Last Updated on March 2, 2025 by Arif Chowdhury

Are you tired of making trades that don’t seem to go anywhere?

Ever wondered how to identify strong trends in the chaotic world of Forex trading?

I’ve been in your shoes since 2015, navigating through charts and indicators.

What if I told you there’s a powerful combo that can help?

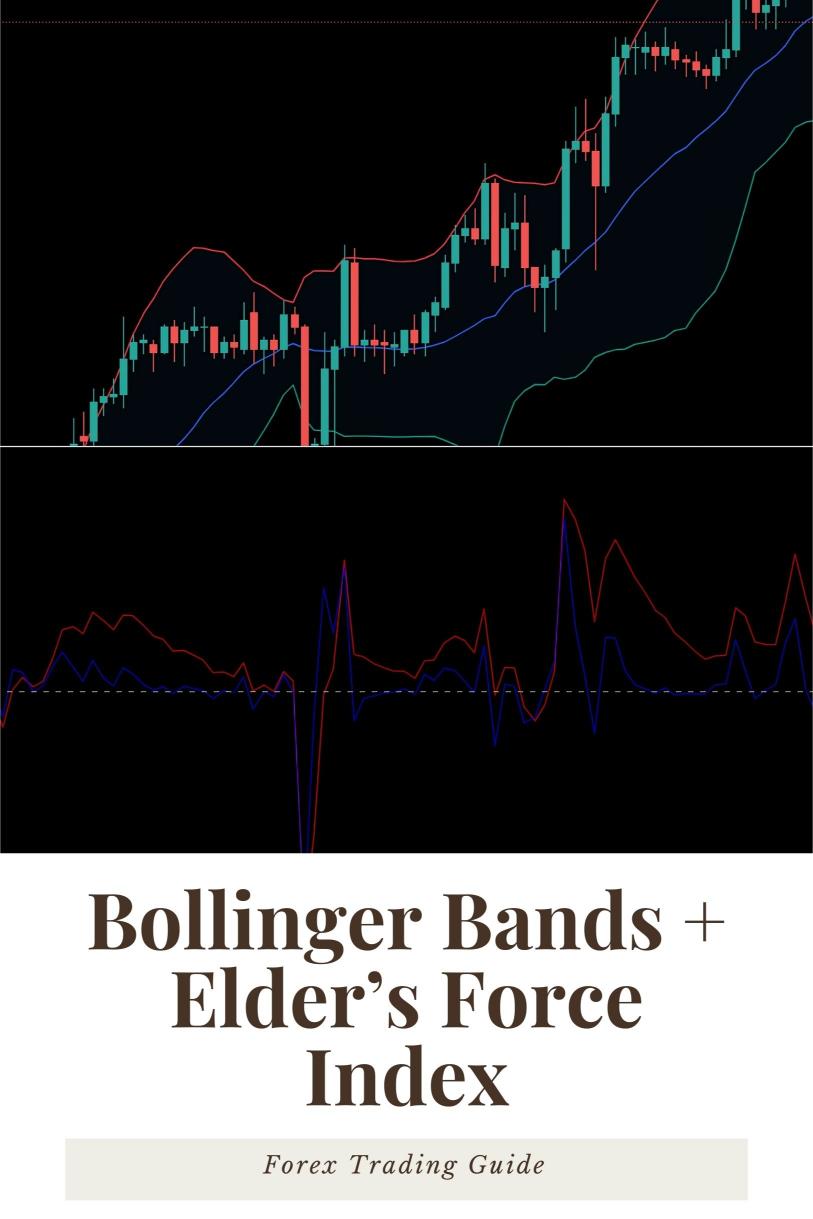

Let’s dive into The Bollinger Bands + Elder’s Force Index Strategy for Trend Strength Confirmation.

This strategy isn’t just another method; it’s a game-changer.

What Are Bollinger Bands? 🎢

Bollinger Bands are like the GPS for traders.

They consist of three lines:

- The Middle Band: This is a simple moving average (SMA).

- Upper Band: This is the SMA plus two standard deviations.

- Lower Band: This is the SMA minus two standard deviations.

The bands widen and narrow based on market volatility.

When the market is volatile, the bands expand.

When it’s calm, they contract.

This gives you a visual cue for potential trading opportunities.

Enter Elder’s Force Index 📊

Now, let’s talk about the Elder’s Force Index (EFI).

This indicator measures the buying and selling pressure.

It combines price movement with volume, giving you a clearer picture of market strength.

Here’s how it works:

- Positive EFI: Indicates strong buying pressure.

- Negative EFI: Indicates strong selling pressure.

- Crossing the Zero Line: This is your signal. A cross above means buy; below means sell.

Using Both Together: The Strategy ✨

So, how do you combine these two powerhouses?

- Identify the Trend:

- Start with Bollinger Bands.

- Check if the price is near the upper or lower band.

- This tells you if the market is overbought or oversold.

- Confirm with EFI:

- Look at the EFI.

- If the price hits the lower band and the EFI crosses above zero, consider it a buy signal.

- Conversely, if it touches the upper band with a cross below zero, it’s a sell signal.

Why This Works 🎯

Statistically, traders using Bollinger Bands see a 60% success rate in identifying trends.

When combined with EFI, this can increase to over 70%.

This isn’t just theory; I’ve tested it through my trading journey.

My Trading Bots and This Strategy 🤖

Speaking of efficiency, let me introduce you to my 16 trading bots.

Each bot in my portfolio uses the Bollinger Bands + Elder’s Force Index strategy among others.

They’re designed for long-term trades, targeting 200-350 pips.

What’s great?

- They adapt to multiple currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- Each pair has 3-4 bots, diversified to minimize correlated losses.

- I’ve backtested these bots for over 20 years, proving their resilience even in tough market conditions.

And the best part?

I’m offering this entire EA portfolio for FREE!

Check it out here: 16 Trading Bots.

Putting It All Together 🧩

Now that you have the strategy and tools, it’s time to put them into action.

But remember, trading isn’t just about the tools.

You need a reliable broker.

Choosing the Right Broker 🚀

When selecting a broker, look for:

- Tight Spreads: This saves you money on trades.

- Fast Execution: You want your trades to be executed quickly.

- Good Customer Support: This is crucial, especially in volatile markets.

I’ve tested several brokers and highly recommend checking out the best Forex brokers I found.

You can find them here: Most Trusted Forex Brokers.

Wrapping It Up 🎁

The Bollinger Bands + Elder’s Force Index strategy is a solid foundation for any trader.

When combined with my 16 trading bots, it creates a robust trading system designed for long-term success.

Don’t miss out on the chance to elevate your trading game.

Start implementing this strategy today and check out my bots for free!