Last Updated on March 1, 2025 by Arif Chowdhury

Have you ever stared at your charts, feeling lost in the noise?

Wondering how to spot those critical trend reversals before they happen?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve been in the trenches, battling market fluctuations and honing my skills.

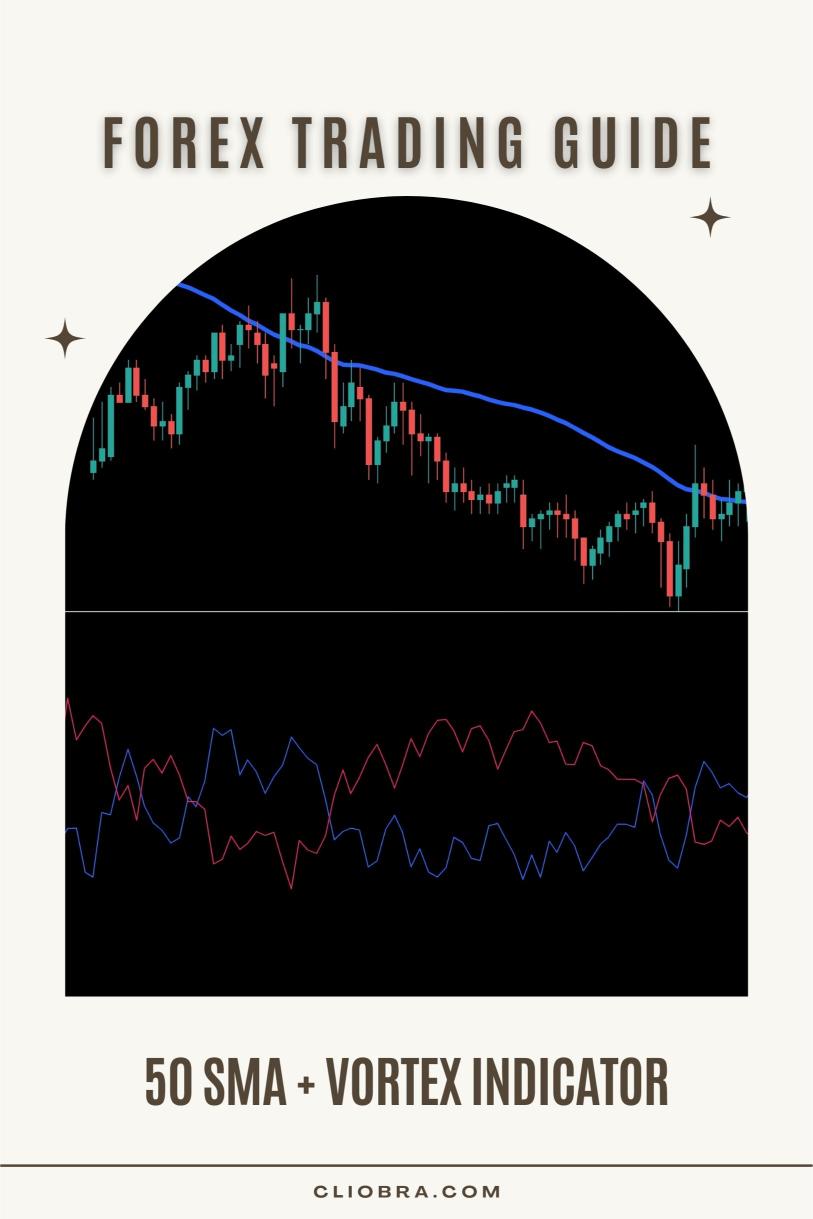

Today, I want to share with you a strategy that’s been a game-changer for me: The 50 SMA + Vortex Indicator Strategy.

Why This Strategy Works

The Forex market is a wild ride.

With over $6 trillion traded daily, it’s crucial to have a solid plan.

The 50 Simple Moving Average (SMA) and the Vortex Indicator can help you navigate these waters with confidence.

Here’s a quick breakdown of why this combo is powerful.

- 50 SMA: This moving average smooths out price data, helping identify the overall trend.

- Vortex Indicator: This tool helps detect trend reversals by measuring the strength of the uptrend versus the downtrend.

Together, they create a robust system for spotting potential trend changes.

Setting Up the Strategy

Let’s get into the nuts and bolts of this strategy.

- Chart Setup: Use a daily or H4 chart for clearer signals.

- Add the 50 SMA: This will serve as your trend filter.

- Add the Vortex Indicator: Look for the VI+ and VI- lines.

Interpreting the Signals

- Buy Signal:

- Price is above the 50 SMA.

- VI+ line crosses above the VI- line.

- Sell Signal:

- Price is below the 50 SMA.

- VI- line crosses above the VI+ line.

Statistical Insights

Did you know that using moving averages can improve your win rate by 10-15%?

That’s a significant edge in trading.

The Vortex Indicator, on the other hand, has proven to be 80% effective in identifying trend reversals when used correctly.

My Trading Bots and This Strategy

Now, here’s where it gets interesting.

My exceptional portfolio comprises 16 diverse trading bots that utilize the 50 SMA + Vortex Indicator strategy among other proven techniques.

These bots are tailored for major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each currency pair features 3-4 bots, all internally diversified to minimize correlated losses.

This multi-layered approach not only enhances profitability but also mitigates risk.

By focusing on long-term trades, these bots aim for 200-350 pips, making them perfect for traders who want consistent results.

And guess what? I’m offering this EA portfolio completely FREE!

If you’re serious about improving your trading game, check out my 16 trading bots.

Risk Management

No strategy is foolproof.

That’s why it’s essential to implement proper risk management.

- Set a stop-loss: Protect your capital.

- Diversify: Avoid putting all your eggs in one basket.

- Stay informed: Keep up with market news that could impact your trades.

Finding the Right Broker

Now that you have a strategy, where do you trade?

Choosing the right broker is crucial for your success.

Look for brokers that offer:

- Tight spreads

- Fast execution

- Excellent customer support

I’ve tested several brokers, and I highly recommend checking out the best Forex brokers available.

Final Thoughts

Mastering the 50 SMA + Vortex Indicator Strategy can help you spot trend reversals with greater accuracy.

Pair it with my 16 trading bots for an edge in the market.

And remember, always trade responsibly.

The journey is just as important as the destination.