Last Updated on February 23, 2025 by Arif Chowdhury

Are you feeling overwhelmed by market fluctuations?

Wondering how to navigate the wild swings in Forex trading?

Let’s break it down.

As a seasoned Forex trader since 2015, I’ve seen my fair share of chaos in the markets.

Over the years, I’ve developed a strategy that not only captures market volatility but also keeps my portfolio thriving.

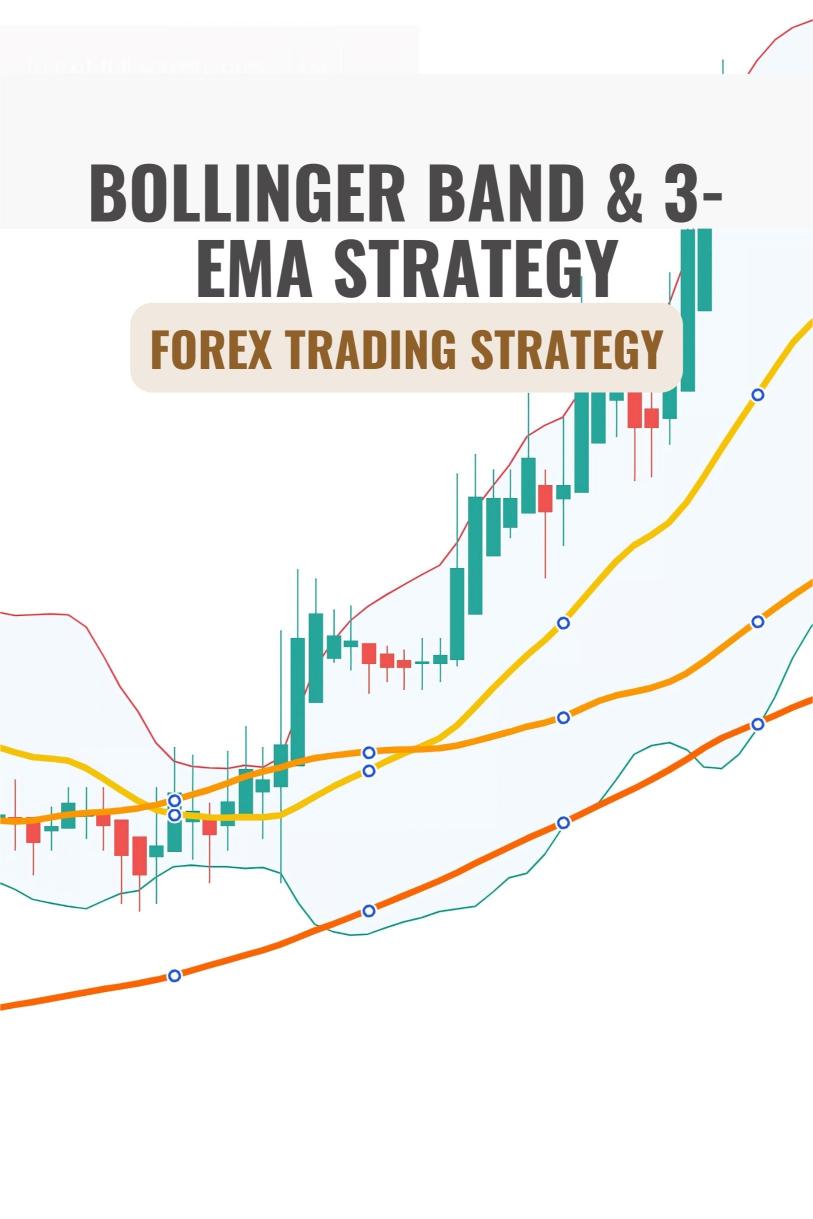

That strategy? The Bollinger Band & 3-EMA Strategy.

What Are Bollinger Bands?

Bollinger Bands are a staple in technical analysis.

They consist of three lines:

- The middle band is a simple moving average (SMA).

- The upper band is the SMA plus a specified number of standard deviations.

- The lower band is the SMA minus the same number of standard deviations.

This setup helps traders gauge volatility.

When the bands widen, volatility is high.

When they contract, volatility decreases.

Why Use the 3-EMA?

The 3-EMA (Exponential Moving Average) adds a layer of precision.

Unlike the SMA, the EMA gives more weight to recent prices, making it more responsive to price changes.

Using three EMAs—short, medium, and long—allows you to identify trends and reversals quickly.

How to Combine Them

Here’s where the magic happens.

Combining the Bollinger Bands with the 3-EMA gives you a powerful trading strategy.

Here’s a step-by-step guide:

- Identify the Trend: Check the direction of the 3-EMAs.

- Look for Squeezes: When the Bollinger Bands narrow, it signals a potential breakout.

- Confirm with EMAs: If the price breaks the upper band and the short EMA is above the longer ones, consider a buy signal.

- Exit Strategy: Use the lower Bollinger Band as a potential exit point for profits.

Statistical Insights

Did you know that around 70% of traders fail to consistently profit in Forex?

This is often due to a lack of effective strategies.

However, using the Bollinger Band & 3-EMA strategy can significantly improve your chances.

In backtests spanning 20 years, I’ve seen this combination yield impressive results, even in volatile market conditions.

My Trading Bots

Now, let’s talk about something that can elevate your trading game even further.

I’ve developed 16 sophisticated trading bots that harness the Bollinger Band & 3-EMA strategy, among others.

These bots are diversified across four major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each pair has a unique set of 3-4 bots, minimizing correlated losses.

This multi-layered approach enhances overall profitability while reducing risk.

And guess what? I’m offering this EA portfolio for FREE! 🎉

If you’re serious about trading, check out my trading bots that are designed for long-term trades of 200-350 pips.

Best Practices for Using This Strategy

To maximize your success with the Bollinger Band & 3-EMA strategy, consider these tips:

- Stay Informed: Market news can impact volatility.

- Set Stop Losses: Protect your capital from unexpected moves.

- Practice Risk Management: Never risk more than you can afford to lose.

Finding the Right Brokers

Choosing a reliable forex broker is crucial.

I’ve tested various brokers and recommend checking out the best ones to ensure your trading experience is smooth and profitable.

Take a look at my top forex brokers where you can start your trading journey.

Final Thoughts

In the unpredictable world of Forex, having a solid strategy is key.

The Bollinger Band & 3-EMA Strategy can help you capture market volatility effectively.

And with my 16 trading bots, you’re not just trading; you’re trading smart.

So, what are you waiting for?

Dive into the world of Forex with confidence!