Last Updated on March 6, 2025 by Arif Chowdhury

Are you tired of unpredictable market swings?

Wondering how to spot price expansions before they happen?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve navigated these waters, and let me tell you, finding a reliable strategy is key.

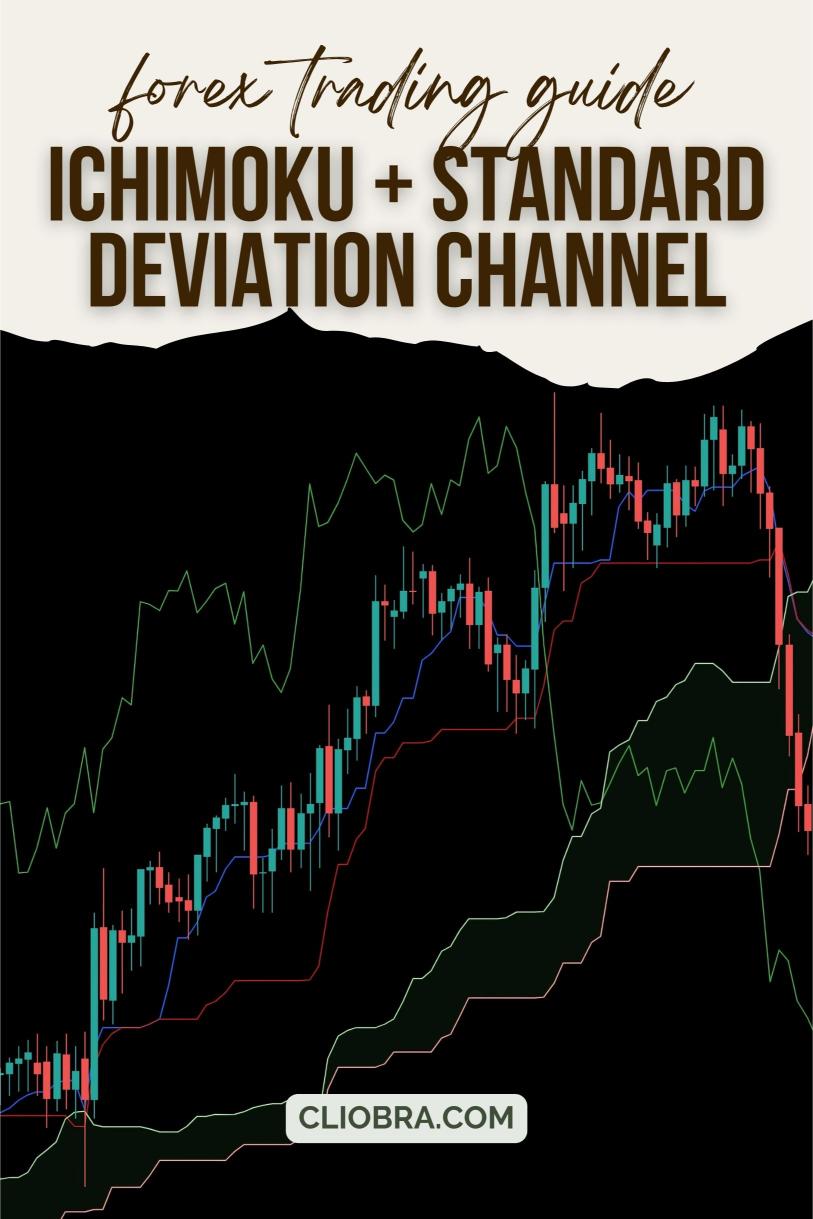

Today, I want to dive into a powerful strategy: The Ichimoku + Standard Deviation Channel Strategy.

This combination offers a fresh perspective on price movements, helping you make informed trading decisions.

What’s the Ichimoku Cloud?

The Ichimoku Cloud is not just a trend indicator; it’s a comprehensive trading system.

Here’s why it’s a game changer:

- Trend Direction: It helps identify whether the market is bullish or bearish.

- Support and Resistance: The cloud acts as dynamic support and resistance levels.

- Entry and Exit Signals: Crossovers of the Tenkan-sen and Kijun-sen lines provide clear signals.

Imagine having a clear view of the market at a glance. That’s what the Ichimoku Cloud delivers.

Understanding the Standard Deviation Channel

Now, let’s throw in the Standard Deviation Channel.

This tool measures market volatility and helps identify potential price expansions.

Why is this important?

- Volatility Insight: It shows when the market is likely to make significant moves.

- Entry Points: Price touching the outer bands can signal potential reversals or continuations.

Combining these two tools gives you a robust framework to predict price expansions.

How They Work Together

When you combine the Ichimoku Cloud with the Standard Deviation Channel, magic happens.

Here’s how to make it work for you:

- Identify the Trend: Use the Ichimoku Cloud to determine the overall trend.

- Watch for Volatility: Employ the Standard Deviation Channel to gauge market conditions.

- Look for Confirmations: Wait for price action to confirm potential expansions.

This strategy can significantly enhance your trading accuracy.

Why This Strategy Matters

Statistically, using a combination of indicators improves your chances of making profitable trades.

In fact, research shows that traders who use multi-faceted strategies can increase their win rate by up to 30%.

That’s not just a number; it’s a game changer.

My Trading Bots: Adding Another Layer of Strategy

Now, let’s talk about how to take this strategy even further with my 16 trading bots.

These bots are designed to implement the Ichimoku + Standard Deviation Channel strategy alongside other proven techniques.

What’s great about them?

- Diversified Portfolio: Each currency pair (EUR/USD, GBP/USD, USD/CHF, USD/JPY) has 3-4 bots tailored to minimize risk.

- Long-Term Focus: They target trades of 200-350 pips, optimizing for long-term performance.

- Backtested Reliability: I’ve tested these bots over the past 20 years, and they excel even in tough market conditions.

Best of all? You can access this exceptional EA portfolio for FREE.

It’s a no-brainer for anyone serious about trading.

Tips for Getting Started

If you’re ready to jump in, here’s how to set yourself up for success:

- Choose the Right Broker: The foundation of your trading journey is a reliable broker.

- Start Small: Begin with a demo account to get the hang of the strategy.

- Use Risk Management: Always protect your capital with proper risk management techniques.

Finding the best brokers can significantly impact your trading experience.

I highly recommend checking out the top Forex brokers I’ve tested.

You can find them here: Most Trusted Forex Brokers.

Final Thoughts

Trading can be daunting, but with the right tools and strategies, it becomes a thrilling adventure.

The Ichimoku + Standard Deviation Channel Strategy can help you predict price expansions.

Combine that with my 16 trading bots for an even stronger approach.

Don’t miss out on this opportunity to elevate your trading game.

Access my trading bots here: Forex EA Portfolio.

By leveraging these strategies and tools, you can navigate the Forex market with confidence and success.