Last Updated on March 13, 2025 by Arif Chowdhury

Ever felt like you’re missing the boat on market reversals?

You’re not alone.

Many traders struggle to identify the right moment to shift gears.

What if I told you there’s a powerful strategy that can help you catch those early turns?

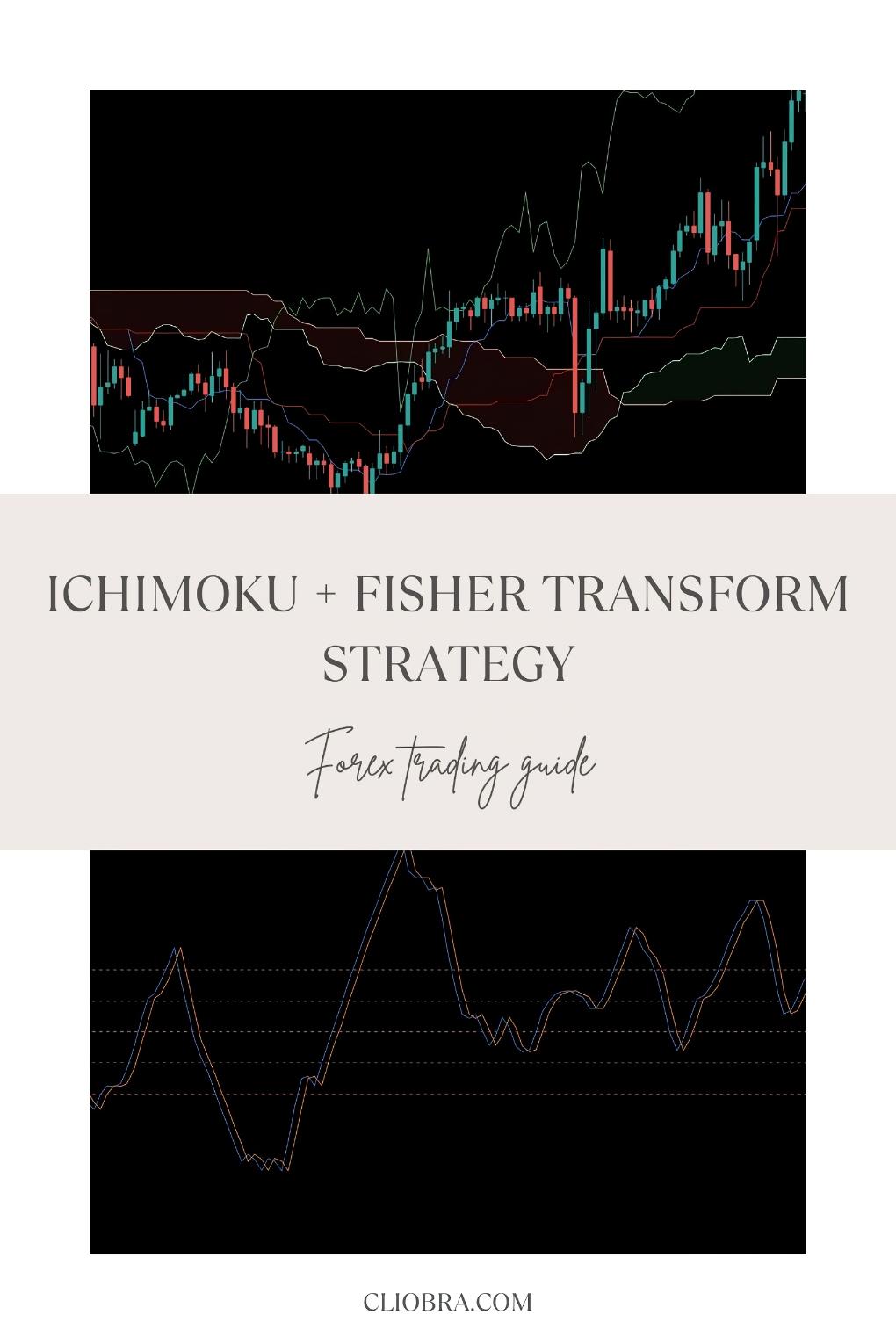

Let’s dive into the Ichimoku + Fisher Transform Strategy.

What’s the Ichimoku Cloud?

The Ichimoku Cloud is more than just a fancy chart indicator.

It’s a comprehensive trading system that gives you insight into trend direction, support, and resistance levels.

Here’s a quick rundown:

- Kumo (Cloud): This shows the market’s trend.

- Tenkan-sen: The short-term average.

- Kijun-sen: The longer-term average.

- Chikou Span: The lagging line that helps confirm trends.

This combo helps you visualize everything at a glance.

Enter the Fisher Transform

Now, let’s spice things up with the Fisher Transform.

This indicator transforms prices into a Gaussian normal distribution.

Why is that important?

It helps you identify potential reversals by highlighting extreme price movements.

Here’s how it works:

- Overbought Conditions: When the Fisher Transform is above +1.5.

- Oversold Conditions: When it dips below -1.5.

These signals can indicate a price reversal is coming.

Combining Forces

Now, what happens when you combine these two?

You get a robust strategy that capitalizes on early market reversals.

Here’s a simple step-by-step approach:

- Identify the Trend: Use the Ichimoku Cloud to determine if the market is bullish or bearish.

- Look for Divergence: Check the Fisher Transform for signals of overbought or oversold conditions.

- Confirm with Price Action: Look for candle patterns or support/resistance levels that align with your signals.

Why This Works

Statistically, markets tend to revert to the mean.

According to research, around 70% of price movements are corrections.

By using this strategy, you’re positioning yourself to take advantage of those corrections effectively.

My Trading Bot Portfolio

You might be wondering how to implement this strategy effortlessly.

That’s where my 16 trading bots come into play.

These bots are designed with the Ichimoku + Fisher Transform strategy as part of their arsenal.

They’re tailored for major currency pairs like:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

Each bot is diversified to minimize risks and maximize returns.

Here’s what makes them special:

- Internal Diversification: Each currency pair has 3-4 bots, reducing correlated losses.

- Long-term Focus: They target 200-350 pips, ensuring better performance over time.

- Backtested for 20 Years: These bots perform excellently under various market conditions.

Best of all, I’m offering this EA portfolio for FREE!

If you’re serious about improving your trading game, check out my trading bots portfolio.

Optimal Brokers for Trading

Now that you’ve got a solid strategy and bots to back you up, it’s crucial to choose the right broker.

You want a broker that complements your trading style and provides reliable execution.

Here’s what to look for:

- Tight Spreads: Reduces your transaction costs.

- Fast Execution: Essential for capturing those quick market moves.

- Excellent Support: You’ll want to have help when you need it.

I’ve tested various brokers and can confidently recommend the best. Check them out here: Most Trusted Forex Brokers.

Wrapping It Up

In trading, timing is everything.

With the Ichimoku + Fisher Transform Strategy, you can catch those early market reversals like a pro.

Combine that with my 16 trading bots, and you’ve got a winning formula.

By choosing the right brokers and using the right tools, you’re setting yourself up for success.

Let’s make those market moves work for you!