Last Updated on March 15, 2025 by Arif Chowdhury

Ever feel lost in the sea of trading strategies?

Wondering how to navigate those unpredictable market phases?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve faced the same challenges.

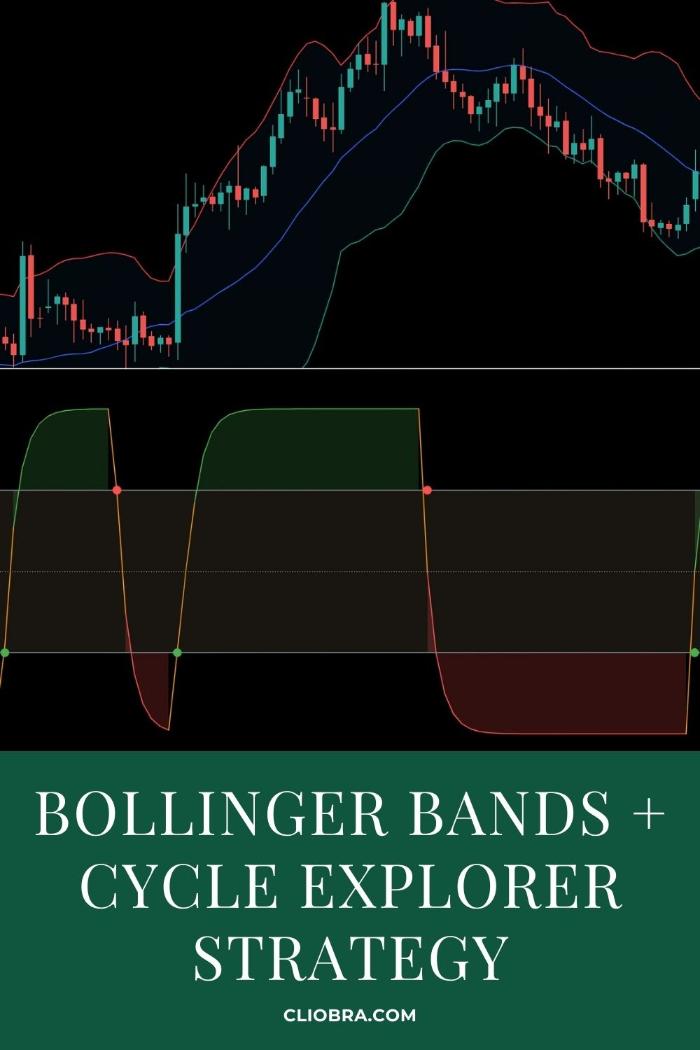

But here’s the good news: I’ve honed a strategy that blends the Bollinger Bands with the Cycle Explorer.

This combo gives clarity and helps you seize opportunities, no matter the market phase.

Let’s dive in!

Understanding Bollinger Bands 🎢

First, let’s break down Bollinger Bands.

These are three lines plotted on your chart:

- Middle Band: This is a simple moving average (SMA).

- Upper Band: This is the SMA plus two standard deviations.

- Lower Band: This is the SMA minus two standard deviations.

Why should you care?

Bollinger Bands help you identify volatility and potential price reversals.

When the bands are tight, it signals low volatility.

When they’re wide, it’s high volatility!

Statistically, about 90% of price action stays within the bands.

So, if prices break out, it’s worth paying attention!

The Cycle Explorer Approach 🔄

Now, let’s introduce the Cycle Explorer.

This tool analyzes market cycles, helping you spot trends and reversals.

It focuses on:

- Timing: Understanding when to enter and exit trades.

- Pattern Recognition: Identifying repeating patterns in price movements.

Integrating this with Bollinger Bands gives you a powerful edge.

When the price hits the lower band and the Cycle Explorer signals an upward cycle, it’s a potential buy.

Conversely, if it hits the upper band with a downward cycle, it could be a sell signal.

Why This Strategy Rocks 🌟

Combining these two strategies enhances your trading game.

Here’s why:

- Risk Management: The bands help you set clear stop-loss levels.

- Informed Decisions: Cycle Explorer confirms your entry or exit points.

- Adaptability: Works across various market phases—trending, ranging, or reversing.

My Trading Bots and This Strategy 🤖

I’ve taken this strategy a step further.

I’ve developed 16 sophisticated trading bots that utilize the Bollinger Bands + Cycle Explorer strategy.

These bots are designed for long-term performance, aiming for 200-350 pips on H4 charts.

Here’s the kicker: they’re completely FREE for you to try out!

Each currency pair—EUR/USD, GBP/USD, USD/CHF, and USD/JPY—has 3-4 bots, each uniquely designed to minimize correlated losses.

This multi-layered diversification enhances profitability and reduces risk.

You can check them out here: Explore My Trading Bots.

Practical Tips for Using the Strategy 💡

Here are some quick tips to make the most of the Bollinger Bands + Cycle Explorer strategy:

- Monitor Volatility: Pay attention to when bands widen or narrow.

- Combine Signals: Look for confirmation from both the bands and the Cycle Explorer before making a trade.

- Stay Disciplined: Stick to your trading plan and avoid emotional decisions.

Choosing the Right Broker 🏦

Now, let’s talk about the importance of having a solid broker.

You want one that offers:

- Tight Spreads: This maximizes your potential profits.

- Fast Execution: This minimizes slippage, especially during volatile times.

- Good Customer Support: You need a broker who’s got your back.

I’ve tested several brokers and can vouch for some of the best.

You can find them here: Top Forex Brokers.

Conclusion

Navigating the Forex market doesn’t have to be daunting.

With the Bollinger Bands + Cycle Explorer strategy, you’re equipped to tackle any market phase.

And with my FREE trading bots, you have the tools to potentially maximize your profits.

Remember, trading is a journey.

Stay curious, keep learning, and always look for ways to enhance your strategy.

Happy trading! 🚀