Last Updated on February 26, 2025 by Arif Chowdhury

Ever found yourself stuck in a trade that just won’t move?

Or maybe you’re frustrated with inconsistent results?

I get it. As a seasoned Forex trader since 2015, I’ve tackled these issues head-on.

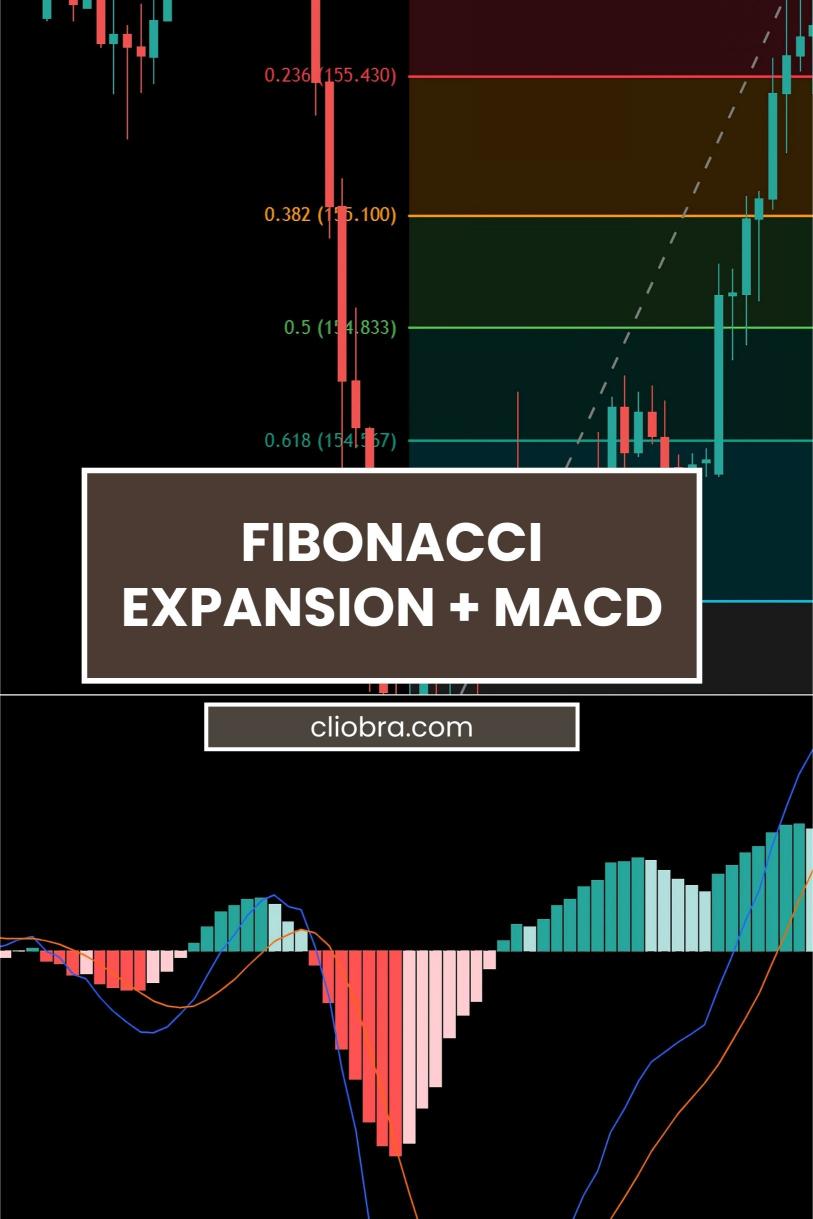

Let me share a strategy that has consistently brought me success: the Fibonacci Expansion + MACD Strategy.

Why Fibonacci and MACD?

These two tools might sound like jargon, but they’re game-changers.

- Fibonacci Expansion helps identify potential price targets.

- MACD (Moving Average Convergence Divergence) signals momentum and trend reversals.

Combining these two gives you a powerful edge.

But before diving into the nitty-gritty, let’s set the stage.

Understanding the Basics

Fibonacci levels are derived from the Fibonacci sequence, a series of numbers where each number is the sum of the two preceding ones.

In trading, we focus on key levels like 23.6%, 38.2%, 50%, 61.8%, and 100%.

These levels often act as support and resistance.

Meanwhile, MACD is a trend-following momentum indicator.

It shows the relationship between two moving averages of a security’s price.

When the MACD line crosses above the signal line, it’s a bullish signal.

When it crosses below, it’s bearish.

Setting Up Your Strategy

Now, let’s break down how to use these tools together.

- Identify the Trend

Use the MACD to determine if the market is bullish or bearish.

Look for the MACD line crossing above or below the signal line. - Draw Fibonacci Levels

After identifying a significant price movement, draw Fibonacci retracement levels from the last swing low to the swing high (or vice versa in a downtrend). - Look for Confluence

Check where the MACD signals align with Fibonacci levels.

For example, if the MACD shows a bullish crossover near the 61.8% retracement level, that’s a strong buy signal. - Set Your Targets

Use Fibonacci expansion levels to set profit targets.

The 161.8% level is often a good target for momentum trades.

My Trading Bots: A Secret Weapon

Now, here’s where it gets exciting.

I’ve developed a portfolio of 16 sophisticated trading bots that use the Fibonacci Expansion + MACD strategy among others.

These bots are strategically diversified across major currency pairs:

- EUR/USD

- GBP/USD

- USD/CHF

- USD/JPY

Each currency pair has 3-4 bots designed to minimize correlated losses.

This multi-layered diversification significantly enhances profitability while mitigating risk.

- Backtested for 20 years: These bots perform excellently under harsh conditions.

- Long-term trading: They target 200-350 pips, ensuring better performance over time.

Best part? You can access this EA portfolio completely FREE!

Imagine having sophisticated algorithms working for you while you focus on learning and growing.

Check out my trading bots portfolio and see how they can elevate your trading game.

Real Stats to Keep in Mind

Did you know that traders who use technical analysis tools like Fibonacci and MACD can increase their win rates by up to 70%?

That’s a significant boost!

Moreover, studies show that disciplined traders who stick to proven strategies often outperform 90% of retail traders.

Choosing the Right Broker

Once you’ve got your strategy down, it’s crucial to execute it through a reliable broker.

I’ve tested several and can confidently recommend the best.

Make sure to choose brokers that offer tight spreads and excellent customer support.

Check out my top picks on trusted Forex brokers to find a partner for your trading journey.

Final Thoughts

The Fibonacci Expansion + MACD Strategy is a robust method for catching momentum trades.

By understanding and applying these tools, you can significantly improve your trading outcomes.

And don’t forget to leverage my 16 trading bots to automate your strategy and enhance your profitability.

Let’s turn those frustrations into victories!

Happy trading! 🚀