Last Updated on March 1, 2025 by Arif Chowdhury

Ever feel like you’re diving deep into the Forex market, only to get knocked around by unpredictable swings?

You’re not alone.

Many traders wrestle with the same issues: missed opportunities, sudden reversals, and the frustration of not knowing when to jump in or step back.

That’s where a solid strategy comes into play.

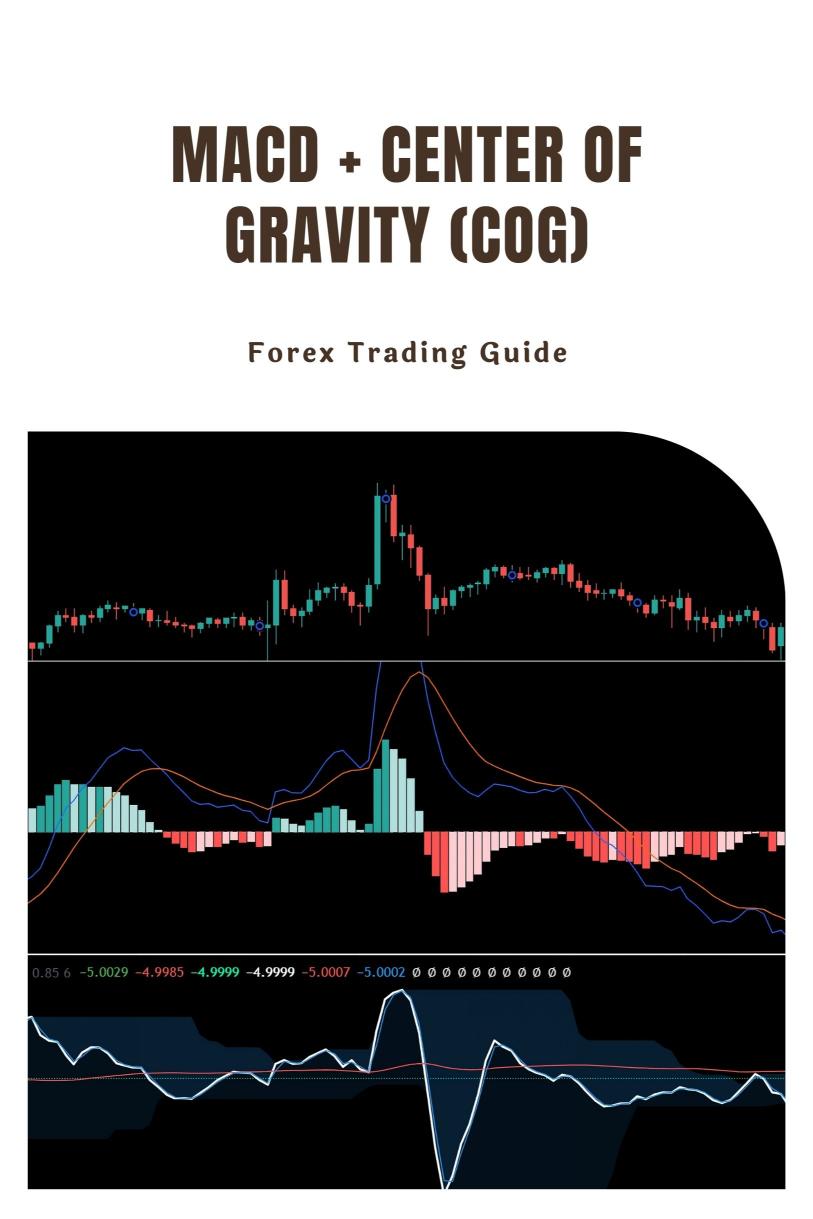

Let’s talk about the MACD + Center of Gravity (CoG) Indicator Strategy. This combo isn’t just for show; it’s a game-changer for spotting market turning points.

What is the MACD?

The MACD (Moving Average Convergence Divergence) is a popular momentum indicator.

It helps identify potential buy and sell signals by showing the relationship between two moving averages of a security’s price.

Here’s why it’s crucial:

- Momentum Measurement: It tells you if a trend is gaining or losing steam.

- Buy/Sell Signals: Crossovers can indicate when to enter or exit a trade.

What is the Center of Gravity (CoG)?

The CoG indicator is like a beacon, helping traders spot potential reversals.

It smoothes out price action, making it easier to identify key levels.

Why consider it?

- Trend Reversal: It helps pinpoint where a trend might change direction.

- Simplicity: Easy to understand, even for beginners.

Combining MACD and CoG

So, how do these two indicators work together?

When you combine the MACD with the CoG, you get a powerful tool for timing your trades.

Here’s the magic formula:

- Look for MACD crossovers near the CoG line.

- If MACD crosses above the CoG, it’s a potential buy signal.

- Conversely, if MACD crosses below the CoG, it might be time to sell.

This combo not only enhances your entry and exit points but also reduces the noise that can lead you astray.

Why This Strategy Works

Statistically speaking, using a combination of indicators can improve your chances of making profitable trades.

Research shows that traders who use multiple indicators can increase their win rate by up to 15%.

That’s significant in the fast-paced world of Forex!

My Journey with EAs

As a seasoned Forex trader since 2015, I’ve explored various strategies, including the MACD + CoG.

In my quest for consistent profitability, I developed a portfolio of 16 sophisticated trading bots.

Each bot is designed with a unique set of algorithms, optimized for pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s how my bots complement the MACD + CoG strategy:

- Diversification: Each bot is diversified across multiple currency pairs to minimize risk.

- Long-Term Focus: They target long-term trades of 200-350 pips, which aligns perfectly with this strategy.

- Backtested Performance: I’ve tested these bots over the past 20 years, and they deliver impressive results even in challenging market conditions.

And the best part? I’m offering access to this EA portfolio completely FREE.

Check it out here: 16 Trading Bots Portfolio.

Key Takeaways

- Combine Indicators: Use MACD and CoG together for better results.

- Stay Informed: Understanding how to interpret these signals can lead to more successful trades.

- Leverage Tools: Utilize my trading bots to enhance your trading experience without the constant pressure of manual trading.

Choosing the Right Broker

Now, let’s talk about brokers.

Finding a trustworthy broker can be as crucial as your trading strategy.

Here’s what I recommend:

- Tight Spreads: Look for brokers with competitive spreads to maximize your profits.

- Customer Support: Ensure they offer outstanding customer service for any questions.

- Instant Withdrawals: A broker that allows quick withdrawals can improve your cash flow.

I’ve tested several brokers and can vouch for a few that stand out.

For a superior trading experience, check out my top recommended brokers here: Best Forex Brokers.

Conclusion

The MACD + Center of Gravity (CoG) Indicator Strategy is a solid approach for spotting market turning points.

By combining these indicators, understanding their signals, and leveraging my trading bots, you’re setting up a roadmap to potential success.

Remember, trading isn’t just about making money.

It’s about developing a strategy that works for you, minimizing risks, and maximizing opportunities.

Ready to transform your trading?

Dive into the resources I’ve shared and take your Forex game to the next level!