Last Updated on March 28, 2025 by Arif Chowdhury

Have you ever found yourself scratching your head, trying to figure out which way the market is heading?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve faced the maze of market trends and price movements.

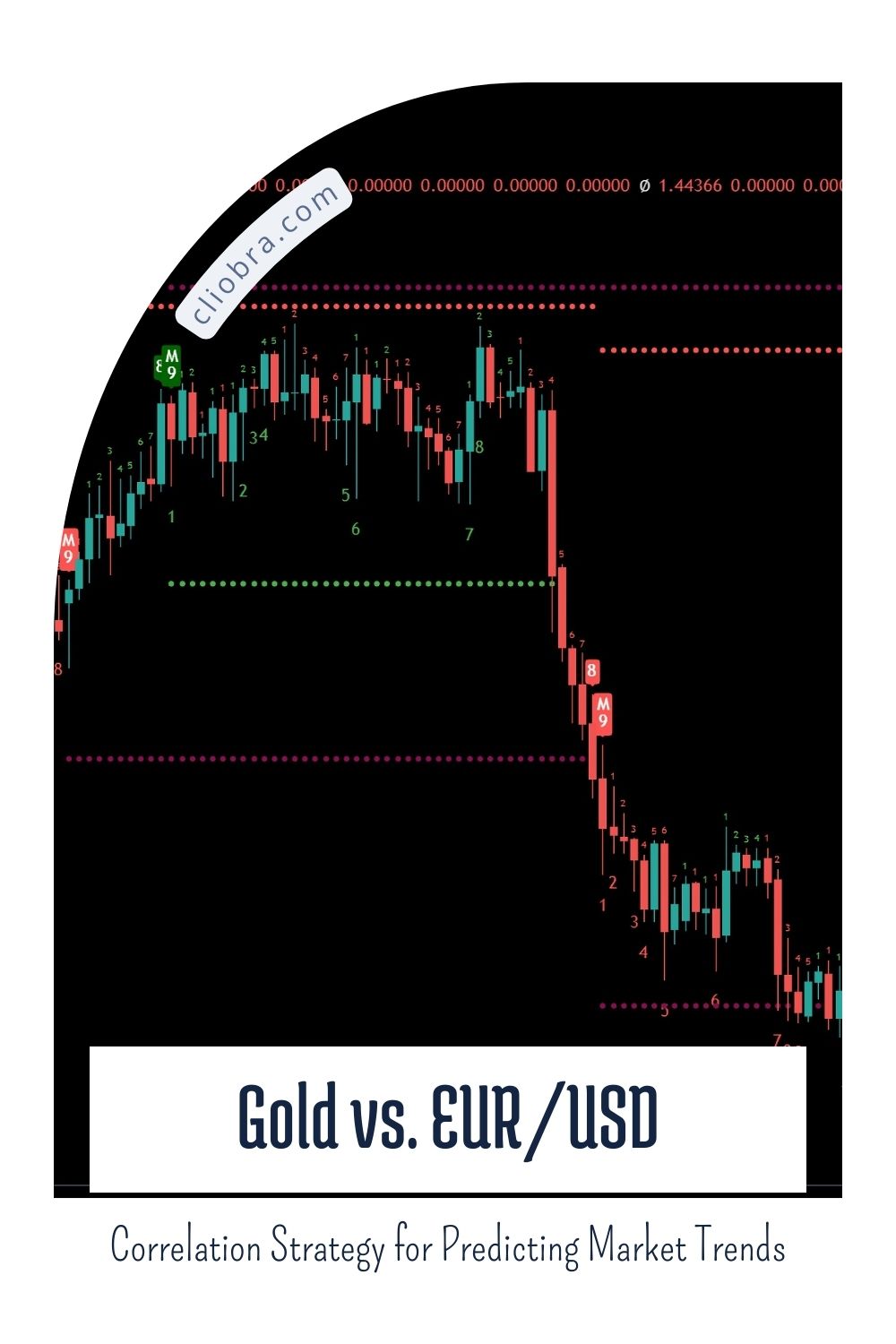

One of the strategies that has consistently helped me navigate these waters is the Gold vs. EUR/USD correlation strategy.

Let’s dive into how you can leverage this powerful approach to enhance your trading game.

Why Gold and EUR/USD?

Gold and the EUR/USD currency pair often move in tandem, reflecting broader economic sentiments.

When investors flock to gold, it usually means they’re looking for a safe haven due to uncertainty in the markets.

Conversely, a strong EUR/USD can indicate confidence in the Eurozone’s economic stability.

Here’s the kicker: understanding this correlation can help you predict shifts in market trends.

Statistical Insights

Check this out:

Research shows that the correlation coefficient between gold and the EUR/USD pair frequently hovers around 0.8.

This indicates a strong positive relationship, meaning when one rises, the other often does too.

Another interesting tidbit is that during times of economic turmoil, this correlation can strengthen, offering traders a unique opportunity.

How to Implement the Strategy

Now, let’s break down how you can use this correlation to your advantage.

- Monitor Economic Indicators: Keep an eye on key economic reports from the Eurozone and U.S. These often affect both gold and EUR/USD.

- Watch the Dollar: A weakening U.S. dollar usually boosts gold prices and vice versa. Track the DXY index to gauge dollar strength.

- Use Technical Analysis: Combine fundamental insights with technical indicators like moving averages and RSI to spot entry and exit points.

Example of Application

Let’s say you notice gold prices are rising due to geopolitical tensions.

At the same time, EUR/USD shows signs of strengthening.

This could be your signal to enter a long position on EUR/USD, anticipating that it will follow gold’s upward trend.

My Trading Bots and Why They Matter

Speaking of strategies, I’ve developed a portfolio of 16 trading bots that align perfectly with my trading philosophy.

These bots are meticulously designed to trade across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is diversified to minimize correlated losses.

This means if one bot takes a hit, others can still perform well, protecting your overall investment.

They operate on H4 charts, targeting long-term gains of 200-350 pips.

Best of all? I’m offering this EA portfolio for completely FREE.

You can check it out here: Explore My Trading Bots.

Staying Ahead of the Game

To truly excel in the Forex market, you need to stay informed.

Utilize resources like economic calendars and financial news websites.

This will help you spot trends before they become apparent to the average trader.

Also, consider joining a community of traders where you can share insights and strategies.

Finding the Right Broker

Before diving into trading, ensure you have a reliable broker by your side.

Look for brokers that offer tight spreads, excellent customer support, and favorable trading conditions.

I’ve tested several brokers and highly recommend checking out the best ones here: Top Forex Brokers.

Final Thoughts

The Gold vs. EUR/USD correlation strategy is a powerful tool for predicting market trends.

By understanding how these two assets interact, you can make more informed trading decisions.

And remember, my 16 trading bots are designed to help you execute these strategies effectively while minimizing risk.

You can start using them for free today.

Stay ahead of the curve, keep learning, and happy trading!