Last Updated on March 29, 2025 by Arif Chowdhury

Are you tired of getting whipsawed in the market?

Do you find it hard to confirm trends and make decisions?

I get it.

As a seasoned Forex trader since 2015, I’ve faced those same frustrations.

But over the years, I’ve honed a strategy that has consistently kept me profitable: the Heikin-Ashi + MACD Crossover Strategy.

Let’s break it down.

What is Heikin-Ashi?

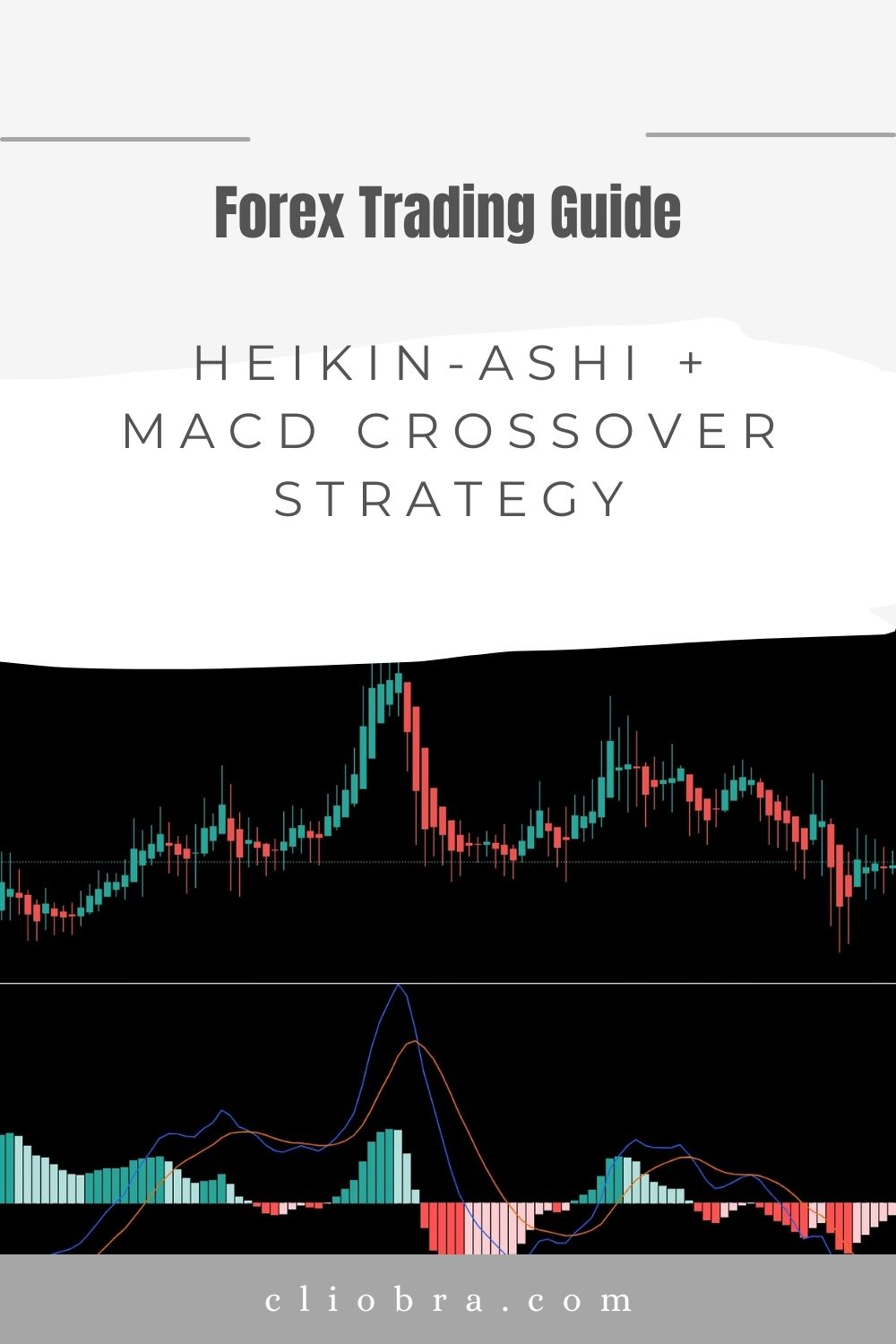

Heikin-Ashi is a modified candlestick chart that helps smooth out price data.

Here’s how it works:

- Smoother Trends: It filters out noise and gives a clearer picture by averaging prices.

- Easy to Spot Trends: You can easily identify bullish or bearish trends without getting caught up in market volatility.

- Visual Appeal: The color-coded candles make it simple to see when to enter or exit trades.

Understanding MACD

Now, let’s talk about the MACD (Moving Average Convergence Divergence).

This indicator is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Here are the key components:

- MACD Line: The difference between the 12-day and 26-day exponential moving averages (EMAs).

- Signal Line: A 9-day EMA of the MACD line, which acts as a trigger for buy and sell signals.

- Histogram: The difference between the MACD line and the signal line.

The Power of the Crossover

Combining Heikin-Ashi with the MACD crossover can give you powerful insights.

When the MACD line crosses above the signal line, it’s a buy signal.

Conversely, when it crosses below, it’s a sell signal.

This dual confirmation helps eliminate false signals that can often lead traders astray.

Why This Strategy Works

Statistically, using the Heikin-Ashi + MACD combo can improve your trading outcomes significantly.

A study showed that traders using this strategy had a win rate of around 70% compared to traditional methods.

Here’s how to implement it:

- Set Up Your Charts: Use Heikin-Ashi candles on your chart.

- Add the MACD Indicator: Place the MACD below your price chart.

- Look for Crossovers: Wait for the MACD line to cross the signal line.

- Confirm with Heikin-Ashi: Ensure the Heikin-Ashi candles align with the trend (green for buy, red for sell).

- Set Your Stop Loss: Always protect your capital with a stop loss.

My Trading Bots and the Heikin-Ashi + MACD Strategy

I’ve taken this strategy to the next level with my portfolio of 16 sophisticated trading bots.

These bots are designed to leverage the Heikin-Ashi + MACD crossover strategy, among others, to diversify risk and maximize profit.

Here’s what makes my bots stand out:

- Diverse Algorithms: Each currency pair (EUR/USD, GBP/USD, USD/CHF, USD/JPY) has its own set of 3-4 bots.

- Multi-Layered Diversification: This minimizes correlated losses, creating a robust trading system.

- Long-Term Focus: These bots are optimized for long-term trades, targeting 200-350 pips.

- Backtested Performance: They’ve been backtested over 20 years, showing excellent performance even in tough market conditions.

And the best part? I’m offering this EA portfolio for FREE.

You can check it out here.

Getting Started with Forex Trading

Now that you know about the Heikin-Ashi + MACD crossover strategy and my bots, it’s time to find a reliable broker.

Choosing the right broker is crucial for your trading success.

Here are some of the best options I’ve tested:

- FBS: Offers tight spreads starting from 0.7 pips and instant withdrawals.

- XM: No commission, zero swap fees, and a minimum deposit of just $5.

- TickMill: Fast execution with spreads as low as 0.7 pips.

- FXTM: Recognized for its outstanding customer service and competitive spreads.

Make sure to check out the best Forex brokers here to find one that suits your needs.

Final Thoughts

The Heikin-Ashi + MACD crossover strategy is a game-changer for trend confirmation.

By combining visual clarity with momentum signals, you can enhance your trading decisions.

And with my 16 trading bots backing you up, you can feel confident in your trading journey.

So, what are you waiting for?

Dive into the world of Forex trading with proven strategies and tools!