this strategy.

Step 1: Set Up Your Indicators

- Add the MACD to your chart.

- Add the DeMarker Indicator.

Step 2: Look for Divergence

- Bullish Divergence: When the price makes lower lows, but the MACD makes higher lows, it’s a potential buy signal.

- Bearish Divergence: When the price makes higher highs, but the MACD makes lower highs, it’s a potential sell signal.

Step 3: Confirm with the DeMarker

- Check the DeMarker Indicator.

- If it’s in the overbought/oversold region, it strengthens your signal.

Why I Trust This Strategy

Over the years, I’ve tested this strategy extensively.

In fact, I’ve backtested my trading bots using this approach for the past 20 years, and they’ve performed excellently under various market conditions.

With solid statistical backing, it’s clear this strategy works.

My Trading Bots: The Secret Sauce

Now, let me introduce you to another layer of my trading success—my 16 trading bots.

Each bot is designed to trade using strategies like the MACD + DeMarker, among others.

Here’s why they’re exceptional:

- Diversity: Each currency pair—EUR/USD, GBP/USD, USD/CHF, and USD/JPY—has 3-4 bots tailored for unique market conditions.

- Risk Management: The internal diversification minimizes correlated losses, creating a robust trading portfolio.

- Long-Term Focus: My bots operate on H4 charts, targeting 200-350 pips, which enhances performance over the long haul.

And the best part? I’m offering this EA portfolio for FREE!

You can leverage these algorithms to maximize your trading potential.

Check out my trading bots portfolio and start enhancing your trading strategy today!

Tips for Success

While the MACD + DeMarker strategy is powerful, it’s crucial to remember a few tips:

- Stay Disciplined: Stick to your trading plan.

- Manage Your Risk: Use stop-loss orders to protect your capital.

- Keep Learning: The Forex market evolves, and so should your strategies.

Choosing the Right Broker

To maximize your trading experience, you need a reliable broker.

Here’s what to look for:

- Tight Spreads: Lower spreads mean better profitability.

- Fast Execution: Quick order execution helps capture those crucial price reversals.

- Excellent Support: A broker that cares about your success is invaluable.

I’ve tested various brokers and can confidently recommend the best.

Check out the top Forex brokers I trust and use by visiting this link.

Final Thoughts

Catching price reversals can transform your trading game.

The MACD + DeMarker Indicator Strategy offers a robust framework to identify these opportunities.

Combine it with my 16 trading bots for a powerful trading experience.

With the right tools and strategies, you can enhance your profitability and minimize risks.

So, are you ready to take your trading to the next level?

Jump into the world of Forex with confidence.