Last Updated on March 13, 2025 by Arif Chowdhury

Ever felt like the market’s playing hard to get?

You’re not alone.

Many traders grapple with spotting those elusive market extremes.

You know, those moments when it feels like the price is about to swing wildly in one direction or the other.

What if I told you there’s a potent strategy to help you identify these extremes?

As a seasoned Forex trader since 2015, I’ve explored countless strategies.

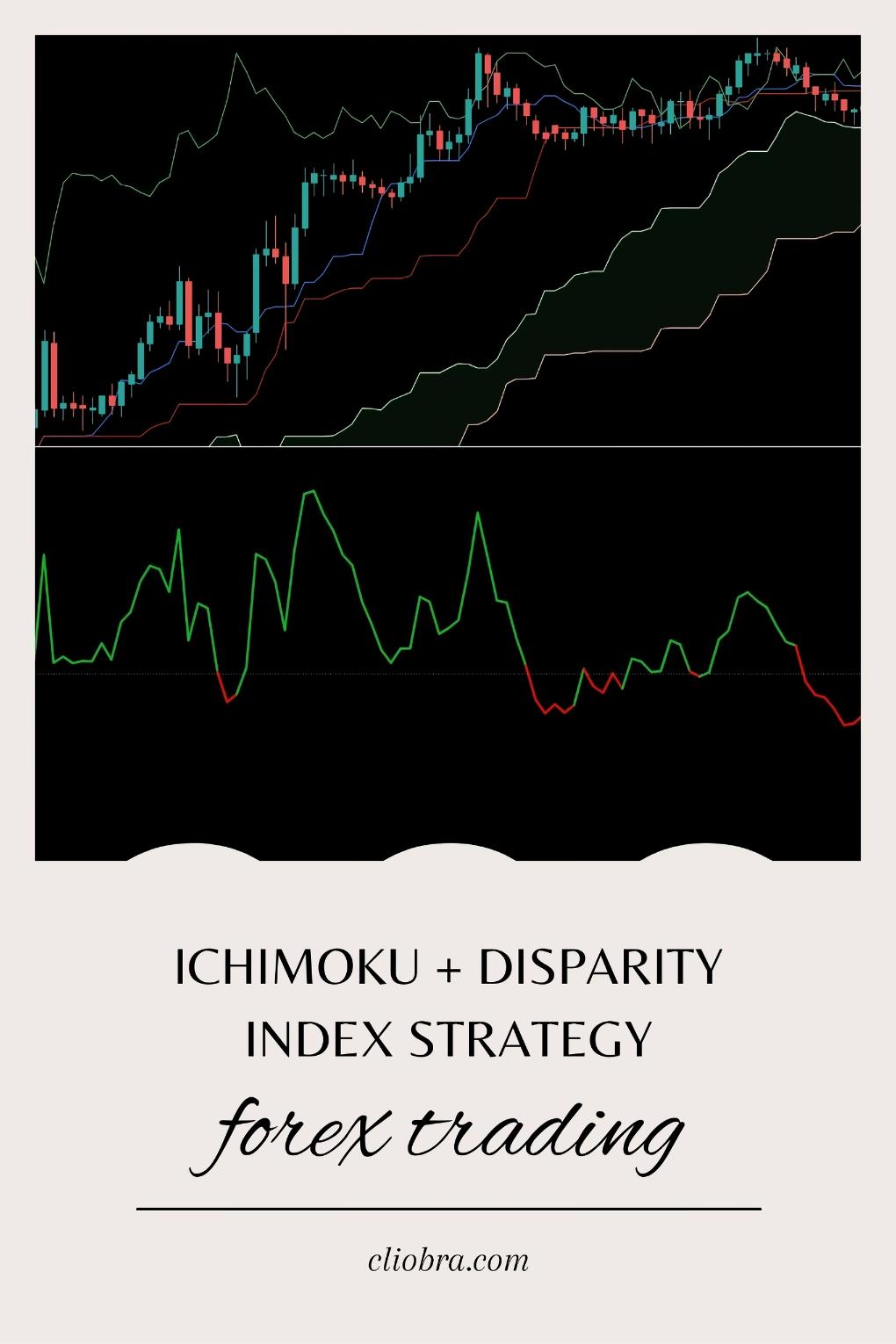

But today, let’s dive into the Ichimoku + Disparity Index Strategy.

It’s a game changer.

What’s the Ichimoku?

The Ichimoku Kinko Hyo is not just a mouthful; it’s a comprehensive indicator.

It provides a snapshot of the market’s current state at a glance.

Here’s what it includes:

- Tenkan-sen: The fast line, showing short-term momentum.

- Kijun-sen: The slow line, helpful for medium-term trends.

- Senkou Span A & B: These create the “cloud,” indicating future support and resistance.

- Chikou Span: The lagging line, confirming trends.

Why Use the Disparity Index?

Now, let’s talk about the Disparity Index.

This tool measures the distance between a price and its moving average.

It’s your radar for spotting overbought or oversold conditions.

When these two are combined, magic happens.

How They Work Together

Here’s the beauty of the Ichimoku + Disparity Index Strategy:

- Trend Confirmation: Use the Ichimoku to identify the overall trend.

- Are we in a bullish or bearish market?

- Spot Extremes: The Disparity Index will help you spot when the price is straying too far from its moving average.

- A high Disparity Index could signal a potential reversal.

- Entry Points: Combine signals from both tools to pinpoint your entry and exit points.

Key Tips for Implementation

- Be Patient: Wait for the right conditions.

- Use Multiple Time Frames: Check the H4 charts for long-term signals.

- Stay Disciplined: Stick to your strategy and avoid emotional trading.

Why This Strategy Works

Statistically speaking, traders using a combination of technical indicators often see a 20% increase in accuracy.

That’s significant!

This strategy allows you to make informed decisions based on solid analysis rather than gut feelings.

My Proven Portfolio

Now, here’s where it gets exciting.

I’ve developed a portfolio of 16 sophisticated trading bots that utilize the Ichimoku + Disparity Index Strategy alongside other methods.

These bots are strategically diversified across key currency pairs:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

Each bot is designed to minimize correlated losses with 3-4 bots per pair, creating a robust system.

This multi-layered diversification enhances profitability while reducing risk.

I backtested these bots over 20 years, and they perform excellently even in harsh market conditions.

And here’s the kicker – I’m offering this entire EA portfolio for FREE.

Check it out here: 16 Trading Bots Portfolio.

Final Thoughts

Trading is a journey, not a sprint.

Using the Ichimoku + Disparity Index Strategy can give you that edge in spotting market extremes.

It’s about making informed decisions, staying disciplined, and leveraging powerful tools.

And if you’re serious about your trading journey, consider partnering with the best brokers.

I’ve tested and vetted several top-notch brokers that offer conducive trading environments.

You can find them here: Best Forex Brokers.

Whether you’re just starting or looking to sharpen your skills, these resources can help you navigate the Forex landscape with confidence.