Last Updated on February 24, 2025 by Arif Chowdhury

Are you tired of your trading strategy not delivering consistent results?

Do you feel overwhelmed by all the indicators and strategies out there?

As a seasoned Forex trader since 2015, I’ve faced these challenges too.

After years of rigorous exploration, I discovered a winning combination: the MACD (Moving Average Convergence Divergence) and ADX (Average Directional Index) strategy.

This strategy has been a game changer for me.

Let’s break it down, so you can start trading with confidence.

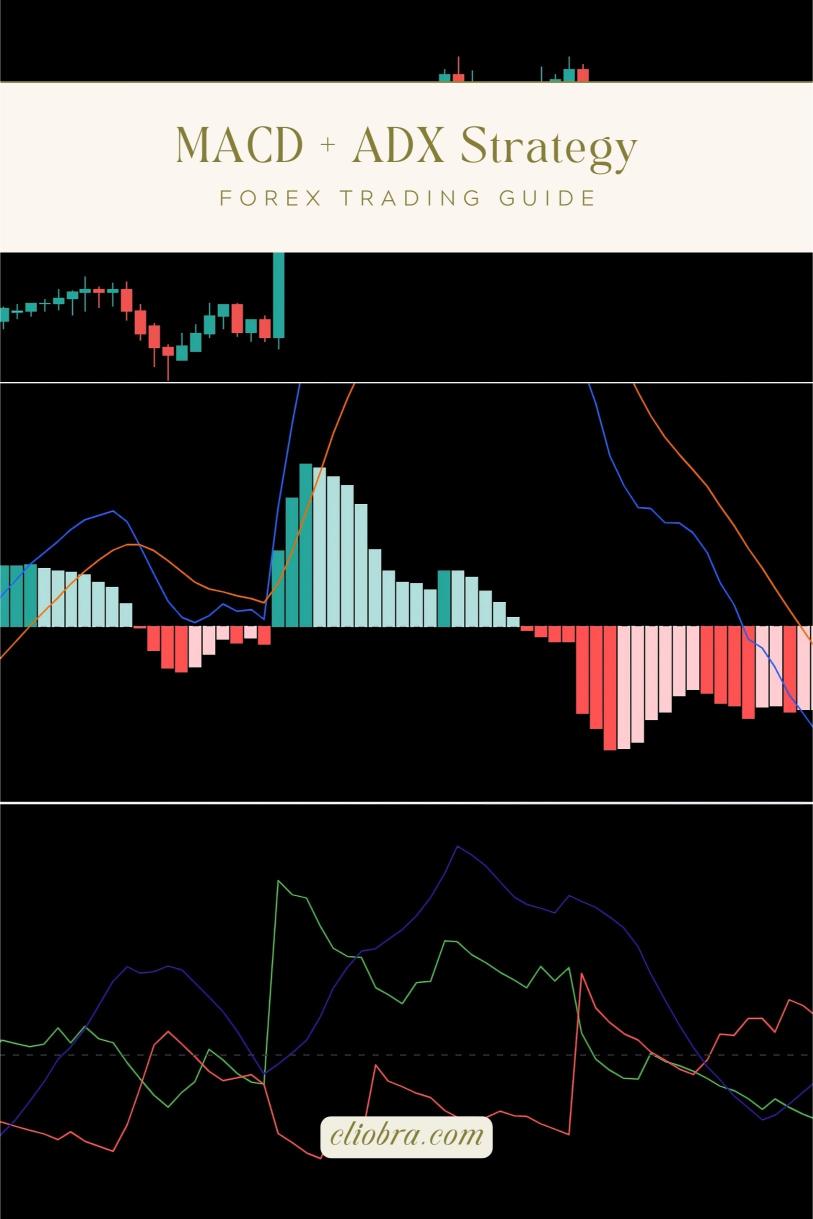

What is the MACD + ADX Strategy?

The MACD is a momentum indicator that shows the relationship between two moving averages of a security’s price.

The ADX, on the other hand, measures the strength of a trend, not its direction.

When combined, these indicators can help you identify strong momentum moves.

Why This Strategy Works

- Momentum Confirmation: The MACD identifies momentum shifts.

- Trend Strength Analysis: The ADX assesses how strong that momentum is.

- Reduced False Signals: Using both reduces the risk of getting caught in choppy markets.

Statistically speaking, traders using multiple indicators can improve their win rate by up to 20%.

How to Use the MACD + ADX Strategy

1. Set Up Your Chart

- Use H4 (4-hour) charts for clearer signals.

- Add the MACD indicator.

- Add the ADX indicator with a threshold of 20.

2. Entry Signals

- MACD Crossover: Look for the MACD line crossing above the signal line.

- ADX Rising: Ensure the ADX is above 20 to confirm a strong trend.

3. Exit Signals

- MACD Divergence: Watch for the MACD to diverge from price action, indicating a potential reversal.

- ADX Falling: If the ADX starts to drop below 20, it may signal the end of a trend.

Tips for Success

- Stay Disciplined: Stick to your strategy and avoid emotional trading.

- Use Stop Losses: Protect your capital with proper risk management.

- Keep Learning: Trading is a journey. Stay updated and refine your strategy.

My Trading Bots and the MACD + ADX Strategy

I’ve developed a portfolio of 16 sophisticated trading bots that utilize the MACD + ADX strategy among others.

These bots are strategically diversified across the major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

What makes my portfolio stand out?

- Multi-layered Diversification: Each currency pair has 3-4 bots, minimizing correlated losses.

- Long-term Focus: Designed to trade for 200-350 pips, these bots excel in the long run.

- Proven Performance: Backtested over 20 years, they perform excellently even in harsh conditions.

And guess what? I’m offering this entire EA portfolio for FREE.

If you want to elevate your trading, check out my trading bots and see how they can work for you.

Choosing the Right Broker

The right broker can make all the difference in your trading journey.

I’ve tested several brokers and recommend those that offer tight spreads, excellent execution, and reliable customer support.

You can find the best brokers in my curated list, which you can access here: Most Trusted Forex Brokers.

Final Thoughts

The MACD + ADX strategy is powerful for trading strong momentum moves.

By using these indicators together, you can enhance your trading decisions.

Whether you’re just starting out or looking to refine your approach, this strategy can provide clarity and confidence.

And don’t forget about the 16 trading bots that can help automate your trading process while you focus on learning and growing.

The Forex market is full of opportunities.

With the right tools and strategies, you can navigate it successfully.