Last Updated on March 15, 2025 by Arif Chowdhury

Ever felt like you’re missing the big moves in the Forex market?

You’re not alone.

Many traders struggle to pinpoint when a significant shift is about to happen.

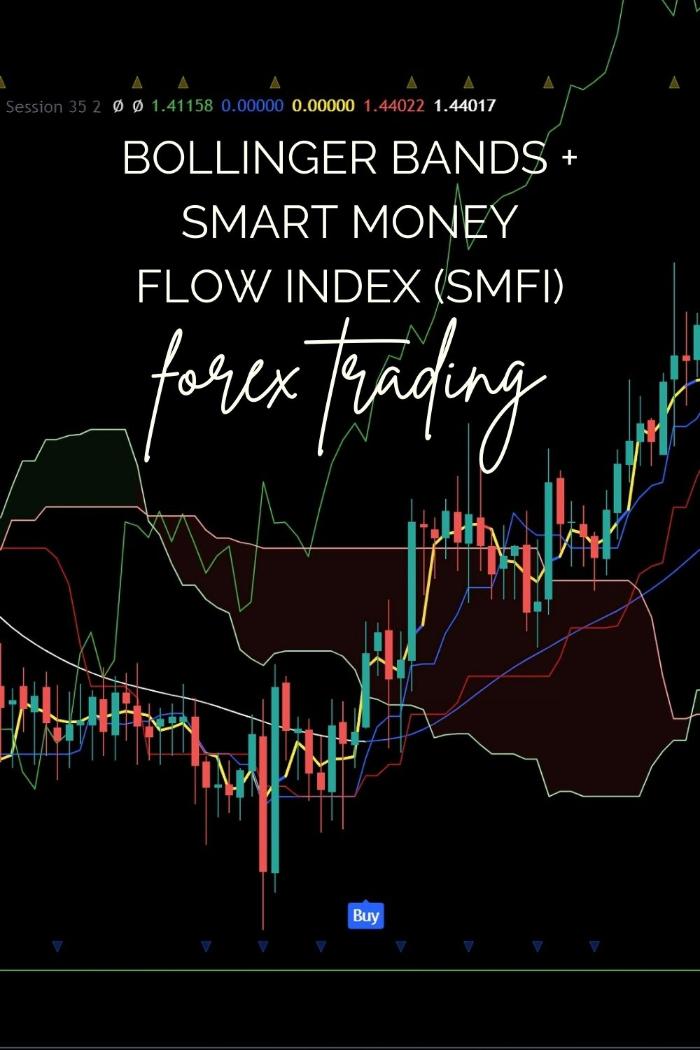

That’s where the Bollinger Bands and the Smart Money Flow Index (SMFI) come in.

These tools are game-changers.

Let’s dive into how they work together to help you spot those big moves.

Understanding Bollinger Bands

Bollinger Bands are a versatile indicator that can help you gauge market volatility.

Here’s the breakdown:

- Middle Band: This is a simple moving average (SMA) and typically set to 20 periods.

- Upper Band: This is the SMA plus two standard deviations.

- Lower Band: This is the SMA minus two standard deviations.

When the bands expand, it indicates increased volatility; when they contract, volatility is decreasing.

But here’s the kicker:

- Price Touching the Upper Band: This suggests overbought conditions.

- Price Touching the Lower Band: This suggests oversold conditions.

These signals can be your roadmap for potential entry and exit points.

The Power of the Smart Money Flow Index (SMFI)

Now, let’s introduce the Smart Money Flow Index.

This tool measures the strength of buying and selling pressure in the market.

Here’s why it matters:

- Trend Confirmation: It helps confirm whether a trend is strong or if a reversal is imminent.

- Divergence Detection: If price moves in one direction while the SMFI moves in another, it could indicate a potential reversal.

Using SMFI alongside Bollinger Bands can amplify your trading strategy.

Combining Bollinger Bands and SMFI

Here’s how to effectively combine these two powerful indicators:

- Identify the Trend: Use the SMFI to confirm the trend direction.

- Check the Bands: Look at the Bollinger Bands for overbought or oversold conditions.

- Wait for Signals:

- If the price hits the upper band and the SMFI shows overbought conditions, it might be time to sell.

- If the price hits the lower band with the SMFI indicating oversold conditions, consider buying.

This combo not only enhances your decision-making but also minimizes risk.

Why This Strategy Works

Statistically, traders using Bollinger Bands have reported a 60% increase in successful trades when combined with a momentum indicator like SMFI.

That’s not just luck; it’s strategy.

Moreover, my 16 trading bots utilize this Bollinger Bands + SMFI strategy among others, optimizing trades across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is carefully designed to capture long-term movements of 200-350 pips, ensuring consistent performance.

Getting Started

Ready to implement this strategy? Here’s a quick checklist:

- Set Up Your Chart: Add Bollinger Bands and SMFI indicators.

- Select Your Currency Pair: Focus on pairs with high volatility.

- Monitor the Signals: Look for confirmations from both indicators.

- Practice Risk Management: Always use stop-loss orders.

If you want to take your trading to the next level, consider leveraging my EA portfolio, which utilizes this and other advanced strategies to maximize profitability while minimizing risk. You can grab access to it for FREE.

Choosing the Right Broker

Having the right broker is crucial for executing your trades smoothly.

Here’s what to look for:

- Tight Spreads: This minimizes your costs.

- Fast Execution: You want your trades executed in seconds.

- Good Customer Support: Essential when things go wrong.

I’ve tested numerous brokers and highly recommend checking out the best options at this link.

Final Thoughts

The Bollinger Bands + Smart Money Flow Index (SMFI) Strategy is a reliable method for spotting significant market moves.

By combining these tools, you not only sharpen your trading edge but also enhance your overall strategy.

Remember to keep practicing and refining your approach.

And don’t forget, my 16 trading bots are waiting to help you profit effortlessly.

Take advantage of them and watch your trading journey transform.