Last Updated on February 28, 2025 by Arif Chowdhury

Ever sat down to trade and thought, “Where do I even start?”

You’re not alone.

Many traders face the daunting task of pinpointing trends across multiple timeframes.

I’ve been there, too.

As a seasoned Forex trader since 2015, I’ve spent years navigating these waters.

One thing I’ve learned?

Having the right strategy is key.

Let me introduce you to The Bollinger Bands + Gator Oscillator Strategy.

It’s a game-changer for spotting trends.

Understanding the Basics

Before we dive in, let’s break down the essentials.

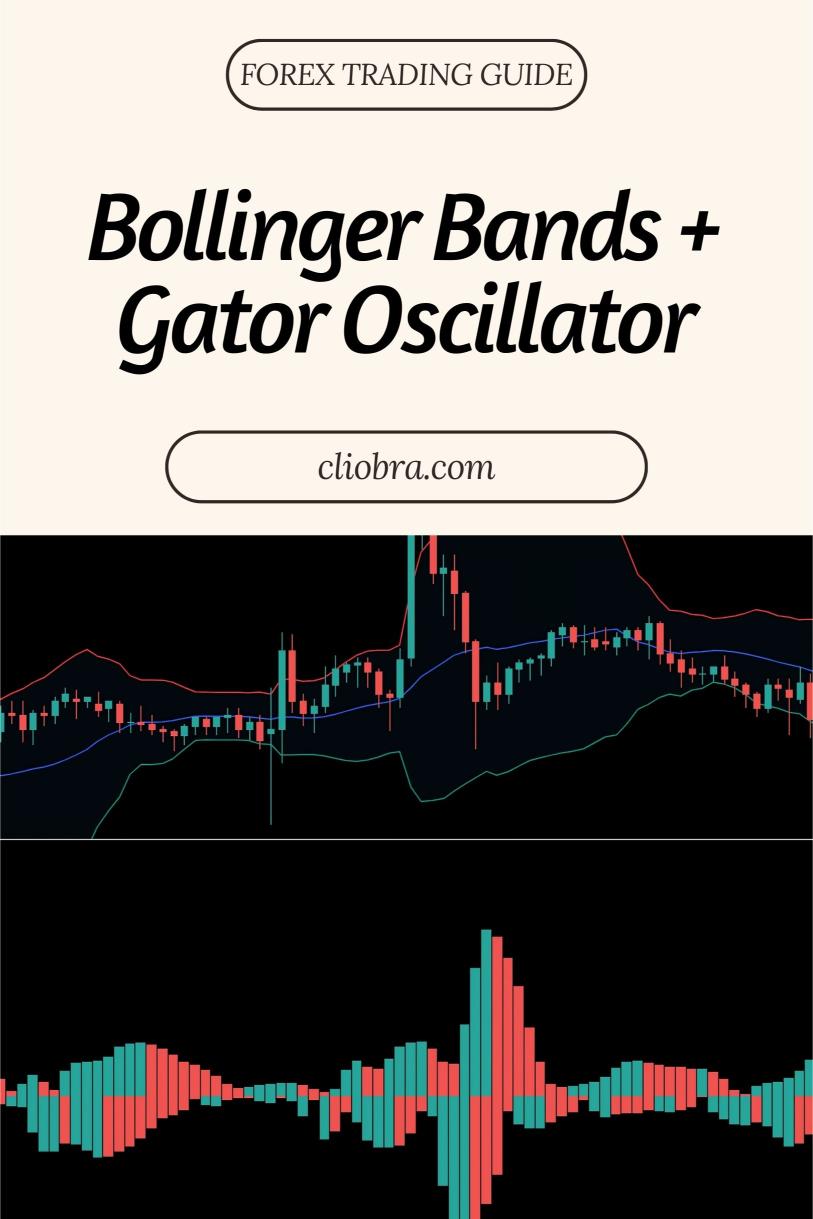

Bollinger Bands are a volatility indicator, showing price movement relative to a moving average.

They consist of three lines:

- The middle line is the 20-period simple moving average (SMA).

- The upper band is two standard deviations above the SMA.

- The lower band is two standard deviations below the SMA.

Gator Oscillator, on the other hand, helps identify market momentum and the phases of the market.

It consists of two histograms:

- Green bars show bullish momentum.

- Red bars indicate bearish momentum.

Together, they provide a powerful signal for traders.

Why This Strategy Works

Here’s the kicker: Combining these two tools allows you to spot multi-timeframe trends effectively.

Imagine being able to see the bigger picture while trading on shorter timeframes.

Statistically, traders using multi-timeframe analysis can improve their win rates by up to 60%.

That’s not just a number; it’s a testament to how powerful this strategy can be.

Getting Started with the Strategy

Here’s how to implement this strategy step-by-step:

- Set Up Your Charts

- Use the H4 timeframe for your main setup.

- Add Bollinger Bands and Gator Oscillator to your chart.

- Identify the Trend

- Look for price action touching the upper or lower Bollinger Band.

- Confirm with the Gator Oscillator: green bars signal a buy, red for a sell.

- Check Multiple Timeframes

- Analyze higher timeframes (like daily or weekly) for overall trend direction.

- Ensure the Gator Oscillator aligns with your findings.

- Enter the Trade

- Enter when both indicators agree.

- Use a stop loss just outside the opposite Bollinger Band.

- Manage Your Trade

- Trail your stop loss as the trade moves in your favor.

- Look for exits when the Gator Oscillator changes color.

My Trading Bots: A Complement to Your Strategy

Now, while this strategy is solid, it’s always good to have backup.

That’s where my 16 trading bots come in.

These bots are designed to trade using diverse strategies, including the Bollinger Bands + Gator Oscillator.

They operate on major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Here’s what makes them exceptional:

- Each currency pair has 3-4 specialized bots.

- Internal diversification minimizes correlated losses.

- They’re built for long-term trading, targeting 200-350 pips.

I’ve backtested these bots over 20 years.

They perform excellently, even in harsh market conditions.

And the best part?

You can access this entire portfolio for FREE.

If you want to elevate your trading game, check out my trading bots here: 16 Trading Bots Portfolio.

Final Thoughts

As you embark on your trading journey, remember that spotting trends is crucial.

The Bollinger Bands + Gator Oscillator strategy provides a robust framework for doing just that.

But don’t forget about the tools at your disposal—like my trading bots.

They can complement your strategy and help you manage risk effectively.

And if you’re looking for reliable platforms, I highly recommend checking out the best Forex brokers I’ve tested.

They’ll ensure you have a smooth trading experience.

Once you’ve mastered the Bollinger Bands and Gator Oscillator, watch your trading transform.