Last Updated on March 2, 2025 by Arif Chowdhury

Ever felt lost in the endless sea of Forex strategies?

You’re not alone.

With so many options, it’s easy to feel overwhelmed.

How do you know which strategy will actually work for you?

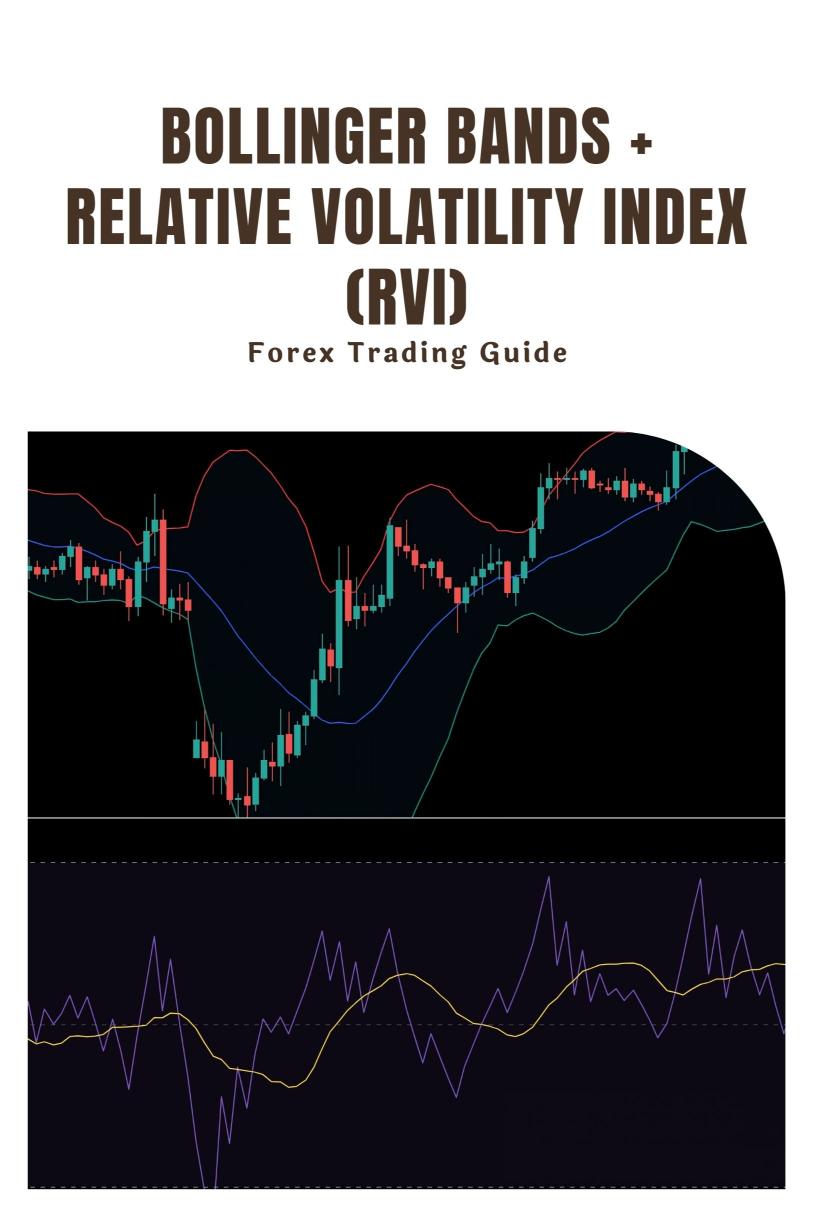

Let’s dive into a powerful combo that’s been a game-changer for me: The Bollinger Bands + Relative Volatility Index (RVI) Strategy.

This strategy is all about catching those breakout moves, and with the right approach, it can lead to some serious profits.

Let’s break it down together.

What Are Bollinger Bands?

Bollinger Bands are like your trading safety net.

They consist of three lines:

- Middle Line: The simple moving average (SMA).

- Upper Band: The SMA plus two standard deviations.

- Lower Band: The SMA minus two standard deviations.

The bands expand and contract based on market volatility.

When the price approaches the upper band, it’s often considered overbought. When it hits the lower band, it’s seen as oversold.

Easy, right?

Understanding the Relative Volatility Index (RVI)

Now, let’s add the RVI into the mix.

The RVI measures the direction of volatility.

It gives us insights into whether the market is trending or ranging.

Here’s how it works:

- Above 50: Bullish momentum.

- Below 50: Bearish momentum.

This helps you gauge whether to buy or sell.

Combining Bollinger Bands and RVI

Now, here’s where the magic happens.

By combining these two tools, you can identify potential breakout opportunities.

Here’s how I typically use them:

- Identify the Trend: Look at the RVI to determine if the market is bullish or bearish.

- Watch the Bands: Wait for the price to touch the upper or lower Bollinger Band.

- Confirm the Breakout: If the RVI supports the direction of the breakout, consider entering the trade.

Key Stats to Consider

Did you know that:

- 70% of traders fail?

Most give up within the first year due to lack of strategy and consistent losses. - Using a solid strategy can improve your win rate.

Just like the Bollinger Bands + RVI combo, which can lead to greater accuracy in breakout trading!

Why This Strategy Works

This strategy capitalizes on market volatility.

When the bands are tight, it often precedes a big price move.

And the RVI helps confirm that move.

So, you’re not just guessing.

You’re making informed decisions.

My Trading Bots and This Strategy

As a seasoned Forex trader since 2015, I’ve developed a portfolio of 16 sophisticated trading bots.

These bots utilize the Bollinger Bands + RVI strategy along with other techniques.

They’re designed for long-term performance, aiming for 200-350 pips.

What’s cool?

Each currency pair—EUR/USD, GBP/USD, USD/CHF, and USD/JPY—has a unique set of 3-4 bots.

This diversification minimizes correlated losses.

And the best part?

I’m offering this entire EA portfolio for FREE!

You get access to a robust system that’s been backtested over the last 20 years.

Tips for Getting Started

Here’s how to make the most of the Bollinger Bands + RVI strategy:

- Keep it Simple: Don’t overcomplicate your chart.

- Practice on Demo: Before going live, test the strategy on a demo account.

- Stay Disciplined: Stick to your plan and avoid emotional trading.

Choosing the Right Forex Broker

Before diving in, you need a solid broker.

A reliable broker can make or break your trading experience.

Look for:

- Low spreads

- Fast execution

- Good customer support

I’ve tested numerous brokers and highly recommend checking out the best forex brokers that I’ve vetted.

They’ll give you the foundation you need to succeed.

Conclusion

The Bollinger Bands + RVI strategy is a powerful tool in your trading arsenal.

It helps you catch those critical breakouts while managing risk.

With my 16 trading EAs, designed to leverage this strategy, you can trade with confidence.

So why not take advantage of it?

Start today by exploring my trading bots portfolio and see how this strategy can boost your trading game.

Embrace the volatility, and let’s make those pips together!