Last Updated on February 22, 2025 by Arif Chowdhury

Are you tired of inconsistent results in your Forex trading?

Do you find yourself second-guessing your entries?

You’re not alone.

Many traders struggle with these same issues.

That’s where the 8-21 EMA Trend-Following Strategy comes in.

It’s a powerful method I’ve used since my early days in trading, and it has transformed my approach to the market.

Let’s break it down.

What is the 8-21 EMA Strategy?

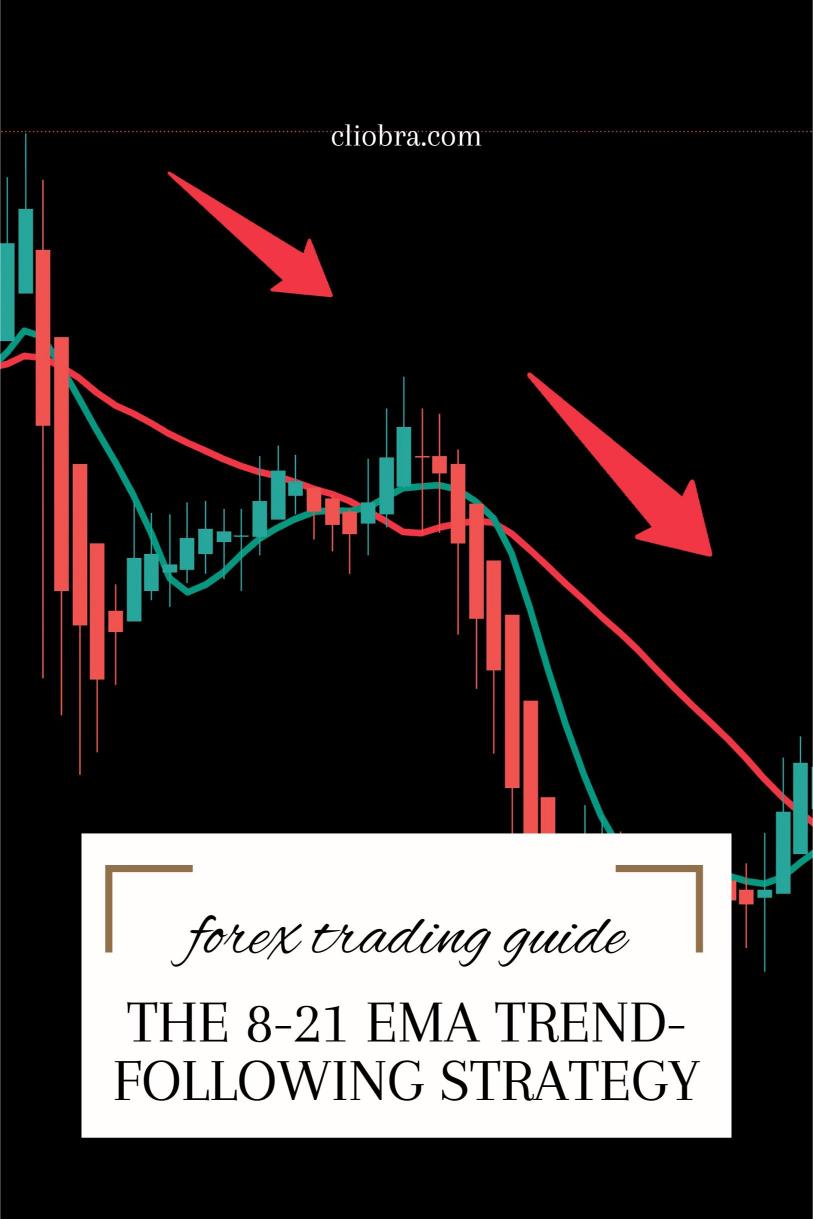

The 8-21 EMA strategy uses two exponential moving averages (EMAs) to identify trends and generate high-probability entry points.

- 8 EMA: This is your fast-moving average, reacting quickly to price changes.

- 21 EMA: This is your slow-moving average, providing a broader view of the market trend.

When the 8 EMA crosses above the 21 EMA, it signals a potential buy opportunity.

Conversely, a cross below indicates a sell signal.

Why Use This Strategy?

- Simplicity: It’s straightforward and easy to implement.

- High Probability: Historically, this method has shown a statistical edge in capturing market moves.

- Versatility: Works well across different currency pairs and timeframes.

Did you know that according to various trading studies, strategies using EMAs can yield success rates as high as 60%?

That’s impressive considering the volatility of Forex markets.

How to Implement the 8-21 EMA Strategy

Here’s how you can start:

- Select Your Pair: Focus on major pairs like EUR/USD, GBP/USD, USD/CHF, or USD/JPY.

- Set Up the EMAs: Apply the 8 EMA and 21 EMA on your chart.

- Wait for Crossovers: Look for the 8 EMA to cross the 21 EMA.

- Confirm with Price Action: Always check for additional confirmation, like support and resistance levels.

A Personal Touch: My Trading Bots

As a seasoned Forex trader since 2015, I’ve created a portfolio of 16 trading bots that incorporate various strategies, including the 8-21 EMA.

These bots are designed for long-term trading, aiming for 200-350 pips per trade.

What’s great is they trade primarily on H4 charts, ensuring that they capture significant market moves without getting bogged down by noise.

- Diversification: Each currency pair has 3-4 bots, diversifying risk.

- Proven Performance: Backtested over 20 years, they excel even in harsh conditions.

And the best part? You can access this EA portfolio for FREE.

Check it out here.

Risk Management is Key

Now, let’s talk about the elephant in the room: risk.

Forex trading carries inherent risks, and it’s crucial to have a solid risk management plan in place.

- Set Stop Losses: Protect your capital by always using stop losses.

- Position Sizing: Don’t risk more than 1-2% of your account on a single trade.

Statistically, traders who implement sound risk management can reduce their losses significantly, increasing their chances of long-term success.

Choosing the Right Broker

To maximize your trading success, choosing the right broker is essential.

- Tight Spreads: Look for brokers that offer tight spreads to minimize costs.

- Execution Speed: Fast order execution can make a difference in your trade outcomes.

- Customer Support: Solid support can save you in times of need.

I’ve tested several brokers and can vouch for those that truly stand out.

Check out my top recommendations for the best Forex brokers here.

Conclusion

The 8-21 EMA Trend-Following Strategy can provide you with the high-probability entries you’ve been searching for.

By combining it with effective risk management and the right broker, you’ll be well on your way to consistent profitability.

And don’t forget about my portfolio of 16 trading bots designed to enhance your trading experience.

You can start your journey towards smarter trading today.