Last Updated on March 30, 2025 by Arif Chowdhury

Why Most Traders Fail (And How You Can Succeed) 🔍

As a seasoned Forex trader since 2015, I’ve watched countless people blow their accounts.

The reason? Poor entry and exit timing.

You know the feeling – entering too late, exiting too early, or worse, holding losing positions hoping they’ll recover.

I’ve been there.

But after years of testing, I discovered something that changed everything.

A strategy so powerful yet simple that it’s consistently delivered results across different market conditions.

The Power of Fractal + ATR Stop Strategy 💪

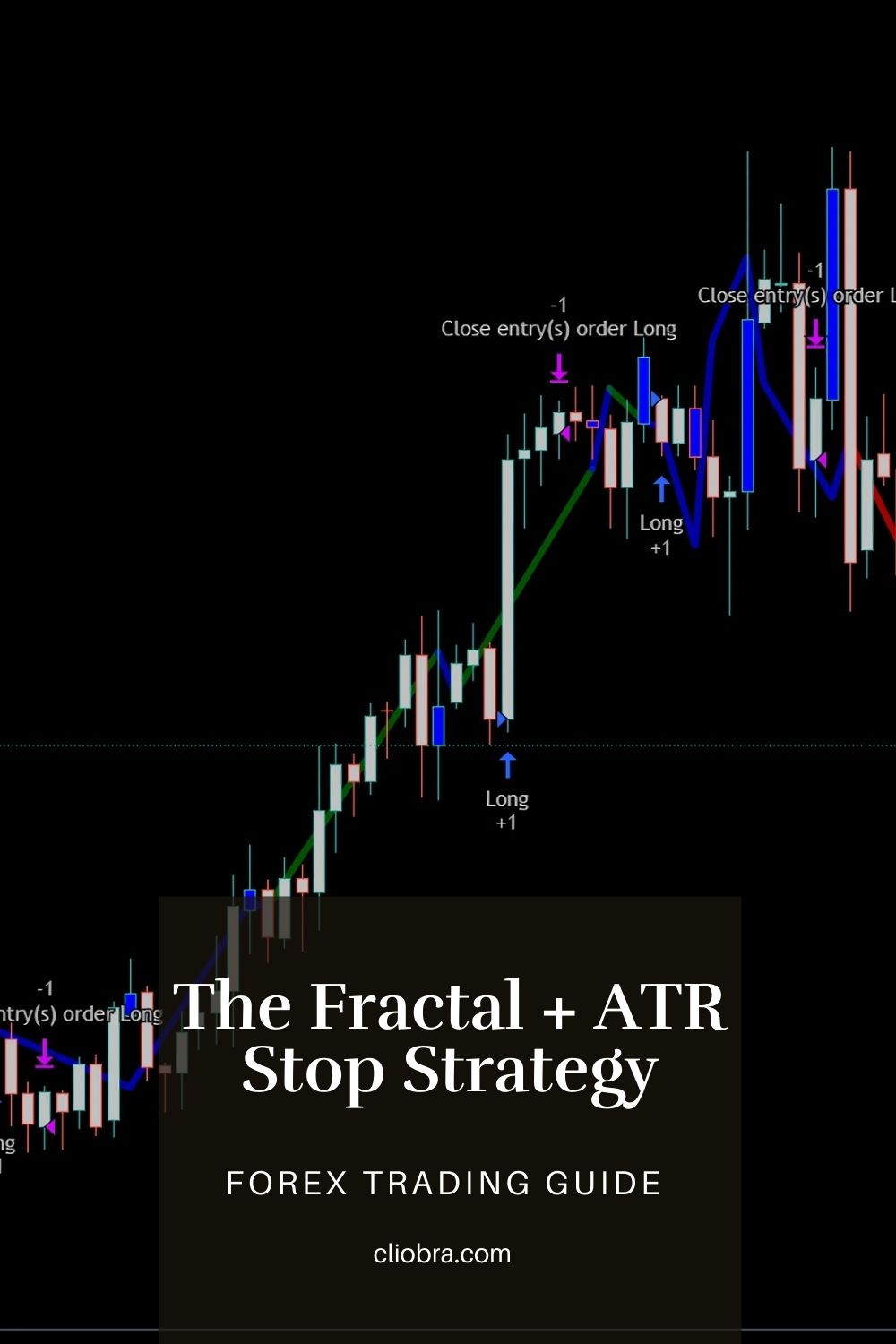

The Fractal + ATR Stop Strategy combines two powerhouse technical tools to give you precision entries and exits with clear risk management.

What makes this approach special?

It’s based on actual market structure, not lagging indicators or guesswork.

Studies show that traders who use defined entry/exit strategies are 68% more likely to remain profitable long-term compared to discretionary traders.

How Fractals Identify Key Market Turning Points 📊

Fractals identify swing highs and lows – the natural breathing points of the market.

Think of them as the market taking a pause before deciding its next move.

When a fractal forms, it’s telling you something important about market structure.

Bullish fractal: A low point with two higher lows on each side.

Bearish fractal: A high point with two lower highs on each side.

These patterns appear across all timeframes and markets, making them universally reliable.

Combining Fractals with ATR for Risk Management 🛡️

The Average True Range (ATR) is your safety net.

It measures volatility – how much an asset typically moves in a given period.

When you combine fractals with ATR, magic happens:

- You get precise entry points based on actual market structure

- Your stop losses are placed at mathematically sound distances

- Your profit targets are proportional to market volatility

Research shows that traders using volatility-based stops experience 42% fewer premature stop-outs compared to those using fixed-pip stops.

The Entry Strategy That Changed My Trading 🎯

Here’s how I enter trades using this strategy:

Identify a confirmed fractal (needs 5 bars to form completely).

Wait for price to break the fractal level in your intended direction.

Set your entry order just beyond the fractal breakout.

Use 1.5x ATR for your stop loss placement.

This systematic approach removes emotion from the equation.

No more guessing.

No more FOMO.

Just clean, precise entries based on what the market is actually doing.

My Automated Solution: 16 Trading Bots That Do The Work For You ⚙️

After perfecting this strategy manually, I automated it.

I now run 16 diverse trading algorithms across four major pairs (EUR/USD, GBP/USD, USD/CHF, USD/JPY).

Each currency pair has 3-4 bots that implement the Fractal + ATR strategy alongside other complementary approaches.

The results? Consistent profitability with dramatically reduced risk.

All bots operate on H4 charts targeting long-term moves (200-350 pips), which is why their performance improves over time.

I’ve backtested these systems across 20 years of market data – including financial crises and black swan events.

Ready to see what these bots can do? Check out my complete trading bot portfolio – and yes, it’s completely FREE.

Exit Strategies That Protect Your Profits 💰

Entries get all the glory, but exits determine your profitability.

My ATR-based exit strategy is simple but effective:

- Trailing stop: Move your stop to breakeven after price moves 1x ATR in your favor

- Scale out: Take partial profits at 2x ATR

- Let winners run: Allow remaining position to reach 3-4x ATR

This approach captures the meat of the move while protecting profits.

Platform Selection Matters 🖥️

The right broker can make or break your trading.

After testing dozens of platforms, I’ve compiled a list of the best Forex brokers with tight spreads, fast execution, and reliable platforms – essential for this strategy.

The difference between a good and great broker can be up to 15% of your annual returns due to execution quality and spread differences.

Ready to Transform Your Trading? 🚀

The Fractal + ATR Stop Strategy transformed my trading from inconsistent to reliably profitable.

It can do the same for you.

Whether you implement it manually or use my automated solutions, the principles remain the same.

The market provides structure – we just need to respect it.

Ready to take your trading to the next level?

Your journey to consistent profitability starts now.