Last Updated on March 17, 2025 by Arif Chowdhury

Are you tired of missing out on breakout opportunities in the Forex market?

Do you find yourself glued to your charts, wondering when the next big move will happen?

You’re not alone.

Many traders struggle to pinpoint those critical moments when price makes a decisive move.

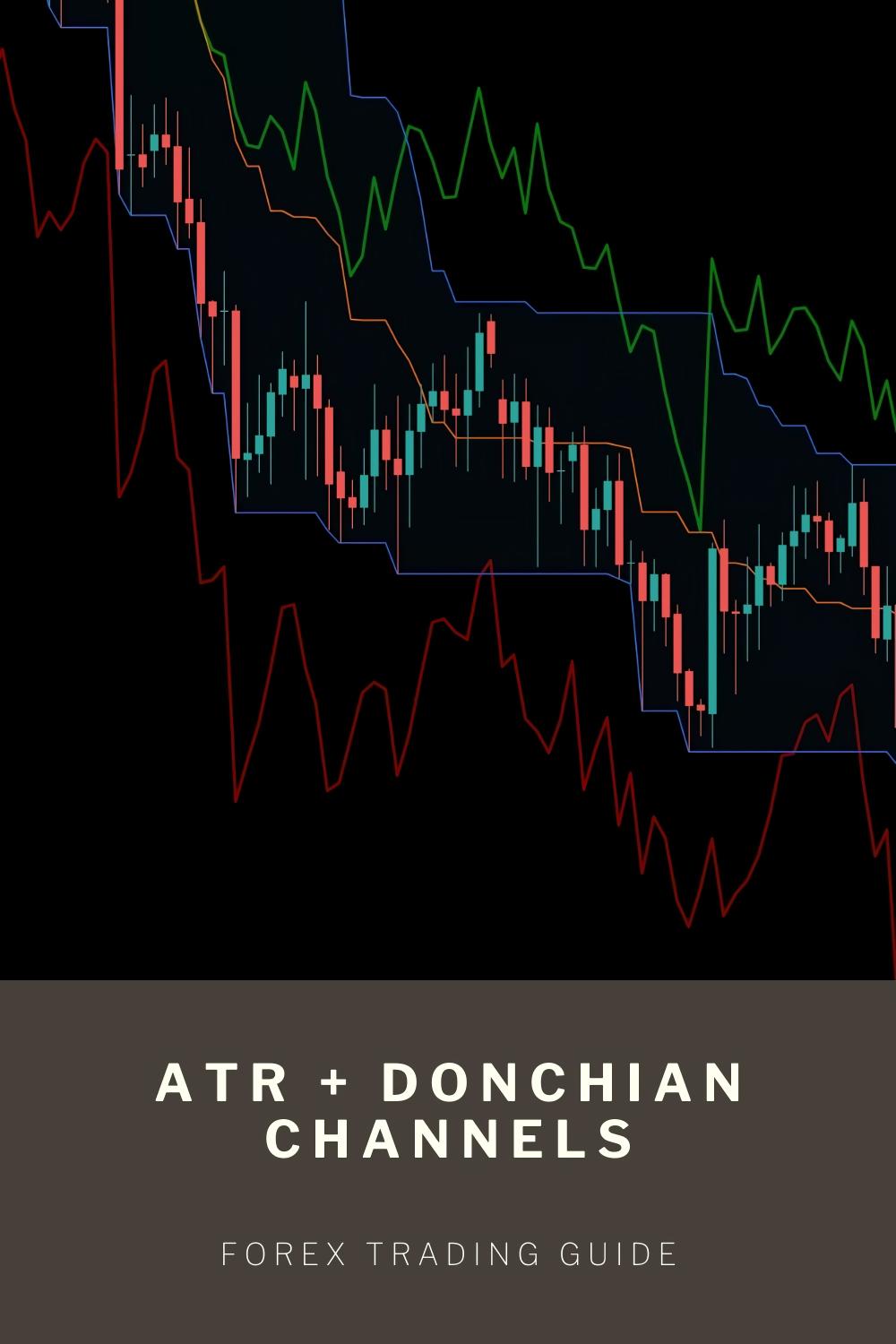

That’s where the ATR (Average True Range) combined with Donchian Channels comes into play.

This strategy has been a game-changer for me, and I’m excited to share how it can elevate your trading game.

What is the ATR?

The ATR measures market volatility by decomposing the entire range of an asset for that period.

Think of it as a gauge for how much a currency pair typically moves.

- Higher ATR: Indicates higher volatility.

- Lower ATR: Indicates lower volatility.

For instance, an ATR of 100 pips means the currency pair typically moves 100 pips in a given timeframe.

This knowledge is crucial for setting stop-loss orders and understanding market conditions.

What are Donchian Channels?

Donchian Channels are a technical indicator that helps identify breakout points.

They consist of three lines:

- Upper Band: Highest high over a set period.

- Lower Band: Lowest low over that same period.

- Middle Band: Average of the upper and lower bands.

When price breaks above the upper band, it signals a potential bullish breakout.

Conversely, a break below the lower band indicates a bearish breakout.

Why Combine ATR with Donchian Channels?

Using ATR with Donchian Channels creates a powerful synergy.

Here’s why:

- Volatility Confirmation: Before acting on a breakout signal, you can check if the market’s volatility is supportive of the move.

- Risk Management: ATR helps in setting stop-loss levels based on the current market volatility.

By integrating both, you get a clearer picture to make informed trading decisions.

How to Implement the Strategy

- Identify the Currency Pair: Choose a pair with a decent ATR.

- Set Up Donchian Channels: Use a standard period (like 20 days) for the channels.

- Monitor ATR: Check if the ATR is above a certain threshold to confirm volatility.

- Wait for a Breakout: Look for price to breach the upper or lower Donchian Band.

- Set Stop-Losses: Use the ATR to determine where to place your stop-loss.

This approach not only simplifies the trading process but also increases the likelihood of catching profitable moves.

My Journey with Trading Bots

Since 2015, I’ve dedicated my time to mastering Forex trading.

Over the years, I’ve developed a portfolio of 16 sophisticated trading bots that utilize various strategies, including the ATR + Donchian Channels strategy.

These bots are designed to:

- Trade key currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- Diversify risk: Each pair has 3-4 bots, reducing correlated losses.

- Focus on long-term trades: Aiming for 200-350 pips, ensuring better performance over time.

I’ve backtested these bots for the past 20 years, and they excel under various market conditions.

Best of all, I’m offering this entire EA portfolio for FREE!

If you’re serious about enhancing your trading experience, check out my 16 trading bots.

Key Benefits of the ATR + Donchian Channels Strategy

- Increased Profit Potential: By identifying breakouts, you position yourself for significant price movements.

- Enhanced Risk Management: The combination of ATR and Donchian Channels allows for smarter stop-loss placements.

- Easy to Understand: This strategy is straightforward enough for both beginners and experienced traders.

Final Thoughts

Trading in Forex can be daunting, but the right tools and strategies can make a world of difference.

The ATR + Donchian Channels strategy is an effective way to detect breakout opportunities, giving you a tactical edge.

And let’s not forget, choosing the right broker is crucial for executing your trades effectively.

I’ve tested several brokers and highly recommend checking out the best Forex brokers to ensure you have a reliable trading platform.

With the right strategy and the right tools, you can navigate the Forex market with confidence.

Start utilizing the ATR + Donchian Channels strategy today and see how it transforms your trading approach!