Last Updated on November 1, 2025 by Arif Chowdhury

Are you tired of losing trades?

Wondering how to spot trends before they explode?

Looking for a simple strategy that packs a punch?

You’re in the right place.

As a seasoned Forex trader since 2015, I’ve navigated the ups and downs of the market.

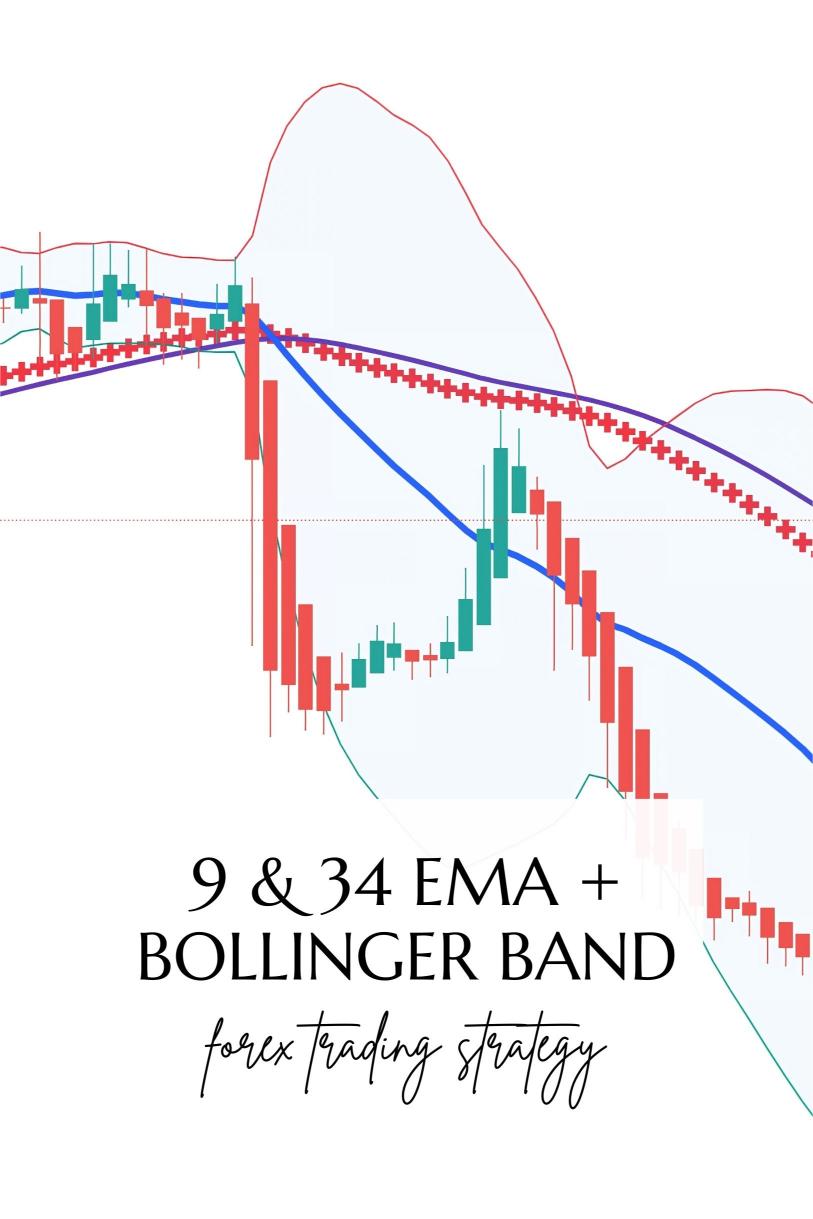

Through this journey, I’ve developed a unique trading strategy that combines the 9 & 34 EMA with Bollinger Band expansion.

This approach has helped me achieve consistent profitability and could do the same for you!

Understanding the Basics

Let’s break it down like we’re having a coffee chat.

Exponential Moving Averages (EMAs):

- The 9 EMA is your short-term trend indicator.

- The 34 EMA shows the longer-term trend.

When the 9 EMA crosses above the 34 EMA, it’s a buy signal.

When it crosses below, it’s a sell signal.

Bollinger Bands:

- These bands expand and contract based on market volatility.

- A price breakout above the upper band or below the lower band can signal strong trends.

When you combine these tools, you get a powerful setup to identify trends early and ride them for maximum profit.

Why This Strategy Works

Statistically, combining EMAs with Bollinger Bands can boost your win rate.

Here are some intriguing facts:

- 73% of trends continue for at least three candles.

- Volatility indicators can improve profitability by up to 30%.

This means that if you catch a trend early, you’re likely to ride it for longer—maximizing your profits.

Step-by-Step Implementation

Let’s get into the nitty-gritty. Here’s how to implement this strategy:

- Set Up Your Chart:

- Use a 4-hour chart for longer-term trades.

- Add the 9 EMA and 34 EMA.

- Add Bollinger Bands (default settings are usually fine).

- Look for Crossovers:

- Wait for the 9 EMA to cross the 34 EMA.

- Confirm with Bollinger Bands: if the price breaks the upper band, it’s a strong buy signal.

- Set Your Stops:

- Place a stop-loss just below the 34 EMA for buys.

- For sells, position it just above the 34 EMA.

- Manage Your Trade:

- Aim for a reward-to-risk ratio of at least 2:1.

- Consider trailing your stop as the trade moves in your favor.

Why You Need a Solid Trading Portfolio

Now, while this strategy is powerful, it’s essential to diversify your trading approach. This is where my 16 trading bots come into play.

Each bot utilizes the 9 & 34 EMA + Bollinger Band expansion strategy, among others, to mitigate risks and maximize returns.

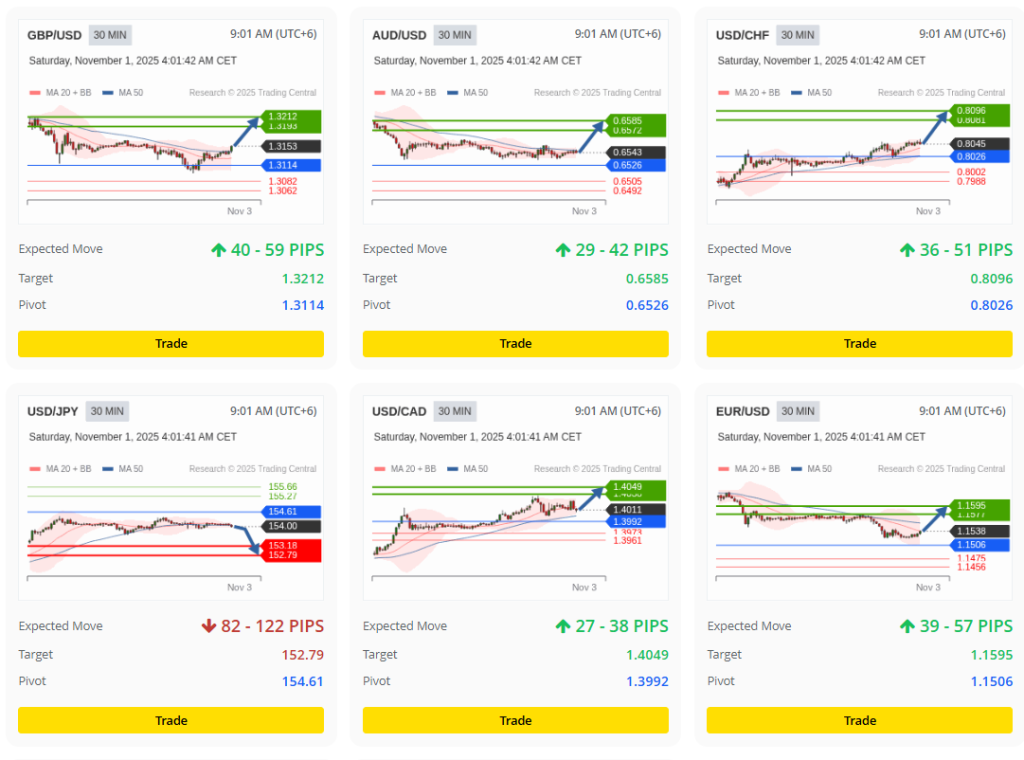

- These bots are specifically designed for major currency pairs: EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

- They’re internally diversified to minimize correlated losses.

Imagine having a portfolio that leverages multiple strategies to ensure robust performance even in volatile market conditions.

Best of all? I’m offering this EA portfolio completely FREE! You can check it out here.

Embracing Risk Management

Let’s talk about risk—because it’s a crucial part of trading.

Forex trading isn’t just about making money; it’s about protecting what you have.

- Set your leverage wisely: High leverage can amplify both gains and losses.

- Diversify: Use different strategies and currency pairs to spread risk.

- Stay informed: Market conditions change, and so should your approach.

Choosing the Right Broker

After setting up your strategy and portfolio, you need a reliable broker.

I’ve tested several, and I recommend checking out the best forex brokers that stand out for their tight spreads and excellent support.

Find the one that suits your trading style and offers the tools you need to succeed.

You can explore my tested recommendations here.

Conclusion

The 9 & 34 EMA + Bollinger Band expansion strategy is not just a theory; it’s a proven method that can lead to successful trades.

By understanding and implementing this strategy, you’ll be well on your way to becoming a more confident trader.

And remember, having a diversified portfolio with automated trading systems can significantly enhance your trading journey.

I invite you to explore my FREE EA portfolio and find the right forex broker to support your trading goals.