Last Updated on February 24, 2025 by Arif Chowdhury

Are you tired of making trades that just don’t work out?

Do you feel overwhelmed by all the indicators out there?

You’re not alone.

As a seasoned Forex trader since 2015, I’ve faced the same struggles.

Over the years, I’ve honed my expertise, focusing on powerful technical analysis tools.

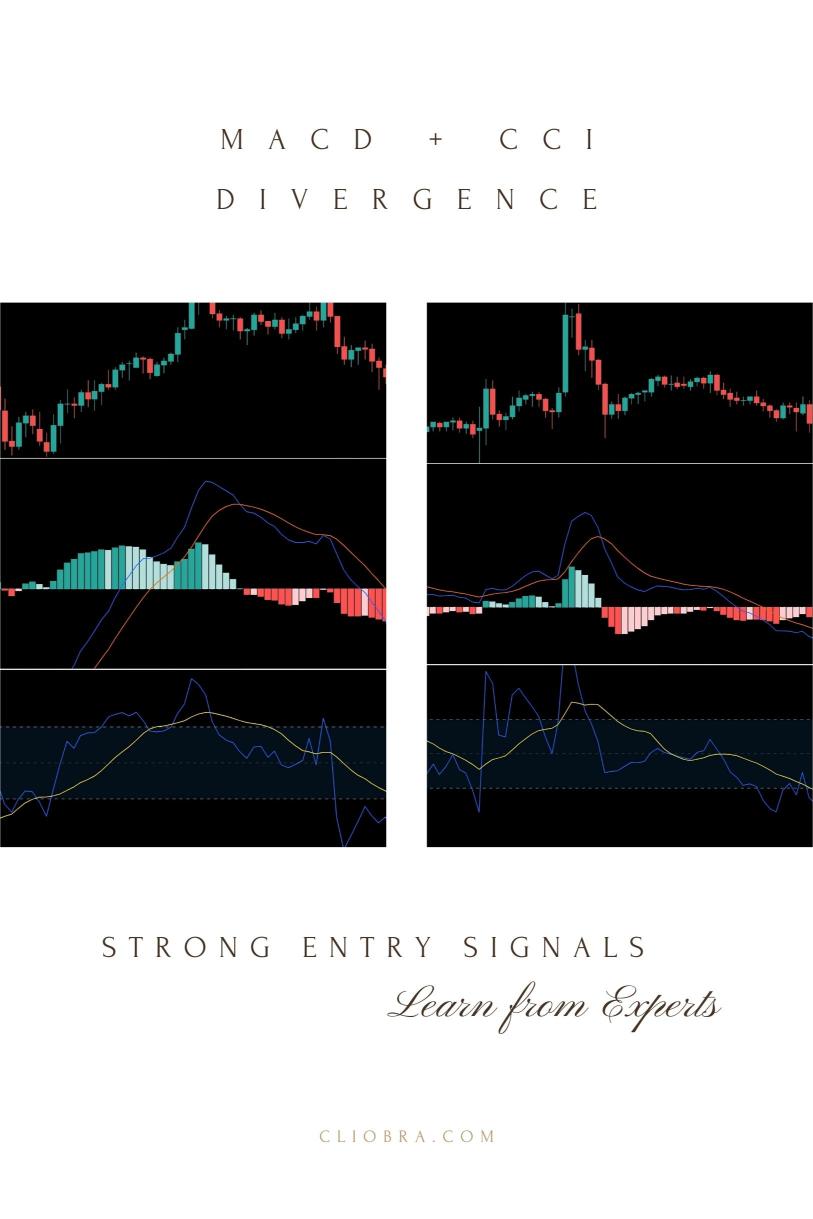

Today, let’s dive into how to leverage the MACD and CCI divergence to spot strong entry signals.

This is a game changer! 🚀

Understanding MACD and CCI

MACD (Moving Average Convergence Divergence) is a trend-following momentum indicator.

It helps identify changes in the strength, direction, momentum, and duration of a trend.

CCI (Commodity Channel Index) is a versatile indicator that measures the deviation of a security’s price from its average price.

When combined, they can provide clear signals for when to enter a trade.

Why Divergence Matters

Divergence occurs when the price moves in one direction while the indicators move in another.

This can signal a potential reversal.

Here’s why it’s important:

- Statistically, 70% of divergences can lead to profitable trades if analyzed correctly.

- It helps to confirm market sentiment and potential reversals.

How to Spot MACD + CCI Divergence

- Identify the Trend:

- Use MACD to determine if the market is bullish or bearish.

- Look for MACD lines crossing above or below the zero line.

- Look for Divergence:

- Compare price action with CCI readings.

- If the price is making new highs but CCI isn’t, that’s bearish divergence.

- If the price is making new lows but CCI isn’t, that’s bullish divergence.

- Confirm the Signal:

- Wait for the MACD to cross in the direction of the divergence.

- This adds weight to the signal.

Executing the Trade

Once you spot a divergence and have confirmation:

- Set Your Entry Point:

- Enter the trade when the MACD confirms the direction.

- Risk Management:

- Always set stop-loss orders to protect your capital.

- Target Profit:

- Aim for a realistic target based on recent price action.

Why This Works

Combining MACD and CCI gives you a comprehensive view of the market.

Using both enhances your chances of spotting reliable entry points.

As an added bonus, my exceptional trading bot portfolio incorporates this MACD + CCI divergence strategy among other proven methods.

With 16 diverse algorithms across major currency pairs like EUR/USD, GBP/USD, USD/CHF, and USD/JPY, you can trade confidently.

These bots have been backtested for 20 years, delivering impressive results even in volatile markets.

Best of all? I’m offering this EA portfolio for FREE!

Check it out here: 16 Trading Bots Portfolio.

Final Tips for Successful Trading

- Stay Informed:

- Keep up with market news. It can impact your trades.

- Practice Patience:

- Not every signal will lead to a win.

- Use Trusted Brokers:

- Your trading experience depends on the broker you choose. I’ve tested the best ones.

For reliable trading, I recommend checking out the top forex brokers here: Best Forex Brokers.

Conclusion

Using the MACD + CCI divergence can significantly enhance your trading strategy.

By identifying divergences and confirming signals, you set yourself up for better entry points.

Don’t forget to take advantage of my FREE trading bot portfolio, designed to help you trade smarter and more effectively.

Let’s make those pips together! 💰