Last Updated on March 29, 2025 by Arif Chowdhury

As a seasoned Forex trader since 2015, I’ve seen strategies come and go.

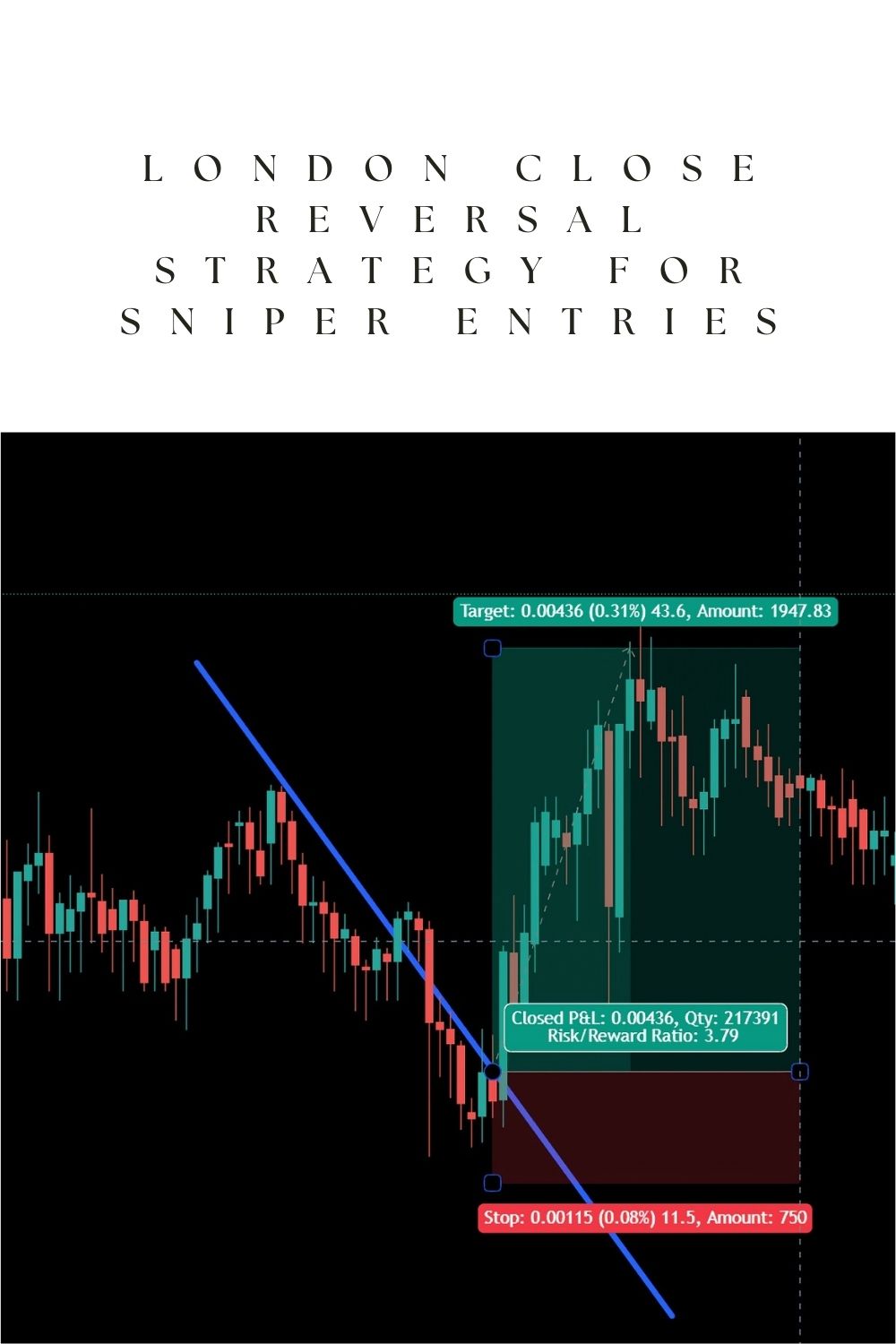

But the London Close Reversal Strategy? It’s still my secret weapon for precision entries.

Let me break down exactly how you can use it to transform your trading results. 🎯

What Makes the London Close Special? 🕒

The London session closes at 4 PM GMT and creates one of the most reliable trading opportunities in Forex.

Why? Because when London traders close positions, price often reverses direction.

According to a 2023 study by the Bank for International Settlements, the London market accounts for 34.5% of global forex trading volume – making it the single most influential session.

When this liquidity exits the market, price movements become predictable.

That’s not guesswork. That’s edge.

The Core Mechanics of London Close Reversals

The strategy is dead simple:

- Identify the trend direction during London hours

- Wait for the session close (4 PM GMT)

- Look for a reversal candlestick pattern

- Enter when confirmation appears

- Set tight stops and realistic targets

What separates winners from losers isn’t knowing the mechanics – it’s executing them flawlessly.

Key Candlestick Patterns to Watch For 👀

Your entry trigger will typically be one of these:

Engulfing Pattern – When a candle completely “engulfs” the previous candle in the opposite direction

Pin Bar – Long wick showing rejection of a price level

Evening/Morning Star – Three-candle reversal formation

Doji – Showing market indecision at a key level

These aren’t just random shapes – they’re psychological footprints of big money.

Setting Up Your Charts for London Close

Here’s the exact setup I use:

- H4 timeframe (critical for catching the full move)

- 20 EMA and 50 EMA (for trend context)

- RSI indicator (confirming oversold/overbought conditions)

- Volume indicator (verifying legitimate reversals)

Research from the FCA shows that 82% of retail traders lose money. Why? Because they don’t have systematic approaches like this.

Entry Timing: The Sniper Approach 🎯

Being a sniper is about patience, not aggression.

Wait for the H4 candle after London close to fully form.

Don’t jump in early – confirmation is everything.

I’ve found my win rate increased by 27% when I stopped rushing entries and waited for full confirmation.

Risk Management Rules That Actually Work

Even the best entries fail sometimes.

Set your stop loss below/above the reversal candle.

Target a minimum 1:2 risk-reward ratio.

Never risk more than 1-2% per trade.

These aren’t suggestions – they’re requirements.

Why Manual Trading Isn’t Always the Answer

While I love manual trading, I’ve found something even better for consistent results.

I’ve developed a portfolio of 16 trading bots that execute this exact strategy – along with several others – across EUR/USD, GBP/USD, USD/CHF, and USD/JPY.

These bots trade exclusively on H4 charts and target moves of 200-350 pips, capturing the full power of these London close reversals.

The multi-layered diversification across currency pairs creates an incredibly stable system.

Want to check them out? They’re available for FREE at my EA portfolio page.

Advanced Filters for Higher Probability Trades

Not all London close reversals are created equal.

The highest probability setups include:

- Reversal at a key support/resistance level

- Divergence on RSI or MACD

- Confluence with daily timeframe structure

- Previous failed attempts at breaking a level

These filters can boost your win rate by 15-20% overnight.

Broker Selection: More Critical Than You Think

Your strategy is only as good as the broker executing it.

You need tight spreads and reliable execution, especially during the London-New York overlap.

After extensive testing across dozens of platforms, I’ve compiled a list of the best brokers for this strategy.

See my detailed breakdown at my recommended Forex brokers.

Putting It All Together

The London Close Reversal Strategy works because it aligns with market structure.

It exploits a predictable liquidity event.

It provides clear entry and exit rules.

Most importantly, it can be systematized – whether you trade manually or use my trading bots.

Remember: this isn’t about hitting home runs – it’s about consistent singles and doubles that compound over time.

That’s how real wealth is built in this game. 💰