Last Updated on March 1, 2025 by Arif Chowdhury

Ever feel like you’re just guessing when trading Forex?

You’re not alone.

Many traders, especially new ones, struggle to understand where the big players are moving the market.

That’s where solid strategies come into play.

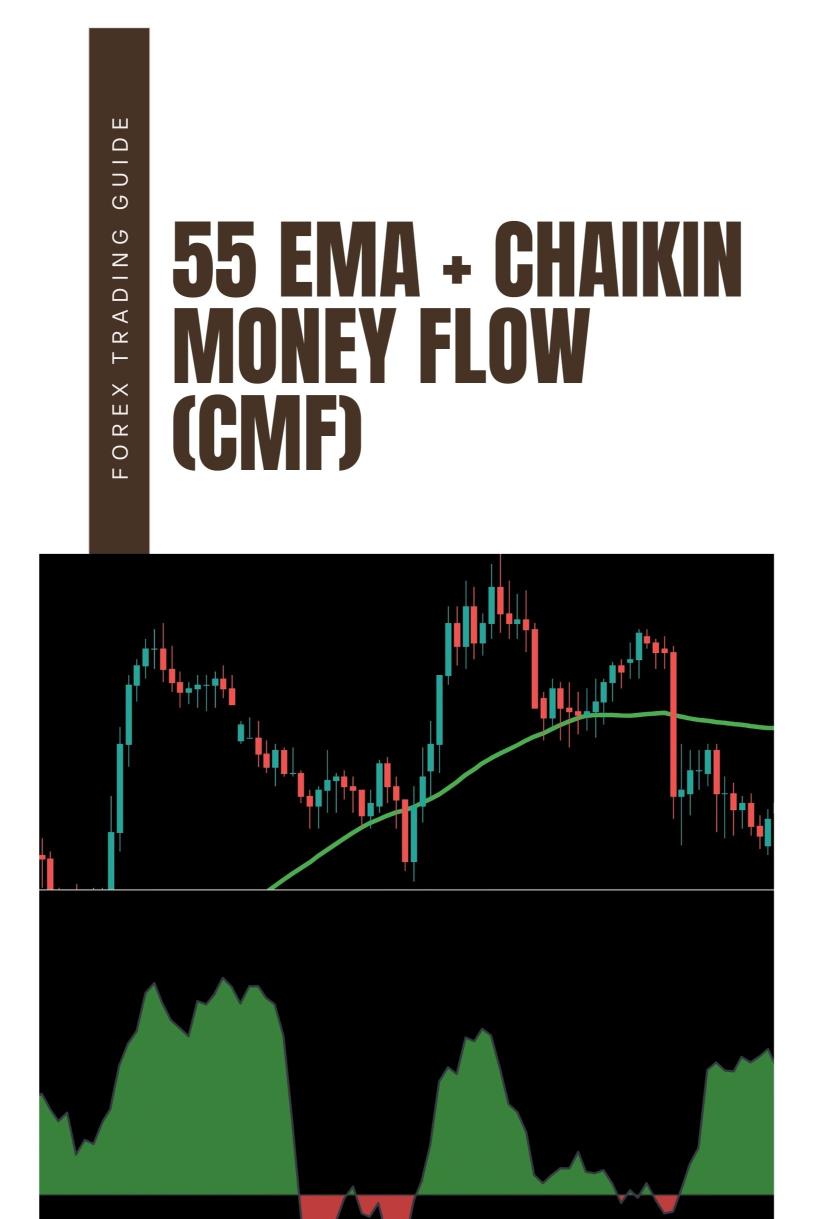

Let’s dive into one that’s been a game-changer for me: the 55 EMA + Chaikin Money Flow (CMF) Strategy.

What is the 55 EMA?

The 55 Exponential Moving Average (EMA) is a tool that helps smooth out price data to identify the trend direction.

Why 55?

It strikes a balance between short-term and long-term trends.

Using this length, I’ve noticed it captures key market movements without getting whipsawed by noise.

Here’s how it works:

- Trend Identification: If the price is above the 55 EMA, we’re looking at a bullish trend.

- Entry Signals: When the price crosses above the 55 EMA, it might be time to jump in.

What is Chaikin Money Flow (CMF)?

The Chaikin Money Flow (CMF) indicator measures the buying and selling pressure for a specified period.

It combines price and volume, offering insights into market sentiment.

Here’s the deal:

- Positive CMF: Indicates buying pressure. The institutions are likely moving in.

- Negative CMF: Suggests selling pressure. Time to be cautious.

Why Combine 55 EMA and CMF?

Combining these two gives us a powerful edge.

- Trend Confirmation: The 55 EMA identifies the trend, while CMF confirms if the big players are backing it up.

- Reduced False Signals: Using both reduces the chances of getting faked out.

How to Implement the Strategy

Here’s a simple step-by-step:

- Set Up Your Charts: Add the 55 EMA and CMF to your chart.

- Look for Crosses: Wait for the price to cross the 55 EMA.

- Check the CMF: If the CMF supports the EMA direction, that’s your entry signal.

- Manage Risk: Always set stop-loss orders to protect your capital.

Real Stats to Consider

Did you know that about 70% of traders lose money in Forex?

This emphasizes the importance of having a solid strategy.

Also, trading with institutional backing can significantly improve your win rate.

Using the 55 EMA + CMF strategy aligns you with those big players.

My 16 Trading Bots

Now, let’s talk about something that can further enhance your trading experience.

I’ve developed 16 sophisticated trading bots that incorporate the 55 EMA + CMF strategy along with other strategies to diversify risk.

These bots are designed to trade on major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot focuses on long-term trades, aiming for 200-350 pips.

What’s cool?

- Diversification: Each currency pair has 3-4 bots tailored to minimize correlated losses.

- Proven Performance: Backtested over 20 years, these bots thrive even in harsh market conditions.

And the best part?

You can access this EA portfolio completely FREE.

Just check it out at my EA portfolio.

Best Forex Brokers

To maximize your trading potential, you need a reliable broker.

I’ve tested numerous brokers and recommend only the best.

These brokers are known for tight spreads, outstanding support, and quick execution.

By choosing a trusted broker, you can optimize your trading experience and enhance your profitability.

Final Thoughts

Trading doesn’t have to be a guessing game.

With the 55 EMA + CMF strategy, you can align yourself with institutional activity, which is crucial for success.

And if you want to take it a step further, consider using my 16 trading bots that utilize this strategy along with others to maximize your chances.

Don’t leave your success to chance—equip yourself with the right tools and strategies.