Last Updated on April 5, 2025 by Arif Chowdhury

What is the TTM Squeeze? 🔍

The TTM Squeeze indicator is one of the most powerful tools in a trader’s arsenal.

It identifies periods of consolidation before explosive price movements.

According to market statistics, approximately 70% of the time markets are in consolidation phases rather than trending.

This makes the TTM Squeeze invaluable for timing your entries and exits.

I’ve been trading forex since 2015, and this indicator has completely transformed my approach to breakout trading.

How the TTM Squeeze Works ⚙️

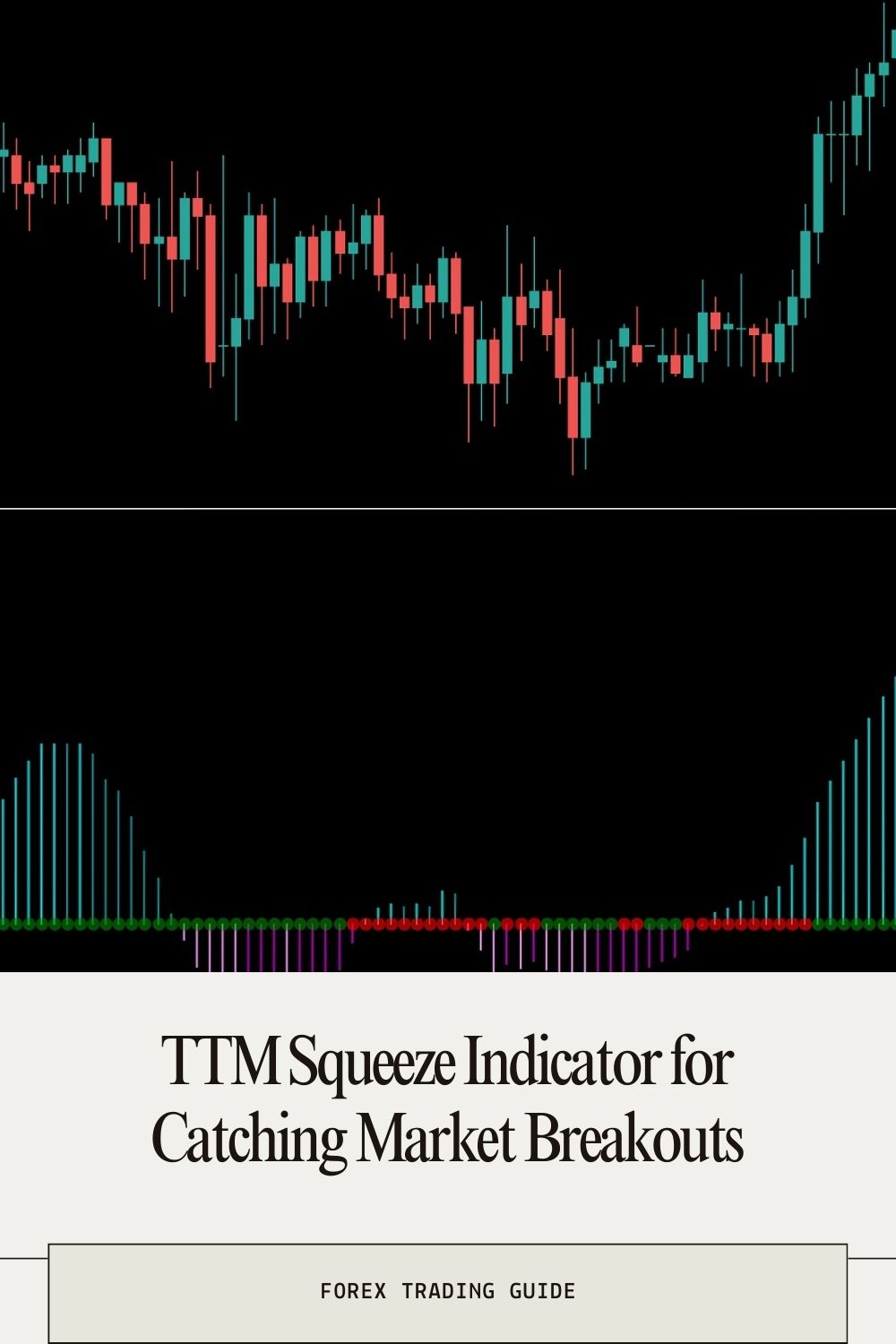

The TTM Squeeze combines Bollinger Bands and Keltner Channels to detect market compression.

When Bollinger Bands move inside Keltner Channels, the market is “squeezing.”

This compression is like a spring coiling tighter and tighter.

When the bands finally break outside the channels, explosive moves often follow.

Research shows that following major squeezes, price movements are typically 2-3 times more volatile than average market conditions.

Setting Up the TTM Squeeze on Your Charts 📊

First, add both Bollinger Bands (20, 2) and Keltner Channels (20, 1.5) to your chart.

The TTM Squeeze indicator will display dots below your price chart:

- Red dots = Market is squeezing (consolidating)

- Green dots = Squeeze is released (potential breakout)

The histogram component shows momentum:

- Rising histogram = Increasing momentum

- Falling histogram = Decreasing momentum

Interpreting the Signals 🧠

The Squeeze Formation

When you see red dots forming, the market is compressing energy.

This is your alert to start paying attention—not to trade yet.

The longer the squeeze lasts, typically the more powerful the breakout will be.

Studies have shown that squeezes lasting more than 15 candles result in breakouts averaging 80% larger than shorter squeezes.

The Breakout Signal

When red dots turn green, the squeeze is releasing.

This is your potential entry signal, but you need confirmation.

Look for the histogram to be moving in the same direction as your anticipated breakout.

Advanced TTM Squeeze Strategies 🚀

Multiple Timeframe Analysis

Check the squeeze on higher timeframes before trading lower ones.

A 4-hour squeeze breaking out carries more weight than a 15-minute one.

Combining with Support/Resistance

The most profitable breakouts often occur when a squeeze resolves near key support/resistance levels.

Introducing the Golden Grid System 💰

While I’ve had great success with the TTM Squeeze, I’ve developed something even more powerful.

My Golden Grid trading system takes advantage of these market volatility patterns automatically.

It’s designed to capture short-term price movements during both consolidations and breakouts.

The system consistently achieves 2-5% ROI daily by capturing just 20-40 pips in quick succession.

Within hours, you can see tangible results in your trading account.

Want to see if Golden Grid is right for you? Check out my free Golden Grid EA that I’m offering to my community.

Risk Management with TTM Squeeze 🛡️

Always place stops beyond the most recent swing high/low before entering breakout trades.

Never risk more than 1-2% of your account on a single TTM Squeeze trade.

The risk/reward should be at least 1:2 for every trade you take.

Choosing the Right Pairs for TTM Squeeze Trading 📈

The TTM Squeeze works exceptionally well on volatile pairs.

Gold (XAU/USD) shows particularly strong moves after squeeze periods.

My Golden Grid system performs remarkably on Gold, often doubling the profits seen on other pairs.

Major forex pairs like EUR/USD and GBP/USD also respond well to squeeze breakouts.

Avoid These Common Mistakes ⚠️

Don’t jump into a squeeze too early—wait for the green dot confirmation.

Don’t ignore the histogram direction—it needs to align with your trade direction.

Don’t overtrade—quality squeezes don’t happen every day.

Getting Started with the Right Tools 🧰

To effectively implement TTM Squeeze trading, you need a reliable broker with tight spreads and fast execution.

I’ve tested dozens of platforms over my trading career.

For the best combination of reliability, low costs, and powerful tools, check out my recommended best forex brokers.

These platforms integrate seamlessly with both manual TTM Squeeze trading and automated systems like my Golden Grid EA.

Test your TTM Squeeze strategy in demo accounts first before going live.

Remember—the key to consistent profits isn’t just finding breakouts, but managing risk while maximizing opportunity.

Ready to catch your first market breakout with the TTM Squeeze?