Last Updated on February 26, 2025 by Arif Chowdhury

Ever look at a price chart and wonder why it feels like the market has a mind of its own?

You’re not alone.

Many traders face the same questions:

- Why do prices reverse at certain levels?

- How can I predict these reversals with confidence?

I’ve been navigating these waters since 2015, and let me tell you, I’ve uncovered some gems along the way.

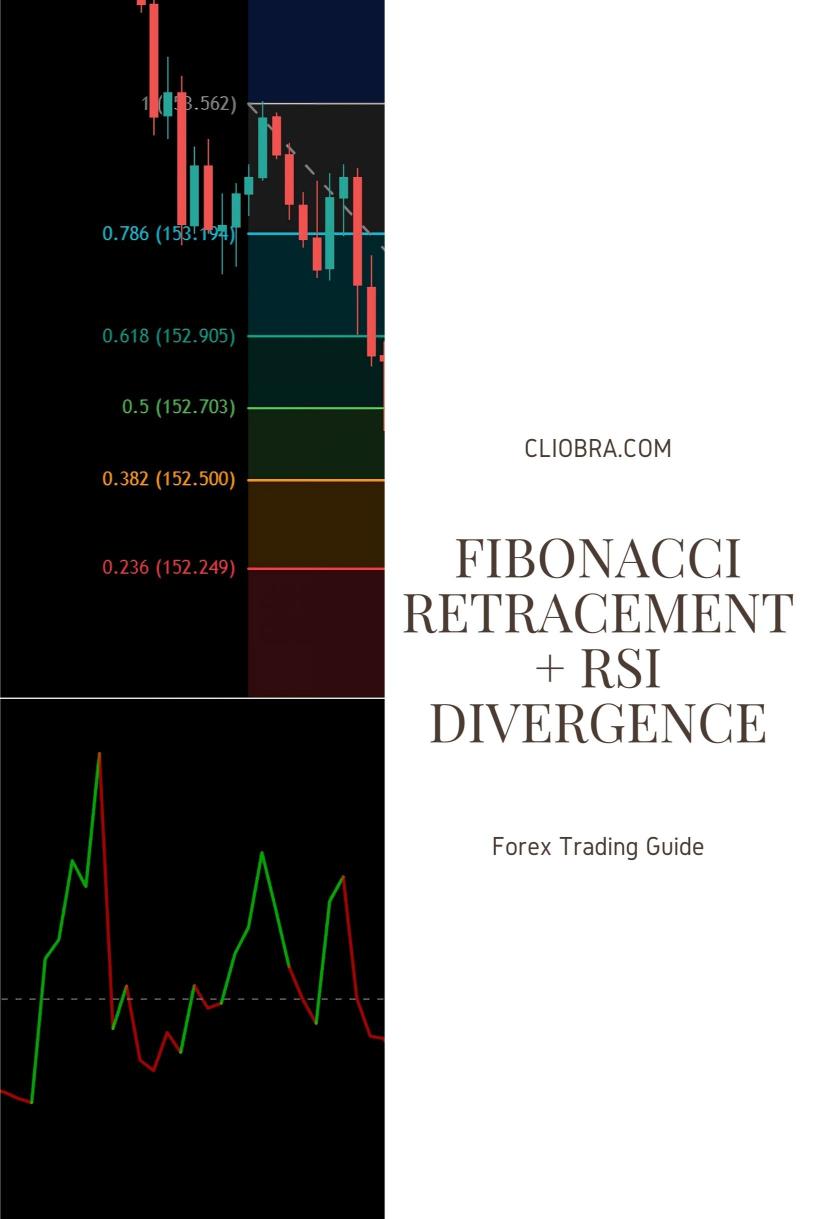

One of the most powerful combinations I’ve found is The Fibonacci Retracement + RSI Divergence Strategy.

Let’s break it down.

What is Fibonacci Retracement?

Fibonacci retracement levels are horizontal lines that indicate potential support and resistance areas based on the Fibonacci sequence.

These levels are derived from:

- 0% – start of the move

- 23.6%

- 38.2%

- 50%

- 61.8%

- 100% – end of the move

These percentages are more than just numbers; they represent areas where traders expect price corrections to occur.

Statistically, about 61.8% of price reversals happen around the Fibonacci levels. That’s a strong indicator to keep in your toolkit.

What is RSI Divergence?

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements.

When prices are making new highs while the RSI makes lower highs, that’s a bearish divergence.

Conversely, if prices are making new lows while the RSI is making higher lows, that’s a bullish divergence.

This divergence often signals potential reversals.

Why Combine These Two?

When you combine Fibonacci retracement levels with RSI divergence, you create a robust strategy for identifying potential reversal points.

Here’s how:

- Identify a Trend: Look for a clear trend on your chart.

- Plot Fibonacci Levels: Draw Fibonacci retracement levels from the recent swing high to swing low (or vice versa).

- Check RSI for Divergence: Look for divergences at the key Fibonacci levels.

The Steps to Implement the Strategy

- Draw Your Fibonacci Levels:

- Use the Fibonacci tool on your trading platform.

- Identify key levels where price might retrace.

- Analyze the RSI:

- Add the RSI indicator to your chart.

- Look for divergences at the major Fibonacci levels.

- Set Your Trade:

- If you see a bullish divergence at the 61.8% level, consider going long.

- If there’s a bearish divergence at the 38.2% level, consider going short.

- Manage Your Risk:

- Always set stop-loss orders just beyond the next Fibonacci level.

- This helps protect your capital from unexpected market moves.

My 16 Trading Bots

Now, here’s where it gets even more exciting.

I’ve developed a portfolio of 16 sophisticated trading bots that incorporate strategies like the Fibonacci retracement and RSI divergence.

These bots are designed for long-term trading, aiming for 200-350 pips per trade, and are backtested over 20 years to ensure they perform well under various market conditions.

Each bot is unique, focusing on major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

This diversification minimizes correlated losses and enhances overall profitability.

If you’re looking to step up your trading game, check out my FREE EA portfolio.

It’s a no-brainer when you consider the potential for consistent returns while managing risk effectively.

Real-World Application

So, why does this work?

Traders flock to Fibonacci levels because they’re self-fulfilling prophecies.

Many traders set their buy and sell orders around these levels, reinforcing them.

When combined with RSI divergence, you’re not just relying on one indicator but two layers of confirmation.

Choosing the Right Broker

To make the most of your trading strategy, you need a solid broker.

I’ve tested numerous brokers and found a few that stand out for their tight spreads, excellent execution speeds, and customer service.

If you’re serious about trading, I highly recommend checking out the best Forex brokers I’ve vetted. You can find them here: Most Trusted Forex Brokers.

Conclusion

The Fibonacci Retracement + RSI Divergence Strategy for reversal trading is powerful.

It’s not just about understanding the indicators; it’s about using them in tandem to boost your trading success.

With my 16 trading bots, you can automate this strategy and take advantage of market opportunities 24/7.

So, why not give it a shot?

Your trading journey could take a turn for the better!