Last Updated on March 6, 2025 by Arif Chowdhury

Are you struggling to find the right entry points in the chaotic world of Forex trading?

Do you often find yourself second-guessing your trades, only to watch them go in the opposite direction?

You’re not alone.

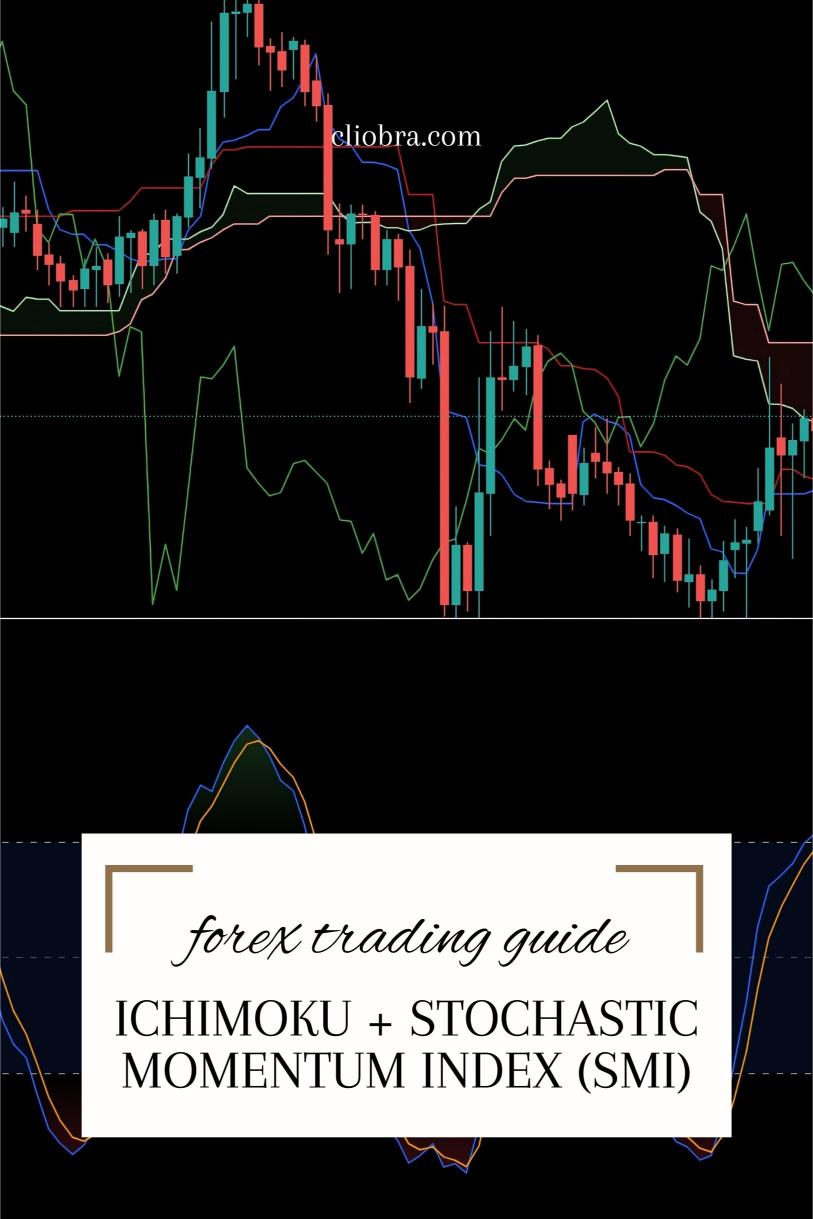

Many traders face the same frustration, and that’s why I want to share a strategy that has served me well since 2015: the Ichimoku + Stochastic Momentum Index (SMI) strategy.

This combo can help you pinpoint better entry points and navigate those tricky market waters.

Let’s dive in! 🚀

Understanding the Basics

First off, let’s break down the two components of this strategy.

Ichimoku Cloud is a trend-following indicator that provides a comprehensive view of support and resistance levels, trend direction, and momentum all in one glance.

The Stochastic Momentum Index (SMI), on the other hand, is a momentum oscillator that helps identify overbought and oversold conditions.

When combined, these tools create a powerful framework for making informed trading decisions.

Why This Strategy Works

Statistics show that traders who rely on a combination of indicators can improve their win rate by up to 30%.

That’s a game changer!

Here’s how the Ichimoku + SMI strategy enhances your trading:

- Visual Clarity: The Ichimoku provides a clear picture of the market structure, helping you see the big picture.

- Momentum Confirmation: The SMI confirms whether a trend is gaining or losing momentum, adding another layer of analysis.

- Reduced Noise: By filtering out market noise, this strategy allows you to focus on what truly matters for your entries.

Steps to Implement the Strategy

- Set Up Your Chart:

- Add the Ichimoku Cloud indicator.

- Add the Stochastic Momentum Index.

- Identify the Trend:

- Look at the Ichimoku Cloud.

- If the price is above the cloud, you’re in a bullish trend.

- If it’s below, it’s bearish.

- Check for Overbought/Oversold Conditions:

- Use the SMI to identify overbought (above 40) or oversold (below -40) conditions.

- Look for Confluence:

- A buy signal occurs when the price is above the Ichimoku Cloud AND the SMI is below -40.

- A sell signal occurs when the price is below the Ichimoku Cloud AND the SMI is above 40.

- Manage Your Risk:

- Always set a stop-loss based on your risk tolerance.

- Consider using a trailing stop to lock in profits as the trade moves in your favor.

My Trading Bots and the Ichimoku + SMI Strategy

To make things even easier, I’ve developed a portfolio of 16 sophisticated trading bots that incorporate the Ichimoku + SMI strategy, among others.

These bots are designed to operate in a diversified manner across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s why they stand out:

- Diversification: Each currency pair features 3-4 bots, minimizing correlated losses.

- Long-Term Focus: They target 200-350 pips, ensuring better performance over time.

- Backtested Success: My bots have been rigorously backtested over the past 20 years, performing excellently under various market conditions.

And the best part? I’m offering this EA portfolio completely FREE!

Curious to see how it can enhance your trading?

Check out my trading bots here: 16 Trading Bots Portfolio.

Final Thoughts

Finding the right broker is just as crucial as the strategy itself.

Having tested various options, I can confidently recommend brokers with tight spreads, excellent customer support, and zero commission.

If you’re ready to elevate your trading game, check out the best Forex brokers I’ve vetted: Most Trusted Forex Brokers.

Combining the Ichimoku Cloud with the Stochastic Momentum Index can give you a competitive edge in your trading.

With the right tools and strategies, you’ll be better equipped to navigate the Forex market and make profitable trades.

Happy trading! 📈