Last Updated on February 28, 2025 by Arif Chowdhury

Have you ever felt overwhelmed by market noise?

Wondered how to spot a solid trading opportunity without getting lost in the chaos?

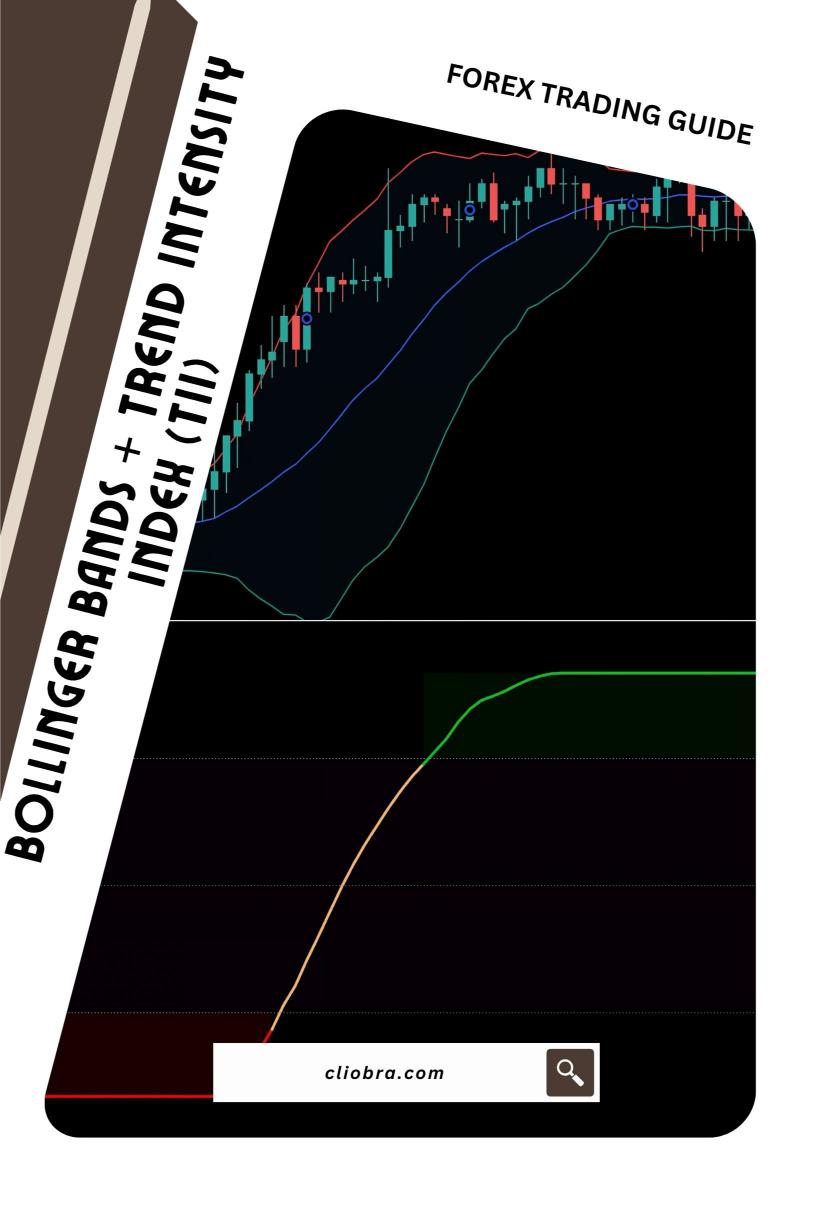

As a seasoned Forex trader since 2015, I’ve navigated these waters, and let me tell you, the Bollinger Bands + Trend Intensity Index (TII) Strategy is a game-changer for analyzing market strength.

What Are Bollinger Bands?

Bollinger Bands are like your trading safety net.

They consist of three lines:

- The middle line is the simple moving average (SMA).

- The upper band is the SMA plus two standard deviations.

- The lower band is the SMA minus two standard deviations.

This setup helps you see volatility at a glance.

When the bands widen, volatility is high. When they narrow, volatility is low.

Why Use the Trend Intensity Index (TII)?

Now, let’s talk about the Trend Intensity Index.

The TII measures the strength of a trend.

It ranges from 0 to 100, giving you clear signals:

- A reading above 50 indicates a strong uptrend.

- Below 50 shows a downtrend.

- Exactly at 50 means indecision.

This makes it a powerful partner for Bollinger Bands.

How They Work Together

Combining these two tools can elevate your trading game.

Here’s how:

- Identify the Trend: Use the TII to determine whether the market is trending or ranging.

- Spot Volatility: Check the Bollinger Bands. If the price hits the upper band in an uptrend (with TII above 50), it’s a signal to consider taking profit or entering a new position.

- Confirm Entries: If the price breaks out of the bands and the TII supports the trend, it’s a solid entry point.

Key Stats to Keep in Mind

- Volatility: Markets can swing wildly, with daily fluctuations averaging around 100 pips in major pairs like EUR/USD.

- Trend Strength: Studies show that trends can last longer than expected, with over 60% of trades benefiting from riding a trend.

My Trading Approach

In my journey, I’ve developed a unique strategy that incorporates this Bollinger Bands + TII setup, among others.

It’s not just about the tools; it’s about how I apply them.

I’ve crafted a portfolio of 16 trading bots, each using diverse strategies tailored to major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

This multi-layered approach minimizes correlated losses and enhances overall profitability.

Why You Should Consider My Trading Bots

These bots are built to trade on H4 charts, focusing on long-term gains of 200-350 pips.

They’ve been backtested over 20 years, performing excellently even in volatile conditions.

Plus, I’m offering this EA portfolio completely FREE!

By using my trading bots, you can automate the Bollinger Bands + TII strategy and let the algorithms do the heavy lifting.

Check out my 16 trading bots portfolio and see how they can work for you.

Finding the Right Broker

No strategy is complete without a reliable broker.

I’ve tested several, and I’ve got my top recommendations laid out for you.

Using a trusted broker ensures you get the best spreads and execution speed.

If you’re serious about trading, check out these best forex brokers that I personally vouch for.

Final Thoughts

Trading can feel like a rollercoaster, but with the right tools and strategies, you can harness the market’s power.

The Bollinger Bands + Trend Intensity Index (TII) Strategy offers a clear roadmap for understanding market strength.

Combine that with my 16 trading bots and a solid broker, and you’ve got a winning formula.

Let’s do this together!