Last Updated on April 5, 2025 by Arif Chowdhury

Ever felt like you’re swimming against the tide in Forex trading?

Struggling to find reliable signals while the market seems to move on its own?

You’re not alone.

Many traders often wonder how to read the market’s true intentions and catch those profitable moves.

That’s exactly where the Forex Smart Money Divergence Strategy comes into play.

Let’s break it down.

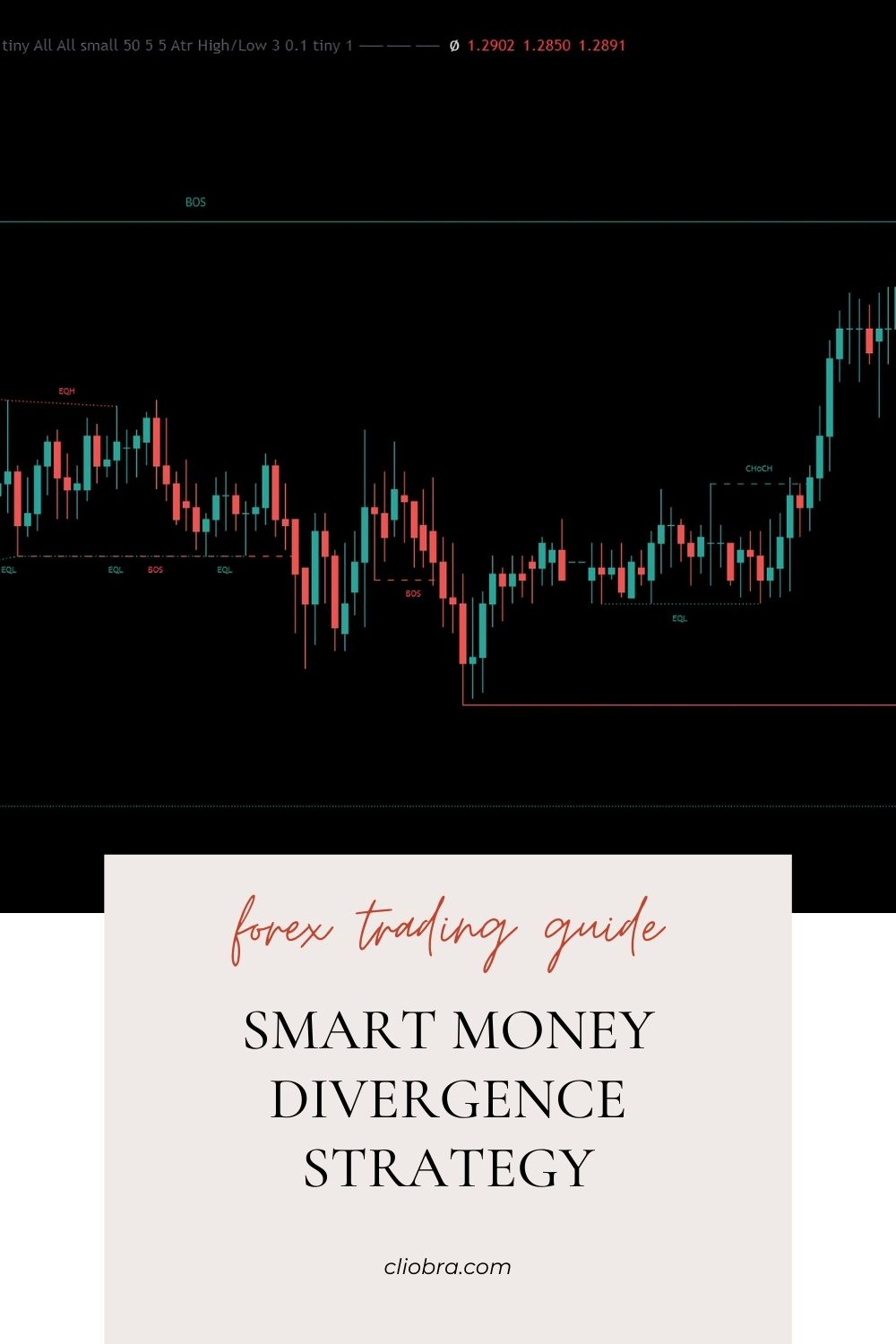

What Is Smart Money Divergence?

Smart money refers to the capital that major financial institutions or experienced traders invest.

When you can identify divergence between price action and market depth, you can pinpoint potential reversals.

Divergence occurs when:

- Price moves in one direction

- Market depth (the number of buy/sell orders) moves in the opposite direction

This can signal that the current trend may be losing steam.

For instance, if the price is hitting new highs but market depth shows fewer buy orders, it’s a red flag.

That’s your cue to consider a potential reversal.

Understanding Market Depth & Liquidity Zones

Market depth shows the number of buy and sell orders at different price levels.

Liquidity zones are areas where there’s a high concentration of buy or sell orders.

When you analyze these zones, you can see where big players are likely to enter or exit the market.

Why is this important?

Stats show that over 70% of retail traders lose money.

One reason? They often trade without understanding where the liquidity is concentrated.

Knowing where the big players are placing their bets can give you a significant edge.

Implementing the Strategy

Here’s how you can effectively use the Smart Money Divergence Strategy:

- Identify Divergence:

- Look for points where price action diverges from market depth.

- Use tools like oscillators (e.g., RSI) to spot divergence.

- Analyze Market Depth:

- Check the order book to see where liquidity zones are located.

- Look for large buy/sell walls that indicate strong support or resistance.

- Spot Liquidity Zones:

- Mark areas on your chart where significant orders are clustered.

- These are potential reversal points.

- Set Your Entry and Exit Points:

- Enter trades when you see confirmation of divergence and liquidity support.

- Use tight stop-losses to manage risk effectively.

- Monitor and Adjust:

- Keep an eye on market conditions.

- Be ready to adjust your strategy as needed.

Enhance Your Trading with Golden Grid

Now, let’s talk about something that can supercharge your trading journey: my Golden Grid EA.

I created this powerful trading bot to capture market volatility and help you achieve consistent profits.

Here’s the scoop:

- It works across all currency pairs, but it shines on Gold (XAU/USD).

- It starts trading immediately, so no more waiting around for signals.

- You can expect to gain 2-3% ROI in just a few hours, capturing 20-40 pips in quick succession.

The best part? I’m offering this Golden Grid bot for FREE.

Just imagine having a tool that helps you trade smarter, not harder.

You can get started right away and see how it fits into your trading strategy. Check it out here: Golden Grid EA.

The Power of Choosing the Right Broker

Your trading strategy is only as good as the broker you choose.

Having a solid broker can make all the difference in your trading experience.

Here are a few I recommend based on my personal testing:

- FBS:

- Tight spreads starting from 0.7 pips

- Fast order execution in 0.01 seconds

- Minimum deposit from just $5

- XM:

- Spreads as low as 0.8 pips

- No swap fees or commissions

- A chance to win $200,000 in cash prizes every month

- TickMill:

- Spreads from 0.7 pips

- Average execution in 0.20 seconds

- Welcome bonus of $30

Choosing the right broker means better trade execution and potentially higher profits.

Take a look at some of the best forex brokers I’ve vetted to enhance your trading journey.

Final Thoughts

Trading doesn’t have to be overwhelming.

By using the Forex Smart Money Divergence Strategy, you can gain insights into market movements that many traders overlook.

Combine that with the efficiency of my Golden Grid EA, and you’re setting yourself up for a profitable trading experience.

Remember to start with a demo account to test the waters before diving in.

So, are you ready to take your trading to the next level?