Last Updated on March 2, 2025 by Arif Chowdhury

Have you ever felt the sting of a bad trade?

Or watched in disbelief as your hard-earned capital evaporated overnight?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve been there too.

But here’s the good news: effective risk management can make all the difference.

Let’s explore how to safeguard your capital and thrive in this volatile market.

Understanding Risk in Forex Trading

Forex trading isn’t just about making profits.

It’s also about protecting what you’ve got.

Did you know that about 70% of retail traders lose money in Forex?

That’s a staggering statistic.

Understanding risk is crucial if you want to be part of the minority that succeeds.

Key Principles of Risk Management

- Set a Risk Percentage

Decide how much of your capital you’re willing to risk on each trade.

A common rule is to risk 1-2% of your total account balance.

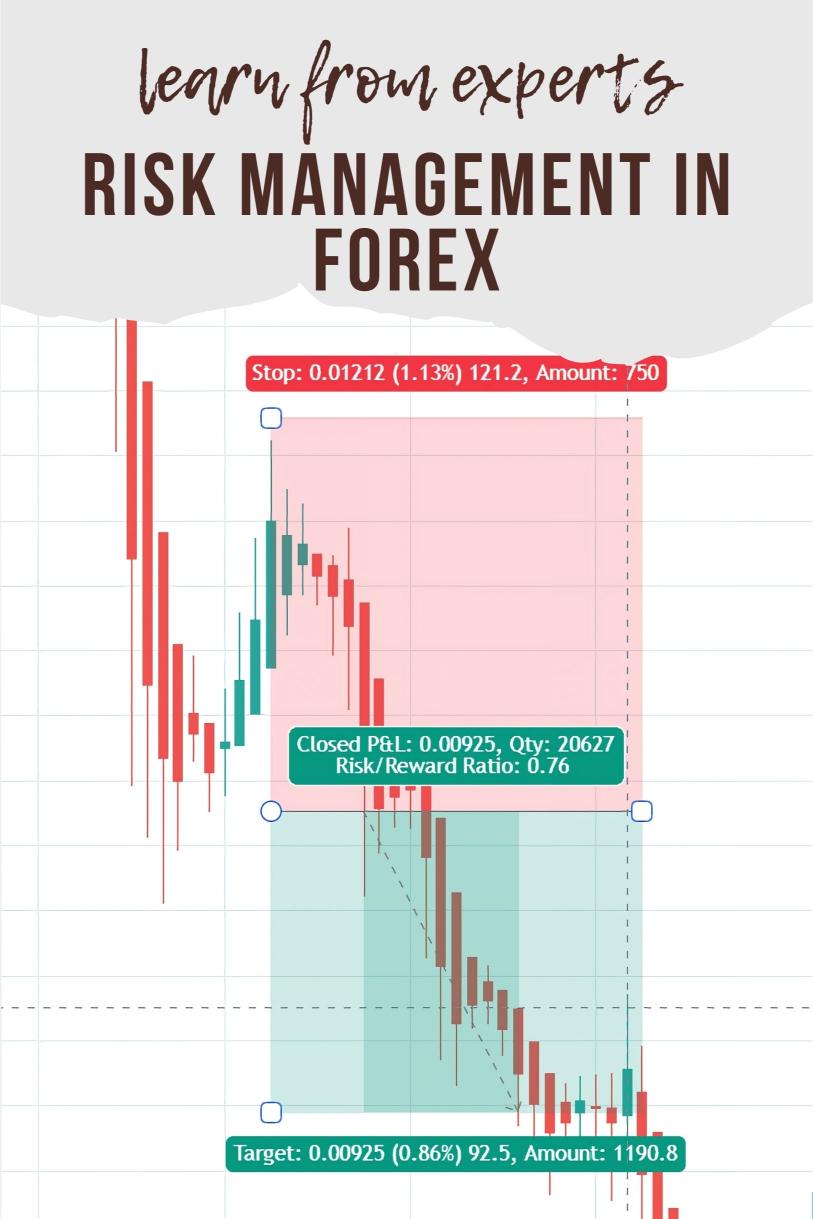

This way, even a string of losses won’t wipe you out. - Use Stop-Loss Orders

A stop-loss order automatically closes a trade at a predetermined price.

This helps to minimize losses without having to watch the charts 24/7.

It’s like setting a safety net under your trading strategy. - Diversify Your Portfolio

Don’t put all your eggs in one basket.

I’ve developed a portfolio of 16 trading bots spread across major pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

Each bot is designed to trade in different market conditions, which mitigates risk. - Position Sizing

Calculate your position size based on your risk percentage.

This helps ensure you’re not over-leveraging your trades, which can lead to devastating losses.

The Power of a Trading Strategy

Having a solid trading strategy is essential.

Since I focused on technical analysis, I’ve crafted a strategy that leverages support and resistance zones.

It’s not about making every trade a winner; it’s about having an edge over time.

For instance, I backtested my bots over the last 17 years.

They perform exceptionally well, even in tough market conditions.

This kind of data-driven approach is invaluable.

🚀Get this Forex EA Portfolio for FREE from here.

Emotional Control: The Hidden Risk

Let’s talk about the psychological side of trading.

Fear and greed can lead to impulsive decisions.

Have you ever held onto a losing trade, hoping it’ll turn around?

Or jumped into a trade because of FOMO?

Recognizing your emotional triggers is key.

Here’s what works for me:

- Stick to Your Plan

Follow your trading strategy without deviation. - Take Breaks

If you’re feeling overwhelmed, step back. - Keep a Trading Journal

Documenting your trades helps you learn from mistakes and reinforces discipline.

Leverage: A Double-Edged Sword

Leverage can amplify profits, but it also magnifies losses.

Did you know that about 40% of Forex traders use leverage?

It’s tempting to take on high leverage, but it’s risky.

Use it judiciously, and always be aware of the risks involved.

The Importance of Continuous Education

The Forex market is always evolving.

To stay ahead, invest time in your education.

I share insights and trading strategies on my YouTube channel, where I discuss everything from market trends to risk management tips.

Engaging with a community of traders can also provide fresh perspectives.

Final Thoughts

Risk management is not a one-time task; it’s an ongoing process.

By implementing these strategies, you can better protect your capital and increase your chances of success in Forex trading.

Consider checking out reputable Forex brokers I’ve tested to find the right fit for your trading style.

And if you’re interested in a hands-off approach, my portfolio of trading bots is designed to help you navigate the Forex landscape with reduced risk.

Remember, the goal isn’t just to make money; it’s to keep your money.